For the third consecutive month, annual home price gains have slowed nationwide, according to the latest Case-Shiller Home Price Index from S&P Dow Jones Indices and CoreLogic.

The report's results showed that October 2018 saw an annual increase of 5.5% for home prices nationwide, holding steady from the previous month's report.

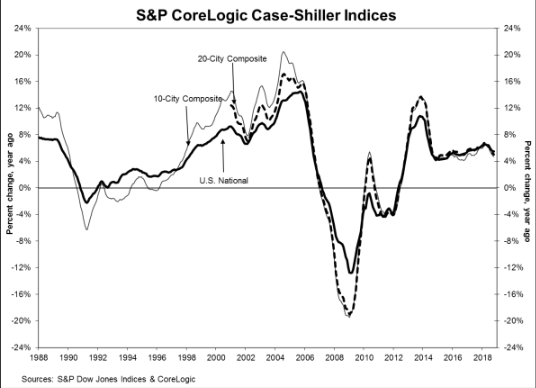

The graph below highlights the average home prices within the 10-City and 20-City Composites.

(Click to enlarge)

Before seasonal adjustment, the National Index increased 0.1% month-over-month in October. The 10-City Composite came in at 4.7%, falling from 4.9% the month before. Furthermore, the 20-City Composite posted a 5% year-over-year gain, retreating from 5.2% in September.

After seasonal adjustment, the National Index recorded a month-over-month gain of 0.5% in October. Notably, the 10-City Composite and the 20-City Composite posted 0.5% and 0.4% month-over-month increases, respectively.

The 10-City and 20-City composites did not report any increases for the month. Before seasonal adjustment, nine of 20 cities reported increases, while 18 of 20 cities reported increases after the seasonal adjustment.

S&P Dow Jones Indices Managing Director and Chairman of the Index Committee David Blitzer said home prices in most parts of the U.S. rose in October from September, as well as from the previous year.

“The combination of higher mortgage rates and higher home prices rising faster than incomes and wages means fewer people can afford to buy a house. Fixed rate 30-year mortgages are currently 4.75%, up from 4% one year earlier,” Blitzer continued. “Home prices are up 54%, or 40% excluding inflation, since they bottomed in 2012. Reduced affordability is slowing sales of both new and existing single-family homes.”

Blitzer explained that sales peaked in November 2017 and have drifted down since then.

“The largest gains were seen in Las Vegas where home prices rose 12.8% in the last 12 months, compared to an average of 5.3% across the other 19 cities. This is a marked change from the housing collapse in 2006-12 when Las Vegas was the hardest hit city with prices down 62%,” Blitzer said. “After the last recession, Las Vegas diversified its economy by adding a medical school, becoming a regional center for health care, and attracting high technology employers. Employment is increasing 3% annually, twice as fast as the national rate.”