Home price growth and rate hikes have contributed to an uptick in monthly mortgage payments nationwide, leaving many prospective buyers speculating when it will be the right time to purchase a home.

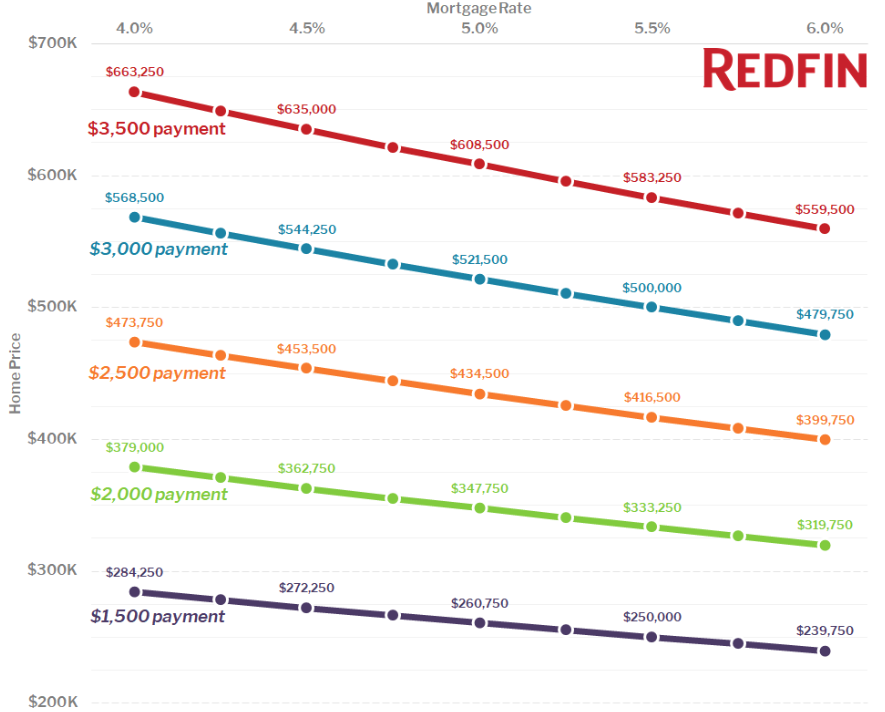

According to data collected by Redfin, at the beginning of the year, a homebuyer with a monthly housing budget of $2,500 and a 20% down payment could afford a home priced at $473,750. However, rates have now climbed above 4.75%, reducing $29,750 of a homebuyer's purchasing power.

Coastal cities are especially feeling this change, as homes in these markets are now sitting on the market longer and has resulted in sellers being forced to drop their prices.

From the article:

Let’s say you’re looking for a three-bedroom, two-bathroom home. If your monthly house payment budget is $3,500, an increase in mortgage rates from 5.0% to 5.5% would reduce the number of homes for sale that you could afford by over 15% in Orange County, Honolulu, and San Jose. In Boston, Seattle, Los Angeles, and San Diego your selection shrinks by 10 to 14%.

"Every fall and winter we see prices decline relative to spring and summer, but this year's seasonal declines have been more extreme as buyers, especially in coastal markets, are finally reaching a limit in terms of how much they are willing to pay," Redfin Chief Economist Daryl Fairweather explained.

"Sellers haven't quite come to terms with the fact that they no longer have buyers wrapped around their finger, Fairweather continued. “This push and pull is likely to continue until early 2019 when the home-buying season picks back up."

(The graph below shows how much home you can afford as mortgage rates climb)

Rates are expected to continue increasing in 2019, which could directly weaken homebuyer affordability. In fact, the Mortgage Bankers Association recently revealed that mortgage applications have fallen further.

This paired with the eighth consecutive decrease in pending home sales indicates that the market might be in some trouble.

Fannie Mae’s recent Home Purchase Sentiment Index indicated mortgage rates and household income contributed to a slight decrease in homebuyer sentiment.

“HPSI remains flat this month as perceptions of high home prices and expectations for rising mortgage rates continue to weigh on potential homebuyers,” Fannie Mae Senior Vice President and Chief Economist Doug Duncan said.

As rates continue to creep up, potential homebuyers are expected to hesitate when it comes time to seal the deal.