Mortgage rates decreased for the third consecutive week, according to Freddie Mac’s latest Primary Mortgage Market survey.

Freddie Mac Chief Economist Sam Khater said mortgage rates have now reached their lowest level since the middle of April.

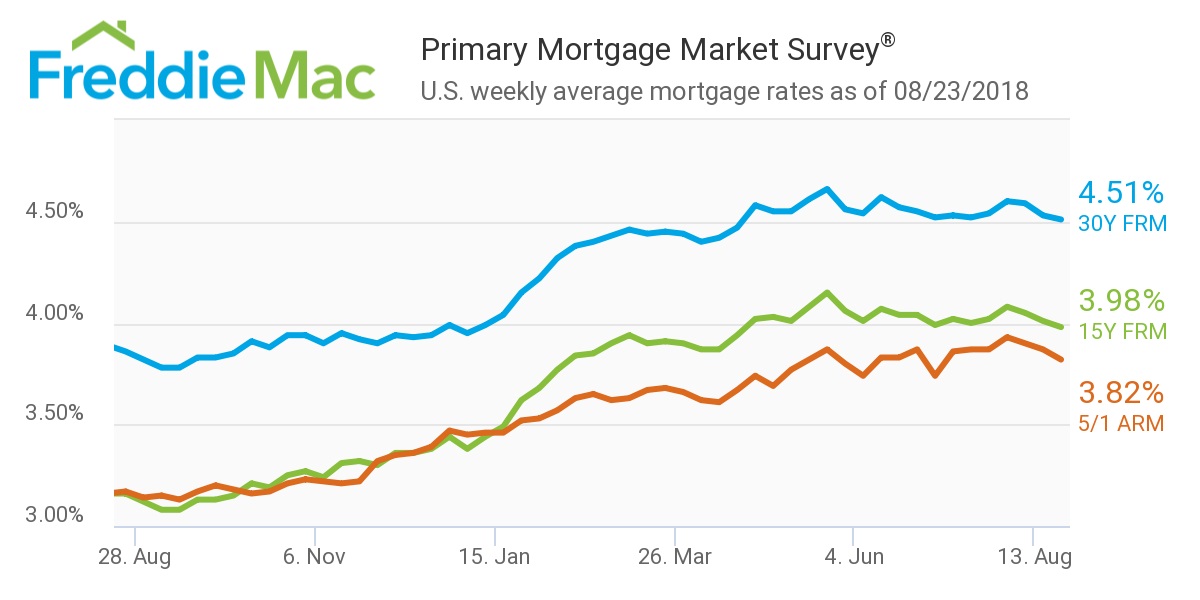

According to the Primary Mortgage Market survey, the 30-year fixed-rate mortgage averaged 4.51% for the week ending Aug. 23, 2018, down from 4.53% during last week, but still significantly increasing from last year’s rate of 3.86%.

“Backed by very strong consumer spending, the economy is red-hot this month, which is in turn rippling through the financial markets and driving equities higher,” Khater said. “Unfortunately, the same cannot be said about the housing market, where it appears sales activity crested in late 2017."

As such, Khater noted that existing-home sales have fallen annually for the fifth consecutive month, and this week's purchase mortgage applications are barely above last year's levels.

Notably, the most recent House Price Index from the Federal Housing Finance Agency, revealed home prices are now increasing at its slowest pace in the last four years.

(Source: Freddie Mac)

The 15-year FRM averaged 3.98 this week, down from last week when it averaged 4.01%. This time last year, the 15-year FRM was 3.16%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged this week at 3.82%, down from 3.87% last week, but still up from this time last year when it was 3.17%.

Realtor.com Chief Economist Danielle Hale said, differing economic forces are responsible for keeping mortgage rates relatively stagnant again this week.

“Strong economic growth and optimism continue to be countered by concerns about tariffs, trade wars, and emerging markets stocks — resulting in a mortgage rate of 4.51%, Hale said. “This is at the lower end of the 4.5 to 4.7% range mortgage rates have held since mid-April.”

“Compared to last year, rates are up. Higher interest rates have weakened the buying power of shoppers still in the market, Hale continued. “As inventory has started to pick up in certain high-priced markets, buyers may find more options, but their dollars don’t buy as much house as they did before.”