Mortgage rates decreased by just a few basis points, but remain above 4.5%, according to Freddie Mac’s latest Primary Mortgage Market survey.

Freddie Mac’s chief Economist Sam Khater said mortgage rates remained relatively stagnant over the past week, which has been the dominant theme since late spring.

“This stability in borrowing costs comes despite the highest core inflation rates since 2008 and turbulence in the currency markets,” Khater said. “Unfortunately, this pause in rates is not leading to increasing home sales. Purchase mortgage applications trailed year ago levels again last week, and it’s clear that in some markets the combination of ascending home prices, limited affordable inventory and this year’s higher rates are curtailing homebuyer demand.”

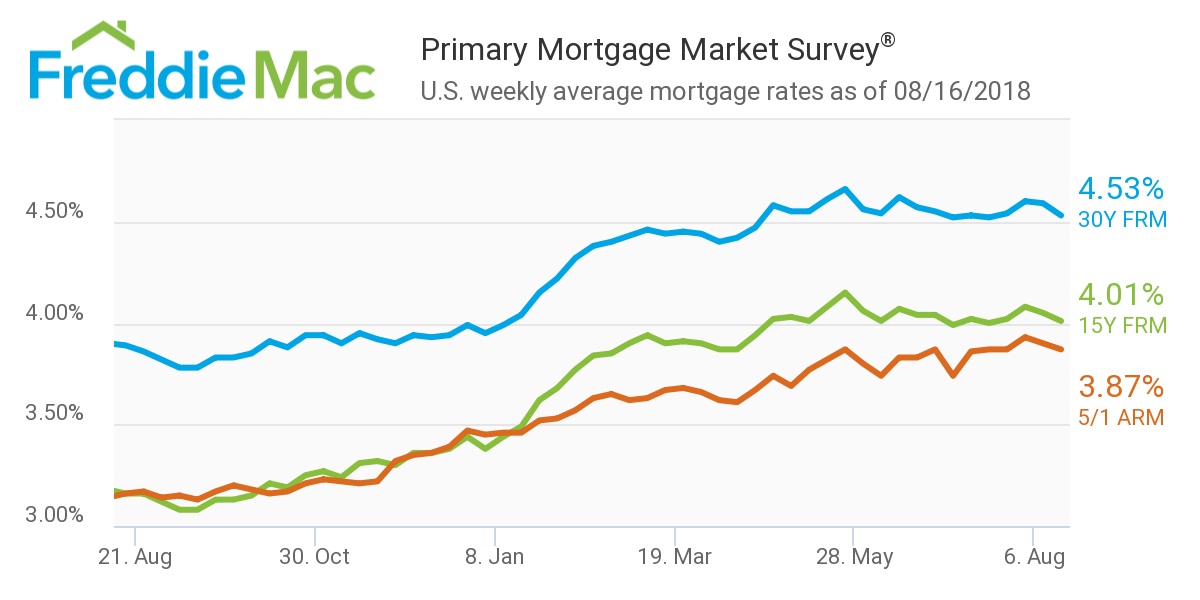

According to the report, the 30-year fixed-rate mortgage averaged 4.53% for the week ending August 16, 2018, down from 4.59% last week, and up significantly from last year's rate of 3.89%.

(Source: Freddie Mac)

In fact, concerns about market affordability contributed to homebuilder confidence falling one point to 67 in August, according to the National Association of Home Builders/Wells Fargo Housing Market Index. Additionally, newly released data indicated that housing affordability reached a 10-year low in the second quarter of 2018.

The 15-year FRM inched averaged 4.01 this week, down from last week when it averaged 4.05%. This time last year, the 15-year FRM was 3.16%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged this week at 3.87%, down from 3.90 last week, but still up from this time last year when it was 3.16%.