With much of the recent housing data pointing to double dip in housing prices, the April Home Price Index (HPI) from CoreLogic showed the first month-over-month increase since mid-2010.

The 0.7 percent increase between March and April was the first increase since the homebuyer tax credits expired in 2010. However, although the index registered the increase, national home prices, including distressed sales, declined by 7.5 percent in April when compared to the same month in 2010. Excluding distressed sales, the decrease was only 0.5 percent.

"While the economic recovery is still fragile and one data point is not a trend, the month-over-month increase based on April sales activity is a positive sign," said Mark Fleming, chief economist for CoreLogic. "This is the first month-over-month increase in the HPI since government support for home buying was removed, and it provides reason for cautious optimism."

Since the HPI is not seasonally adjusted, the April report is just at the onset of the traditionally peak home sales season of spring and summer. Accordingly, there is potential for this Index to see a trend of increases for the coming months.

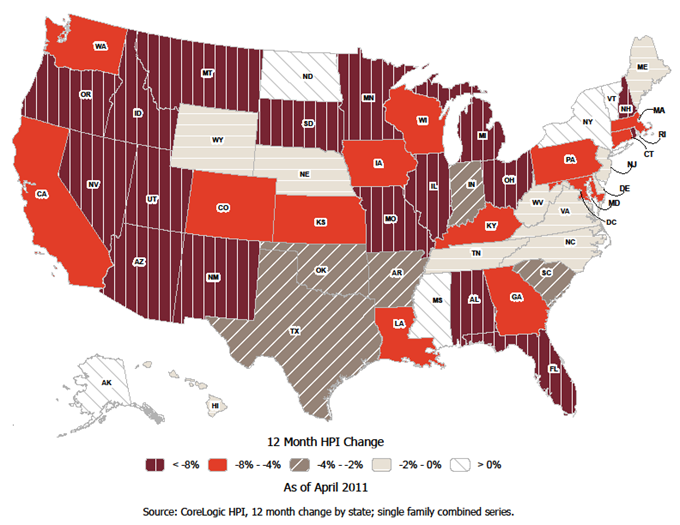

A positive trend would likely begin to counteract a 12 month HPI trend where only five states (Alaska, Mississippi, New York, Vermont and North Dakota) and the District of Columbia have registered positive gains in their HPI.