Following last week's decline, mortgage rates fell for the second consecutive week, according to Freddie Mac’s latest Primary Mortgage Market survey.

“Homebuyers have taken advantage of the recent moderation in rates, which led to a 4% increase in purchase applications last week,” Freddie Mac Chief Economist Sam Khater noted in the report. “Although demand has remained steadfast against the backdrop of this year’s higher borrowing costs, it’s important to note that the growth rate of purchase loan balances has moderated so far this year – and particularly since March.”

This slowdown indicates that buyers are struggling to match the rate of home-price growth, according to Khater.

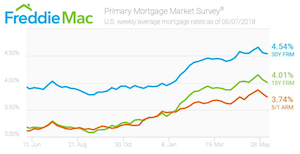

(Source: Freddie Mac)

According to the report, the 30-year fixed-rate mortgage averaged 4.54% for the week ending June 7, 2018, down from 4.56% last week, but up from 3.89% last year.

The 15-year FRM decreased to an average 4.01% this week, down from 4.06% last week and up from 3.16% in 2017.

The five-year Treasury-indexed hybrid adjustable-rate mortgage decreased to an average 3.74% this week, down from 3.80% last week. This time last year it was 3.11%.

“While the very healthy job market continues to fuel interest in buying a home, the supply shortages in most markets are pushing prices higher and currently keeping sales at a standstill,” Khater said. “Listings for new and existing homes need to increase in the months ahead to moderate price growth and reignite sales activity.”