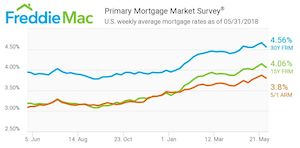

After climbing to their highest level in more than seven years, mortgage rates fell last week, according to Freddie Mac’s latest Primary Mortgage Market survey.

“The decline was driven by recent trade and geopolitical issues, which led to a sudden decrease in long-term Treasury yields,” Freddie Mac Chief Economist Sam Khater noted in the report. “Meanwhile, confident American consumers shrugged off the market volatility, as purchase mortgage applications continued to trend higher from a year ago.”

Click to Enlarge

(Source: Freddie Mac)

According to the report, the 30-year fixed-rate mortgage averaged 4.56% for the week ending May 31, 2018, down from 4.66% last week but up from 3.94% last year.

The 15-year FRM decreased to an average 4.06% this week, down from 4.15% last week and up from 3.19% in 2017.

The five-year Treasury-indexed hybrid adjustable-rate mortgage decreased to an average 3.80% this week, down from 3.87% last week. This time last year it was 3.11%.

“Extremely low inventory conditions in most markets are preventing sales from breaking out, while also keeping price growth elevated,” Khater said. “Even if rates climb closer to 5%, sales have room to grow more, but only if current supply levels start increasing more meaningfully.”

Some experts wonder if recent struggles in Italy could be the next Brexit, keeping mortgage rates subdued throughout 2018. As of right now, investors continue to watch, waiting to see how the European Central Bank will respond, and if the new turmoil will destroy the European Union.