Millennials saw an increase in their share of refinances in September to the highest level since February, according to Ellie Mae’s latest Millennial Tracker.

Refinances for Millennial buyers increased to 14% of all closed loans in September, up from 12% of all loans originated to Millennials in August. In its Origination Insights report, which looks at mortgage trends among all age groups, Ellie Mae showed the share of refinances increased across every group, from 35% in August to 38% in September.

Among conventional loans, refis rose from 15% in August to 17% in September for Millennials, from 4% to 5% for FHA refinances, and from 30% to 38% for VA refis.

“With average interest rates falling to their lowest point in 2017, Millennials are taking advantage of refinance opportunities,” said Joe Tyrrell, Ellie Mae executive vice president of corporate strategy. “While we are also seeing Millennials with more purchase power, the uptick in refinances indicates maturity among those Millennials who previously purchased a home and are looking for an opportunity to lower their monthly interest payments.”

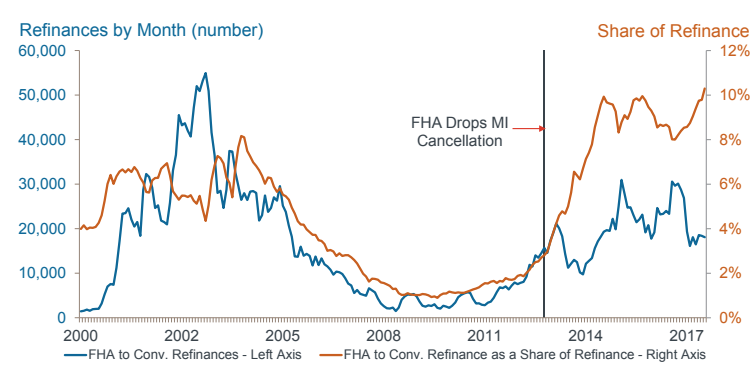

During CoreLogic and the Urban Institute’s Housing Finance, Affordability and Supply in the Digital Age conference last week in the District of Columbia, CoreLogic Chief Economist Frank Nothaft explained even as rates begin to rise once again, one share of Millennial borrowers will continue to increase – FHA to conventional refinances.

Many FHA borrowers will seek to refinance their mortgage into a conventional loan in order to cancel their mortgage insurance, Nothaft said. In fact, FHA to conventional refinances reached a new all-time high in 2017 at just over 10%, stretching back to 2000 when CoreLogic began tracking that data.

(Click the image to enlarge. Courtesy of CoreLogic.)

Per the Ellie Mae report, the average Millennial refinancing in September was 31.5 years old with a FICO score of 732. About 66% of those who refinanced were married, and the majority of borrowers were male.