During CoreLogic and the Urban Institute’s Housing Finance, Affordability and Supply in the Digital Age conference Wednesday in the District of Columbia, CoreLogic Chief Economist Frank Nothaft predicted rising interest rates will cause home prices to rise.

Mortgage interest rates are expected to continue rising over the next couple years as experts predict the Federal Reserve will raise the Federal Funds rate in once more this year in December and up to four more times in 2018. As the chart below shows, CoreLogic forecasted it will rise to 4.7% by December 2018.

Click to Enlarge

(Source: CoreLogic)

Nothaft explained as mortgage interest rates increase throughout 2018, less current homeowners will be motivated to sell their home, wanting to keep their low interest rate. This will then lead to less homes coming onto the market, and will squeeze the already tight housing inventory.

While commenting on the panel, First American Financial Chief Economist Mark Fleming agreed it could hurt housing supply, saying, “There is no reason the current homeowner today will want to sell.”

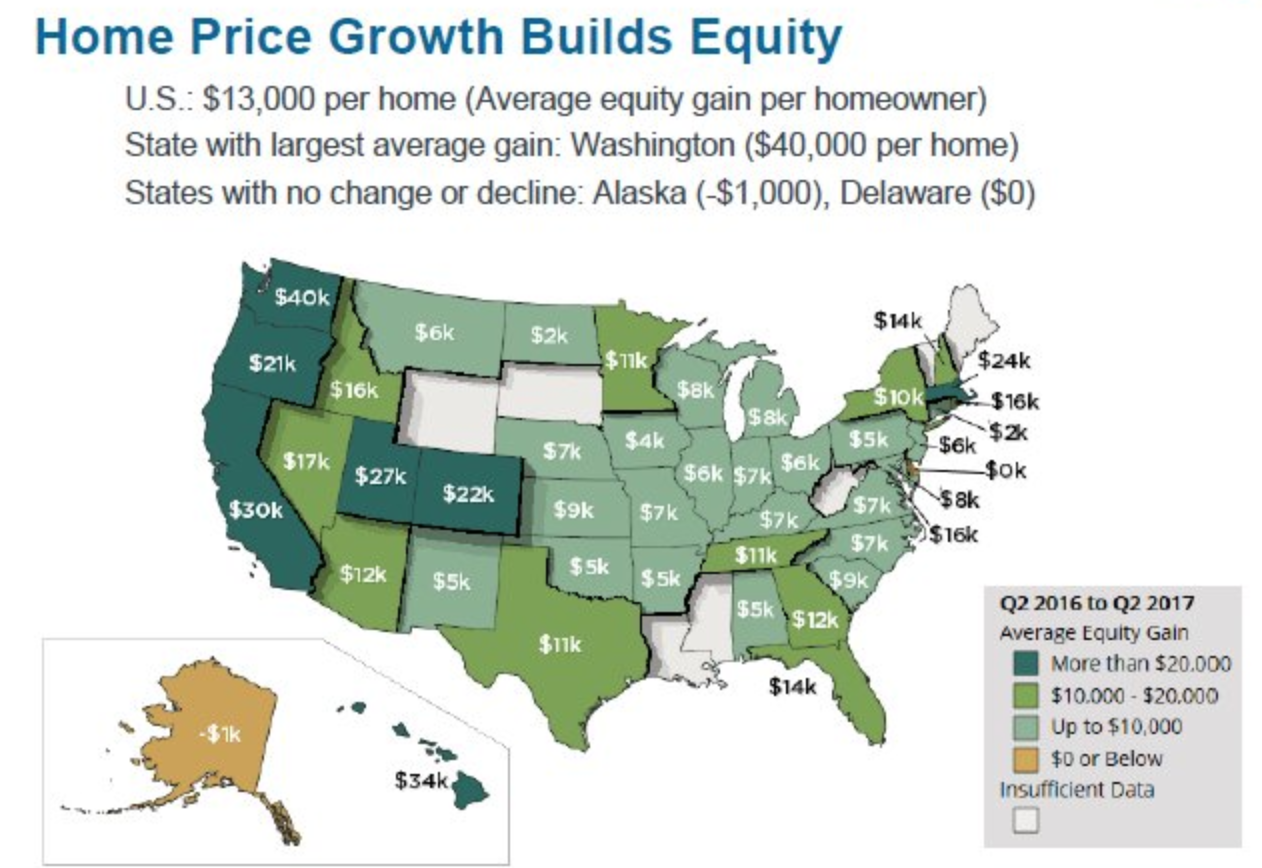

Nothaft predicted home prices will rise yet another 5% in 2018, benefitting current homeowners as their home equity increases. CoreLogic data shows the average homeowner gained $13,000 in home equity in just the past year. In Washington, where Seattle saw a surge in home prices, homeowners gained a full $40,000 in equity since last year.

The chart below shows the amount of equity the average homeowner gained in each state from the second quarter of 2016 to the second quarter of 2017.

Click to Enlarge

(Source: CoreLogic)

However, the rise in prices will not bode as well for the mortgage market, which will continue to see decreases in refinance originations. But refis will not fall off completely as Nothaft explained many FHA borrowers will seek to refinance their mortgage into a conventional loan in order to cancel their mortgage insurance.

In fact, FHA to conventional refinances reached a new all-time high since CoreLogic began tracking in 2000 at just over 10%.

Nothaft predicted while originations will continue to rise, it will be much more moderate, and see less volatility from year to year.

The decrease in refi originations and the slowdown of purchase origination will be partially offset by a rise in home equity lines of credit, which has been rising steadily over the past several years.

But will interest rates increase in 2018? Fleming cautioned economist have been forecasting an increase to 4.5% in mortgage rate for the past three years.