Delinquencies continued to drop in May, hitting lows not seen in the past decade or even nearly two decades, according to the latest Loan Performance Insights Report from CoreLogic, a property information, analytics and data-enabled solutions provider.

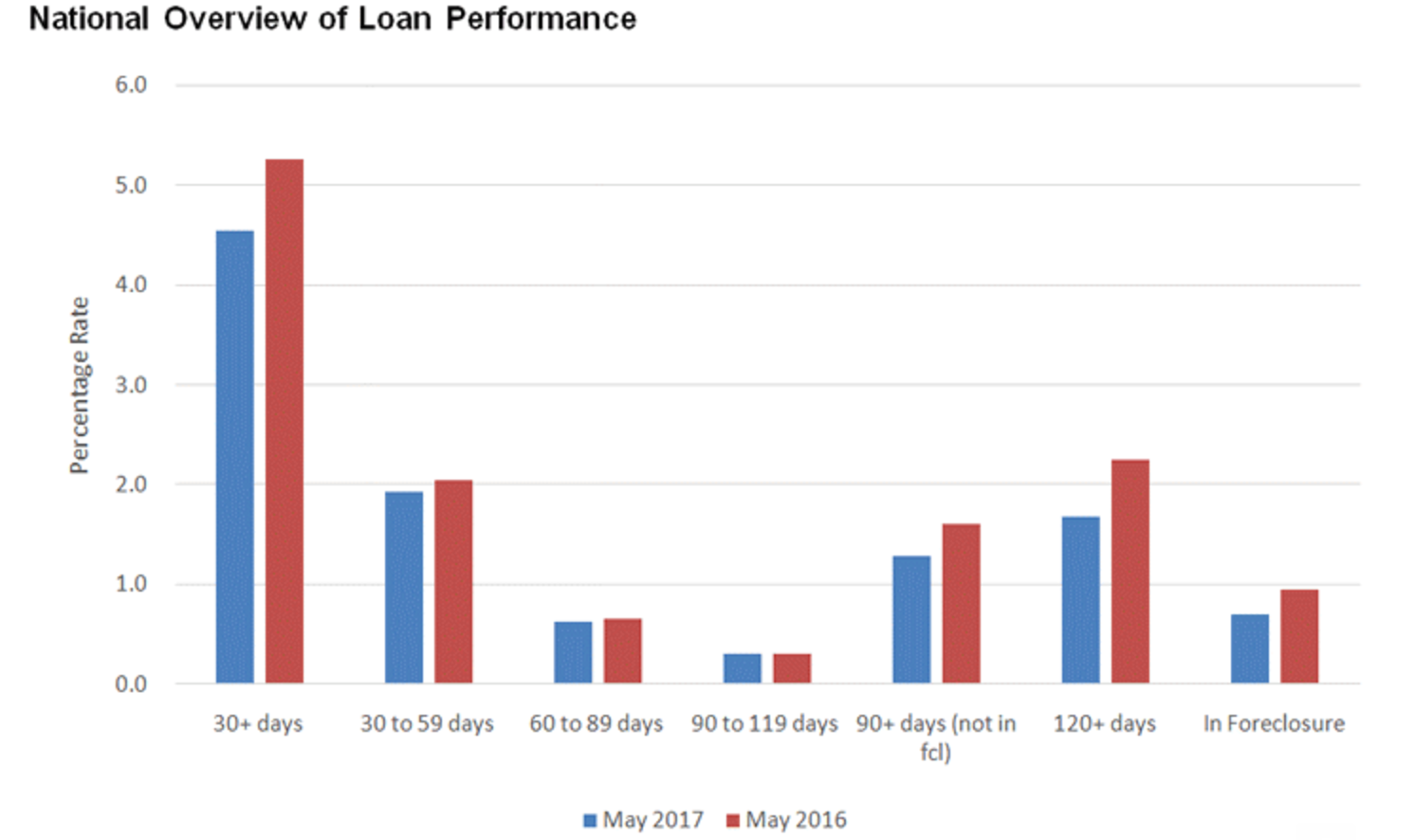

Mortgages in some stage of delinquency, 30 days or more past due, including those in foreclosure, decreased 0.8 percentage points to 4.5% of mortgages. This is down from May 2016 when the delinquency rate was 5.3%.

Click to Enlarge

(Source: CoreLogic)

“A prolonged period of relatively tight underwriting criteria has driven delinquencies down to pre-crisis levels across many parts of the country,” CoreLogic President and CEO Frank Martell said. “As pressure to relax underwriting standards increases, the industry needs to proceed carefully and take progressive, sensible actions that protect hard-fought improvements in mortgage performance.”

The foreclosure inventory rate, which measures the share of mortgages in some stage of the foreclosure process, decreased to 0.7%, down from 1% last year.

The serious delinquency rate, 90 days or more past due, including loans in foreclosure, remained at 2%, unchanged from last month and down 2.6% from May last year. This rate remains the lowest since November 2007 when it was also 2%.

Early delinquencies, defined as 30 to 59 days past due, also decreased slightly, hitting 1.9% in May, down from 2% last year, a 17-year low.

“Strong employment growth and home price increases have contributed to improved mortgage performance," CoreLogic Chief Economist Frank Nothaft said. “Early-stage delinquencies are hovering around 17-year lows, and the current-to-30-day past due transition rate remained low at 0.8%.”

“However, the same positive economic conditions helping performance have also contributed to a lack of affordable supply, creating challenges for homebuyers,” Nothaft said.