What do homebuyers really think about when they’re looking for a home or a mortgage? What do they really want to know about the homebuying process? What is really driving them? What do they really care about?

Real estate professionals and lenders would probably like to know the answers to these questions, but how do they truly get inside the heads of their customers?

A unique new report presents just that opportunity.

The report comes from Chase Home Lending, which partnered with search-engine giant Google, to present a behind-the-scenes look at what homebuyers are Googling, and the results provide a window into what buyers really think.

The report is based on actual Google search data for the past several years.

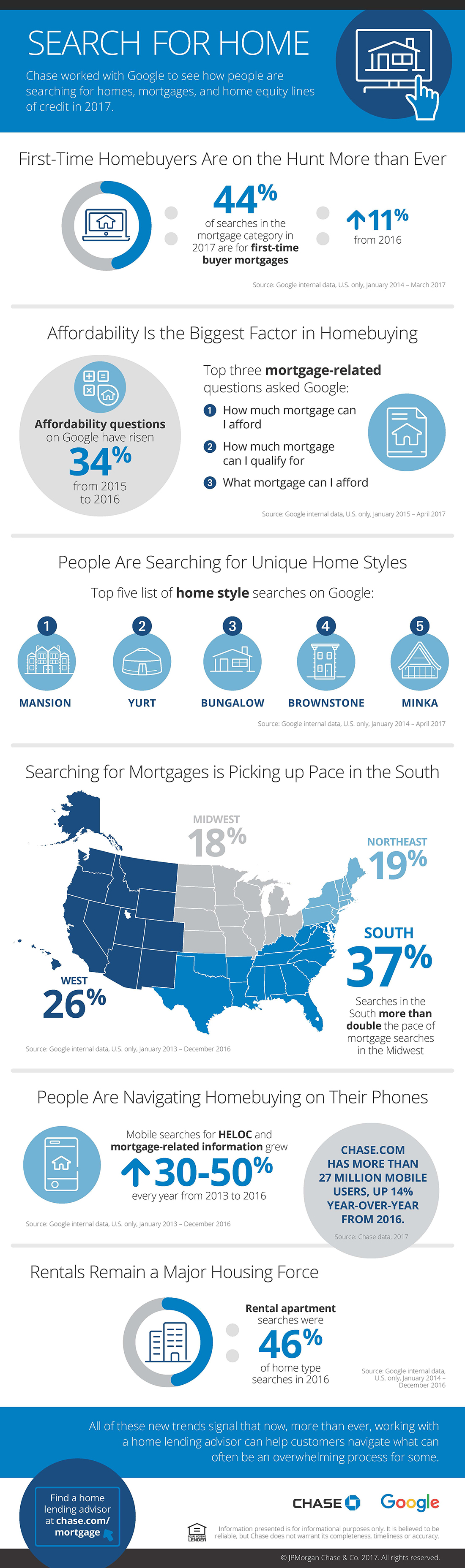

According to the report, one of homebuyers’ top concerns is affordability, i.e. how much house will they be able to afford.

The report showed that in 2016, consumers made 34% more searches around affordability than the year before.

In fact, the top three-mortgage related questions asked in Google are all related to affordability.

The top mortgage-related question asked in Google over the last two years was: How much mortgage can I afford?

Followed by: How much mortgage can I qualify for?; and: What mortgage can I afford?

The report also showed that first-time homebuyers and Millennials are increasing their mortgage-related searches, indicating that younger buyers are preparing to (and actually) buying homes.

The report showed that so far in 2017, 44% of Google searches in the mortgage category are for first-time buyer mortgages, up 11% from last year.

In fact, the data showed that search activity for first-time buyer mortgages is at an all-time high.

Chase said that the increase is also being seen in its mortgage originations, as customers under age 35 made up 36% of Chase’s new mortgages in 2016, which is up 16% from 2015.

The report also showed that more and more people are turning to their phones to help in their search for a mortgage.

According to the report, mobile searches for mortgage-related information and home equity lines of credit increased between 30-50% every year from 2013-2016.

The report also broke things down geographically.

According to the Google data, consumers in the southern part of the country were much more likely to search for mortgage information online.

The report showed that in the last three years, the South is responsible for 37% of the mortgage searches, compared to 26% for the western part of the country, 19% for the Northeast, and 18% in the Midwest.

The report also showed that homebuyers’ preference for a fixed-rate mortgage is increasing.

According to the report, people in Florida searched for fixed-rate mortgages 30% more in 2016 than in 2015, compared to increases of 18% in New York, 9% in Illinois, and 6% in California in the same time period.

Much of the data in the report, and some additional information about what kind of houses people are searching for can been seen in the infographic below.

(Click to enlarge. Image courtesy of Chase and Google.)