Credit availability remained historically tight in the first quarter of 2017, but increased slightly from the previous quarter to the highest level since 2016.

The credit availability index from Housing Finance Policy Center shows mortgage credit availability increased to 5.4 in the first quarter. This is up from 5.2 in the fourth quarter.

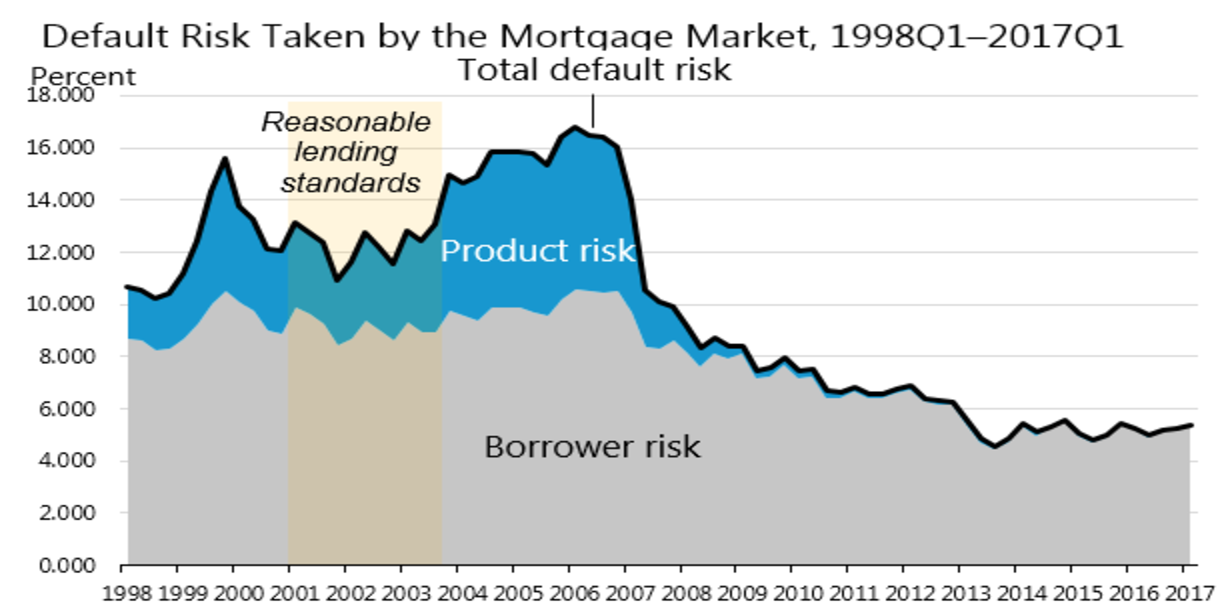

However, the chart below which uses data from eMBS, CoreLogic, HMDA, IMF and the Urban Institute, shows this is still extremely tight compared to historical standards.

Click to Enlarge

(Source: eMBS, CoreLogic, HMDA, IMF and the Urban Institute)

The HCAI measures the percentage of home purchase loans that are likely to default, go unpaid for more than 90 days past their due date. A lower HCAI indicates that lenders are unwilling to tolerate defaults and are imposing tighter lending standards, making it harder to get a loan. A higher HCAI indicates that lenders are willing to tolerate defaults and are taking more risks, making it easier to get a loan.

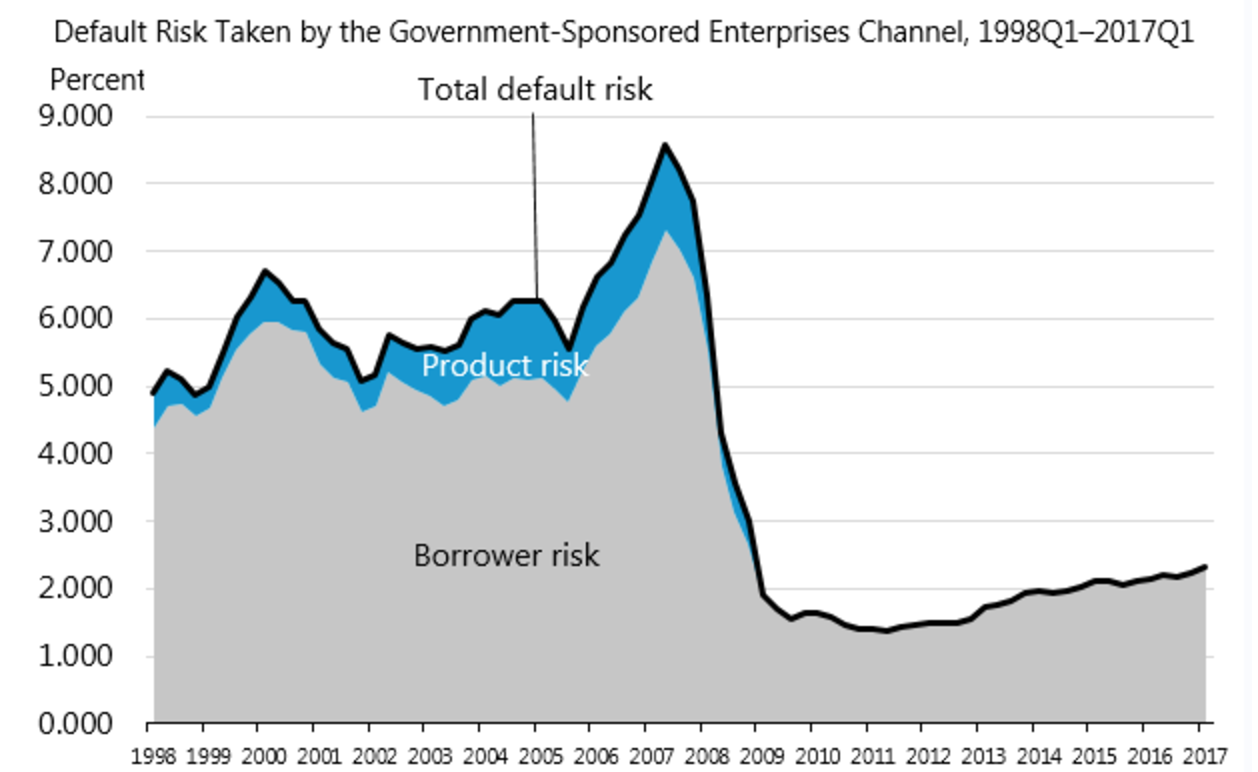

Credit availability at Fannie Mae and Freddie Mac remains at the highest level since its low in 2011. However, both the government channel and portfolio and private-label securities channel continued to stay close to or at the record low for the amount of default risk taken. The government FVR channel includes the Federal Housing Administration, the Department of Veterans Affairs and the Department of Agriculture Rural Development programs.

Earlier this summer, Fannie Mae raised its debt-to-income ratio requirement to further expand mortgage lending.

A new survey from Fannie Mae shows lenders are suddenly ready to begin loosening credit this year as mortgage demand weakens.

The chart below shows that while the government-sponsored enterprises are increasing the risk they take on, it is still low by historic measures.

Click to Enlarge

(Source: eMBS, CoreLogic, HMDA, IMF and the Urban Institute)

The Urban institute pointed out there is still plenty of space to expand the credit box. If the current default risk doubled across all channels, risk would remain within the standard 12.5% seen in the 2001 to 2003 mortgage market.