In the second quarter of 2017, lenders saw increased competition and decreased purchase demand in the housing market. However, lenders also said they have eased credit standards recently and expect further easing in the coming months, giving a slightly more optimistic outlook on the upcoming quarter.

According to an early look at Fannie Mae’s second-quarter 2017 Mortgage Lender Sentiment Survey, the share of lenders reporting they have eased mortgage credit standards over the prior three months has ticked up gradually since the fourth quarter of 2016, as seen in the chart below.

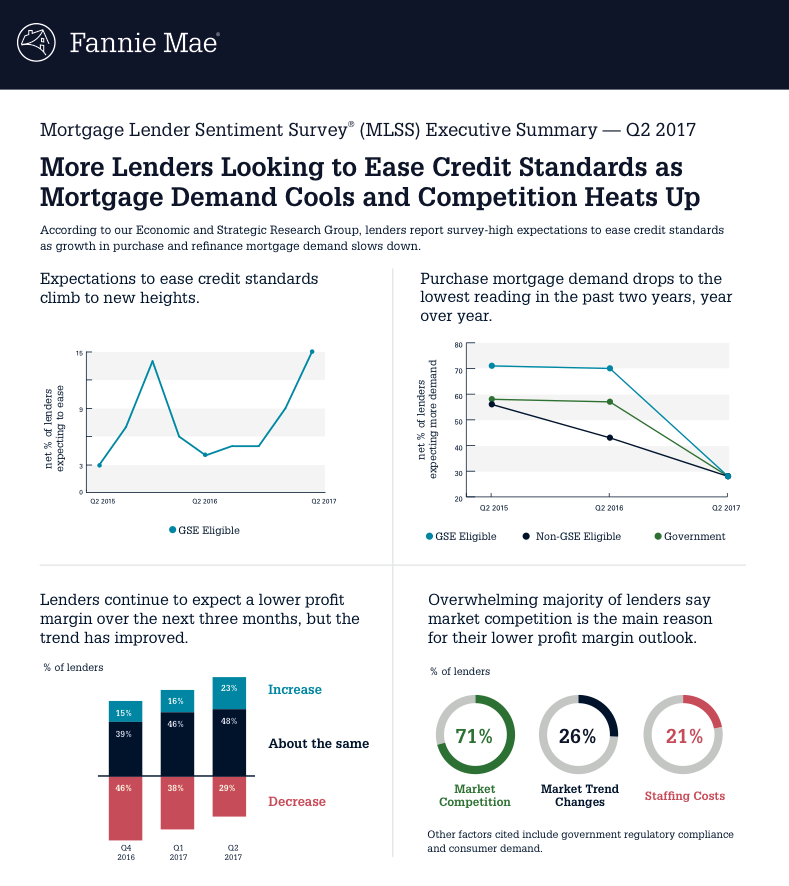

While the absolute percentage increase was modest, the net share of lenders reporting expectations to ease credit standards over the next three months for government- and GSE-eligible loans still reached new survey highs this quarter.

The Mortgage Lender Sentiment Survey polls senior executives of Fannie Mae's customers on a quarterly basis to assess their views and outlook across varied dimensions of the mortgage market. The survey was conducted between May 3 and May 14.

“Expectations to ease credit standards climbed to survey highpoints in the second quarter as more lenders reported slowing mortgage demand and increasing concerns about competition from other lenders,” said Doug Duncan, senior vice president and chief economist at Fannie Mae.

“Lenders cited additional contributing factors such as diminishing compliance concerns and more support from the GSEs, including clarification on representations and warranties and tools that provide greater certainty during the loan underwriting process."

Meanwhile, the survey also found that the net share of lenders reporting growth in purchase mortgage demand over the prior three months has fallen for all loan types. This marked the lowest reading for any second quarter over the past two years.

Looking ahead, lenders are slightly more optimistic. The net share of lenders expecting increased demand over the next three months remains relatively stable for the same quarter year over year.

And to no one's surprise, the net share of lenders reporting rising refinance demand over the prior three months fell significantly to a three-year low, across all loan types.

The survey also found that the net share of lenders reporting a negative profit margin outlook has declined since reaching the survey’s worst reading in Q4 2016. However, more lenders reported a negative outlook than a positive outlook.

Lenders cited competition from other lenders as the key reason for lenders’ decreased profit margin outlook.

“Easing credit standards might also be due in part to increased pressure to compete for declining mortgage volume,” said Duncan. “For the third consecutive quarter, the share of lenders expecting a decrease in profit margin over the next three months exceeded the share with a positive profit margin outlook. For the former, the percentage citing competition from other lenders as a reason for their negative outlook reached a survey high.”

The chart below from Fannie Mae puts into perspective the data from the survey, including the changes in credit standards from lenders.

Click to enlarge

(Source: Fannie Mae)