Despite a boost in net revenue compared to the second quarter of last year, lower mortgage banking revenue at JPMorgan Chase didn’t perform as well, offsetting some of the increase.

According to the bank’s second-quarter earnings results that kicked off earnings season early Friday morning, it reported revenue of $25.5 billion in the second quarter, up from $24.7 billion for first quarter of 2017 and $24.4 billion for the second quarter of 2016. This increases in net revenue beat earnings expectations by $1.1 billion.

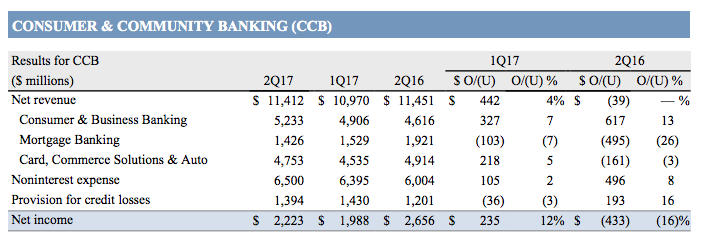

The bank stated that declines in mortgage banking revenue and higher credit card account origination costs offset its increases in Consumer and Business banking net revenue. Mortgage banking net revenue dropped to $1.4 billion, down 26%, driven by higher rates resulting in higher funding costs, lower MSR risk management revenue, and lower production margins.

JPMorgan added that mortgage banking net revenue also included a reduction of approximately $75 million to net interest income, which reflected an adjustment for capitalized interest on modified loans.

The chart below breaks down increases Consumer and Business banking net revenue.

Click to enlarge

(Source: JPMorgan Chase)

In addition, the bank stated its current quarter reserve build of $425 million included $350 million in Card, $50 million in Business Banking, and $25 million in Auto, driven by both loan growth and higher loss rates, predominantly in Card.

However, the reserve build was partially offset by a reserve release of $175 million in Mortgage Banking reflecting continued improvement in home prices and delinquencies.

Tucked into its supplemental earnings release, the bank added that firm-wide mortgage origination volume hit $26.2 billion, $25.6 billion and $28.6 billion, for 2Q17, 1Q17 and 2Q16, respectively.

“We continued to post very solid results against a stable-to improving global economic backdrop. The U.S. consumer remains healthy, evidenced in our strong underlying performance in Consumer & Community Banking. Loans and deposits continue to grow strongly, and card sales and merchant processing volumes were up double digits, reflecting our consistent investment in the business,” said Jamie Dimon, chairman and CEO.