The median FICO score for originations plummeted in April, howeve,r lending standards did not loosen for homebuyers and remains historically tight.

FICO scores for agency originations dropped a full 17 points from 742 in June 2016 to 725 in April, according to Urban Institute’s latest report, Housing Finance at a Glance: A Monthly Chartbook, June 2017.

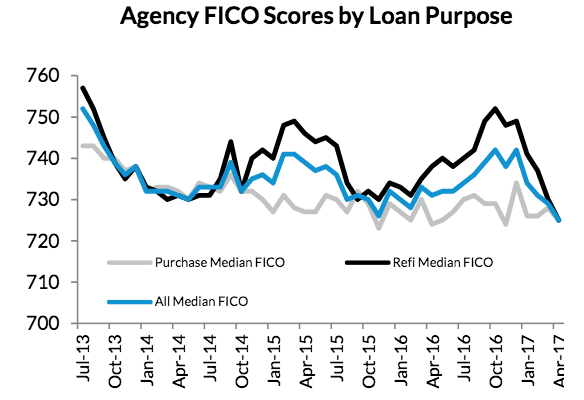

The 44-page report starts off by analyzing the median FICO scores, finding the majority of the drop came from refinance originations, which fell 27 points from 752 in October last year to April’s 725. Comparatively, purchase FICOs dropped by four points during that same period from 729 to 725.

The chart below breaks down the movement in the median FICO score by loan type, purchase or refi.

Click to Enlarge

(Source: Urban Institute, eMBS)

Urban Institute explained that as mortgage interest rates rise and refinance volumes fall, lenders began accepting borrowers with lower FICO scores in order to increase the margin of refinancable borrowers.

But even as the FICO score lowered, the share of refinancable borrowers shrank from 41% in October to 16% in May.

However, this means very little for credit availability. The report points out that while a drop in refinance FICOs is good for those homeowners who are now able to reduce their monthly payments, it is actually a small subset of borrowers.

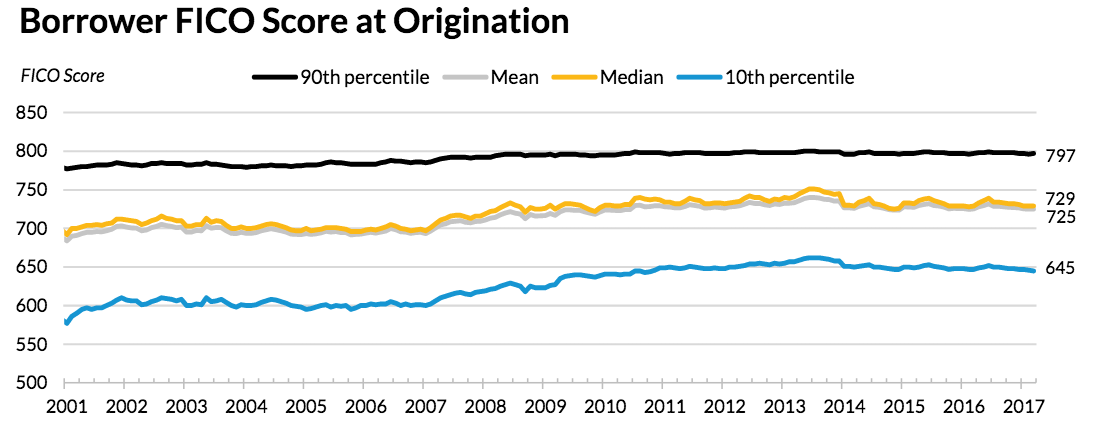

Since the housing crisis, access to credit has been tight. The median FICO scores on new purchase originations increased 23 points over the past decade. The 10th percentile of FICO scores, which represents the lower bound of creditworthiness needed to qualify for a mortgage, stood at 645 in March. Before the Great Recession, that number held steady in the low 600s.

Click to Enlarge

(Source: Urban Institute, CoreLogic, eMBS, HMDA, SIFMA)

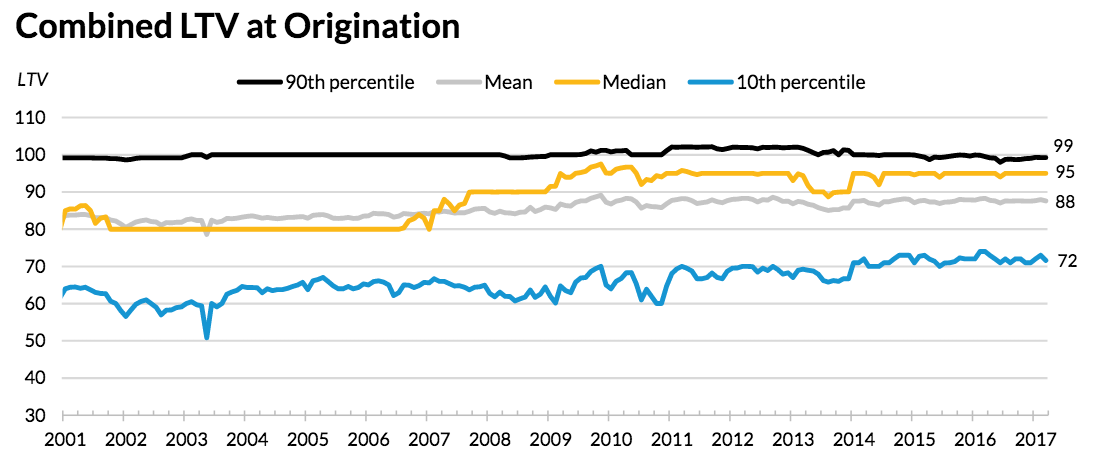

However, loan-to-value ratios at originations remain high, averaging 88%. This could be a reflection of the high number of FHA originations, Urban Institute pointed out.

The chart below shows LTV for borrowers in the 90th percentile remained steady since 2001. The median LTV, however, increased, as did the LTV for borrowers in the 10th percentile.

Click to Enlarge

(Source: Urban Institute, CoreLogic, eMBS, HMDA, SIFMA)

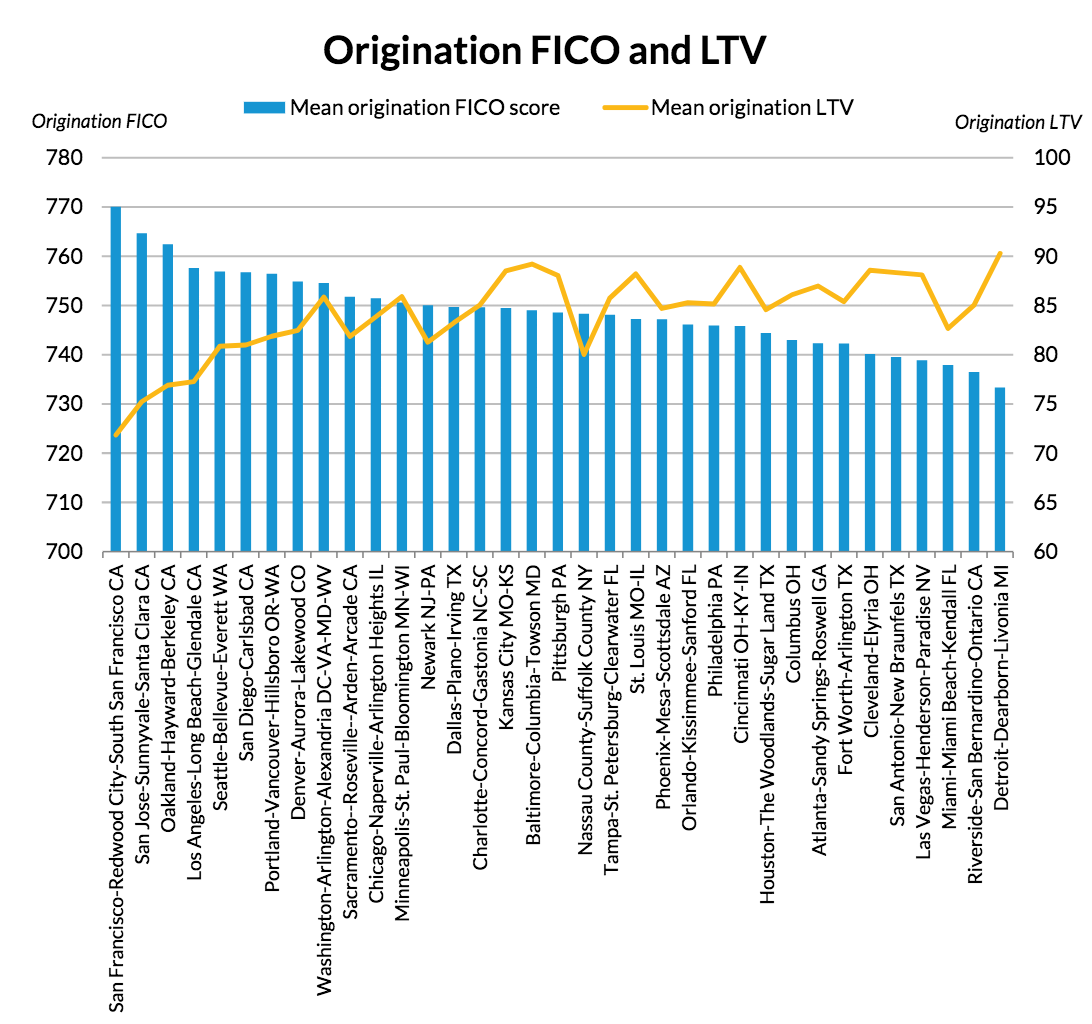

FICO scores are the highest in the most expensive metros, the chart below shows. It also shows the median LTV is lowest where FICO scores are the highest, and vice versa. Borrowers who struggle to save up for a down payment in the most expensive metros make it up in other ways, such as with their high LTVs.

Click to Enlarge

(Source: Urban Institute, CoreLogic, eMBS, HMDA, SIFMA)

But while credit remains tight right now, a recent survey conducted by Fannie Mae shows lenders agree it is time to loosen credit availability as mortgage demand weakens.

This is a significant turnaround from last year, when Fannie Mae’s survey showed almost no lenders planned to ease credit standards.