After a little more than a year, HSBC officially completed its obligations under the National Mortgage Settlement, according to the latest update from Joseph Smith, monitor of the National Mortgage Settlement.

Earlier this year, Smith’s office announced HSBC finished its consumer relief requirement under the settlement, providing more than $371 million in consumer relief.

This latest update gives the final report from Smith’s office on HSBC, noting that the company did not fail any metrics for the third and fourth quarters of 2016 and has satisfied its obligations under the settlement.

The settlement dates back to February 2016 when HSBC agreed to a $601 million settlement with a series of federal agencies and nearly every state over charges that the bank engaged in mortgage origination, servicing and foreclosure abuses.

“HSBC has completed its obligations to the NMS,” Smith said. “The servicer will continue to remain accountable to servicing-related rules issued and enforced by the CFPB.”

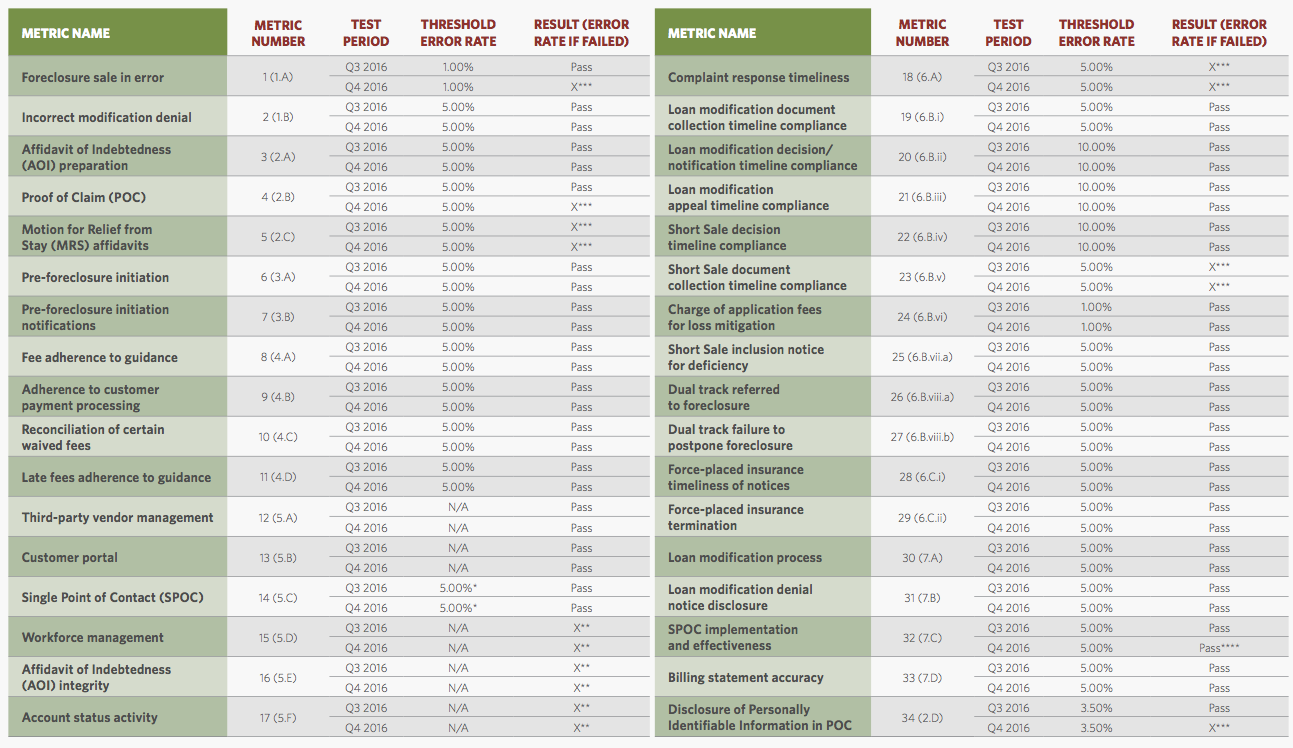

As monitor, Smith evaluates HSBC using the 34 metrics, or tests, detailed in the settlement. These metrics determine whether the servicers adhere to the 304 servicing standards, or rules, contained in the NMS.

The chart below shows the 34 metrics that HSBC was tested on.

Click to enlarge

(Source: Joseph Smith)