JPMorgan Chase beat revenue and earnings per share expectations for the first quarter 2017. But despite performing well overall, the bank’s mortgage department struggled, continuing a recent downward trend in mortgage net revenue.

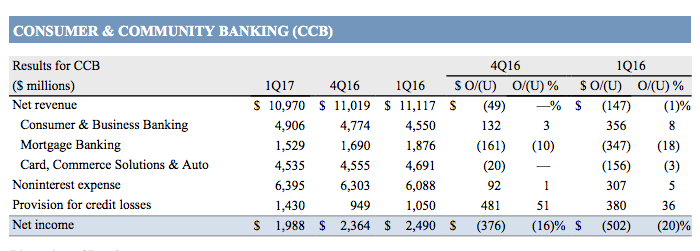

According to its earnings report, for the first quarter of 2017, mortgage banking net revenue fell to $1.5 billion, down 18%, due to lower net servicing revenue reflecting lower MSR risk management results, as well as servicing portfolio run-off.

The bank’s mortgage department, and consumer and community bank overall, was down from the fourth quarter 2016 and a year ago, seen in the chart below.

Click to enlarge

(Source: JPMorgan Chase)

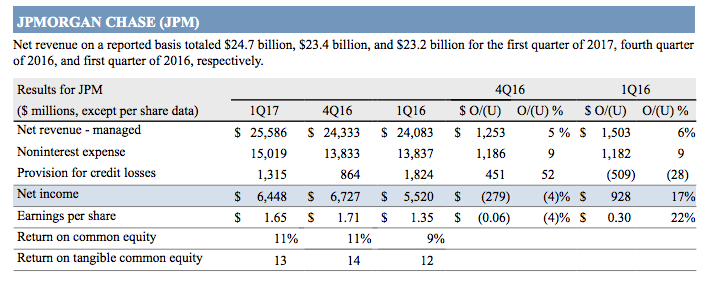

JPMorgan Chase as a whole, however, witnessed a strong start to the year, with net income coming in at $6.4 billion, an increase of 17%.

Net revenue was also up for the first quarter, coming at $25.6 billion, up 6%. This beat expectations by $710 million.

Earnings per share also beat expectations, and even though it was down from the previous quarter, it was up from a year ago. Earnings per share of $1.65 beat expectations by $0.13.

The chart below shows how the bank performed as a whole.

Click to enlarge

(Source: JPMorgan Chase)

Jamie Dimon, chairman and CEO, is still positive on the results.

“We are off to a good start for the year with all of our businesses performing well and building on their momentum from last year,” said Dimon. “The consumer businesses continue to grow core loans at double digits, outperform the industry in deposit growth, and we once again had very strong card sales volume growth this quarter – reflecting our commitment to providing our customers the innovative products and services they want.”

“U.S. consumers and businesses are healthy overall and with pro-growth initiatives and improving collaboration between government and business, the U.S. economy can continue to improve. We will be there to do our part, strong and steadfast in good times and bad, and working every day to support our clients and our communities,” Dimon concluded.