Monday Morning Cup of Coffee takes a look at news coming across the HousingWire weekend desk, with more coverage to come on bigger issues.

The launch date is finally official after much talk and hype surrounding when Fannie Mae would release its update to Desktop Underwriter program that will open up the credit box to potential borrowers previously deemed unworthy.

According to Fannie Mae, during the weekend of Sept. 24, 2016 Fannie Mae will implement Desktop Underwriter Version 10.0. The changes included in this release will apply to new loan casefiles submitted to DU Version 10.0 on or after the release weekend.

The launch date was unexpectedly delayed in mid-June only days before it was supposed to be released on the weekend of June 25.

But this isn’t just any update, and the delay in implementation meant a longer wait time for those eager borrowers on the edge of eligibility.

So why is this one such a big deal? The update is notable and significant because it includes the requirement that lenders must begin using trended credit data when underwriting single-family borrowers. Fannie Mae is working with Equifax and TransUnion to provide the data.

As it stands, credit reports used in mortgage lending only indicate the outstanding balance and if a borrower has been on time or delinquent on existing credit accounts such as credit cards, mortgages or student loans.

Through trended credit data, lenders can access the monthly payment amounts that a consumer has made on these accounts over time.

Equifax explained that trended data expands the credit information used for evaluating a home loan applicant, adding a more dynamic two-year picture of the applicant’s history managing revolving accounts.

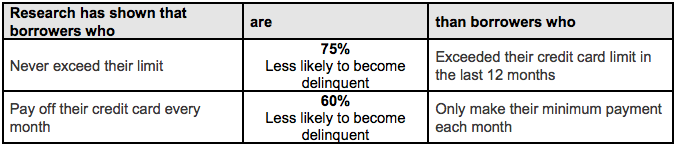

As to how the amount a borrower pays on their credit card account demonstrate how they will pay their mortgage, Fannie Mae explained:

The trended credit data will be used by the DU risk assessment to evaluate how the borrower manages his/her revolving credit card accounts. A borrower who uses revolving accounts conservatively (low revolving credit utilization and/or regular payoff of revolving balance) will be considered a lower risk. A borrower whose revolving credit utilization is high and/or who makes only the minimum monthly payment each month will be considered higher risk.

This chart helps put it into perspective.

Click to enlarge

(Source: Fannie Mae)

Other updates to DU include: Updated DU risk assessment, underwriting borrowers without traditional credit, policy changes for borrowers with multiple financed properties, HomeReady mortgage message updates, updates to align with the selling guide and retirement of DU Version 9.2.

With Home Affordable Refinance Program extended into 2017, it also means that the threat of scammers pretending to offer government-sponsored modifications isn't going away. Beware.

The threat, as mentioned in a blog piece from PennyMac, focuses on the Home Affordable Modification Program, which will still end at the end of the year, but borrowers should always be on guard for scammers.

PennyMac stresses that borrowers need to beware of fraudulent “Making Home Affordable” offers.

“Owning a home can be expensive and, as one of your largest assets, it’s important to protect. As a homeowner, you may receive hundreds of offers a year to refinance or modify your home loan, promising a lower monthly payment. Unfortunately, not all offers are legitimate,” the blog stated.

The scam:

There are companies out there targeting homeowners with fraudulent offers. These scammers call and mail homeowners pretending to be your mortgage servicer or a representative from the Federal Government’s Home Affordable Modification Program. They prey on unsuspecting homeowners by offering fake loan modifications and “trial payment plans”, along with promises of lower monthly mortgage payments. And while these scammers may send genuine-looking letters with your mortgage company’s logo and account number, they also provide deceptive contact information in an effort to route your payment away from your servicer and directly to them. In fact, they may also call from telephone numbers that show up on caller ID as the homeowner’s actual mortgage company

If borrowers for any reason are uncertain about the offer, PennyMac urges them to contact their lender.

Unfortunately this isn’t the only account of mortgage scams happening, back in March, the Federal Trade Commission and the National Association of Realtors issued a warning to consumers, advising them that they could be the next victim of a mortgage closing cost phishing scheme.

According to the FTC and NAR, scammers were hacking the email accounts of consumers and real estate professionals to obtain information about upcoming real estate transactions.

Good news for members of the National Association of Federal Credit Unions, NAFCU announced that its membership has voted to approve the board’s unanimous recommendation to amend the association’s Articles of Incorporation.

This means that federally-insured, state-chartered members have full voting rights and the ability to run for and serve on the NAFCU Board of Directors.

And that’s not the only thing. It also reinforces NAFCU’s focus on credit union issues at the federal level.

“This decision is vital to the growth and success of NAFCU and supports our goal of serving all federally-insured credit unions at the federal level so we may become a stronger, more impactful organization,” said Richard L. Harris, chair of the NAFCU Board of Directors. “While this is great news for NAFCU and the industry, we remain focused on providing our members the best in federal advocacy, education and compliance assistance.”

Social Finance, better known as SoFi, is working in overdrive to not follow the same downward spiral of others in the online lending industry.

The San Francisco-based lender launched into mortgages in October 2014, stepping outside of the student loan world it got its start in, and so far, has been doing quite well, getting approved to be a Fannie Mae servicer and seller back in May 2016.

Back in January, SoFi announced it had officially surpassed more than $7 billion in funded loans, and in September, SoFi announced $1 billion in Series E funding led by SoftBank.

And according to an article in The Wall Street Journal by Peter Rudegeair, there’s a lot more financial growth in store for the lender. The article stated that SoFi is pitching a new fundraising effort as it looks to buck a recent slump in the industry.

From the article:

Privately held SoFi hopes to raise about $500 million in equity to fund new growth initiatives among mass-market borrowers and international markets, according to the people and a presentation reviewed by The Wall Street Journal.

The round is likely weeks away from completion, and neither the lead investor nor the valuation SoFi is seeking could be determined.

If the deal goes through, the article noted that SoFi would close one of the largest U.S. fintech funding deals of the year.

That’s it for this week’s MMCC. Feel free to leave any tips, news, or facts about HAMP scammers in the comments below.