“There's no crisis.”

“There's no deadline.”

“There's no consensus on reform.”

The three quick snippets from Paul Miller, managing director and head of financial services/real estate research with FBR Capital Markets & Company, sum up the constant conversations surrounding GSE reform at the Mortgage Bankers Association’s Secondary conference in New York City.

After attending a conference with some of the top investors in housing, people who are the most in-tune with the market, I’ve come to realize housing is as close to solving GSE reform as it is in solving “Which came first, the chicken or the egg?”

This could mean one of two things for you. I’m either telling you want you already know, or you’re in complete disagreement because you’re set on the fact that you have the answer to GSE reform. And if the latter is you, I genuinely wish you luck because the industry is in desperate need of change.

But for the people in the first category who, like me, spent the last few days inundated with discussion on GSE reform with no real solution, there was one session right before I headed back to Dallas that tossed out an opinion I think holds enough weight to it to mention.

But first, let’s go back to the first general session of the conference, “Executives’ perspectives on the secondary mortgage market.”

The panel featured executives from Quicken Loans, M&T Bank, Mason-McDuffie Mortgage, Freedom Mortgage, Dynex Capital and U.S. Bank Home Mortgage.

The group went through its rounds chatting about homeownership, interest rates and government products. But toward the end of the panel they landed on the topic of GSE reform, and all sense of unity on the topic left.

While one panelist suggested that the entire system needs to be looked at from the perspective of three to five decades down the road and what kind of involvement the government should have creating long-term homeownership, anther settled on the idea that reform won’t happen anytime since things are great. The government doesn’t want to create issues that they don't want to deal with.

I got in a conversation with the person sitting behind me in the audience after the session finished and asked them what they thought of discussion.

They were just as confused.

They came to secondary to figure out how they should plan for the next several years. If GSE reform is something that could happen three to five years down the road, they want to take account of this in their business strategy. But the session left them just as confused on the future as they did when they walked in. One difference is that this time they have the comfort in knowing even the top executives in housing aren’t in agreement.

It was this same sense of disunity that rang throughout the entire conference.

This isn’t to say the conference was spent in one giant arguing debate, as much as to say the industry is longing for answers.

And while it’s not an answer, it’s the closest idea/answer I heard that I think the industry can count on for when change will happen

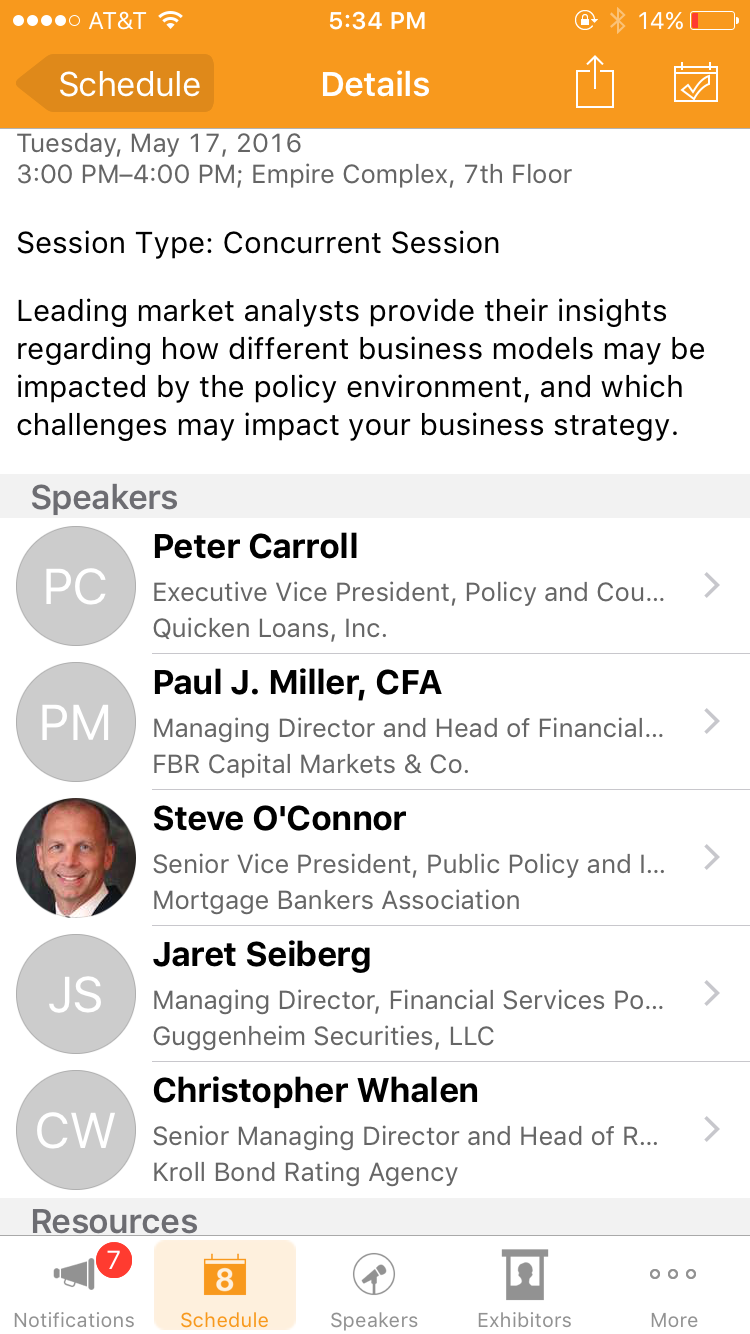

One of the last panel sessions on Tuesday “The intersection of policy and politics in the secondary market,” of course, came around to the topic of GSE reform.

Here’s a quick snapshot of the names on the panel.

Christopher Whalen, senior managing director and head of research with Kroll Bond Rating Agency, when asked about GSE reform, said, “This industry has been downsizing for the current volume of production that is getting done. As the banks exit, it forces more and more public outcry for change. I don't know what the outcome will be, and I don't know what that will be in terms of pressure, but that will be what changes it.”

It meaning when change will happen with GSE reform.

“People can’t get into homes,” Whalen said.

It may not be the exact answer you’re looking for but understand this problematic situation growing. And if owning a home, which is supposed to be the American Dream, is extremely out of reach for the people, the government will be forced to quickly move housing to the top of it priority list.

Take a look at the latest appraisal volume report. Housing is not taking off this spring, a season that is supposed to be the market’s time to shine.

The MBA’s most recent mortgage application data reinforced this data showing that despite mortgage interest rates hitting the lowest level in three years, mortgage applications dropped.

Even the latest survey results by Fannie Mae found that fewer consumers feel that now is a good time to buy than ever before.

HousingWire has tons and tons of coverage behind how housing reform can be executed on HousingWire (check here).

There’s no straight answer there, but as Whalen said, the government won’t have a choice but to address this once millions of people can’t get into homes.