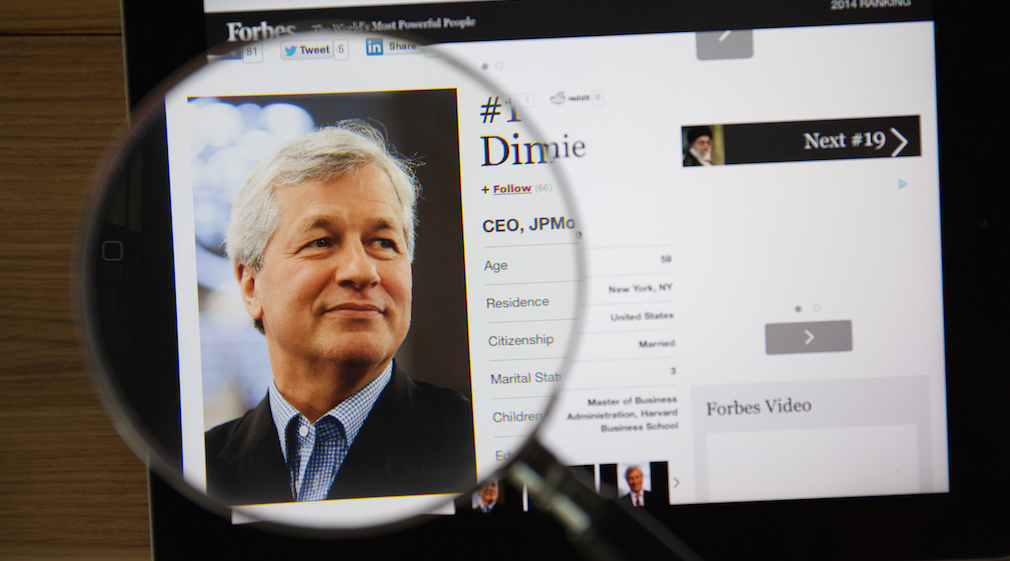

JPMorgan Chase CEO Jamie Dimon did more than predict a coming economic crisis in his yearly letter to shareholders.

In his letter, Dimon also openly questioned why the bank is still in the mortgage business, telling shareholders that one of the main reasons that the megabank is still engaged in mortgage lending is for the benefit of its customers, despite the “volatile” nature of the business and the “increasingly lower returns” coming from mortgages.

Dimon’s letter includes a section titled “Why are you still in the mortgage business?,” a question that Dimon says is a “valid” one given the current environment.

“The mortgage business can be volatile and has experienced increasingly lower returns as new regulations add both sizable costs and higher capital requirements,” Dimon writes.

“In addition, it is not just the cost of the new rules in origination and servicing, it is the enormous complexity of those new requirements that can lead to problems and errors,” Dimon continues. “It is now virtually impossible not to make some mistakes – and as you know, the price for making an error is very high.”

So why does JPMorgan Chase stay in the mortgage business? For its customers, Dimon says.

“Mortgages are important to our customers. For most of our customers, their home is the single largest purchase they will make in their lifetime,” Dimon writes.

“More than that, it is an emotional purchase – it is where they are getting their start, raising a family or maybe spending their retirement years,” Dimon contiues. “As a bank that wants to build lifelong relationships with its customers, we want to be there for them at life’s most critical junctures.”

Dimon writes that the bank recognizes the importance of a mortgage to its customers, and says that the bank believes it has the “brand and scale” to build a “higher quality and less volatile” mortgage business.

Dimon goes on to say that the megabank has reduced its number of mortgage offerings from 37 to 15.

One of those products that Chase is cutting back on is its Federal Housing Administration lending program.

Dimon writes that FHA lending is currently “too costly and too risky” to pursue extensively.

“We have dramatically reduced FHA originations,” Dimon writes. “Currently, it simply is too costly and too risky to originate these kinds of mortgages. Part of the risk comes from the penalties that the government charges if you make a mistake – and part of the risk is because these types of mortgages default frequently.”

And when those mortgages default, Dimon writes that servicing them is cost-prohibitive as well.

“In the new world, the cost of default servicing is extraordinarily high.,” Dimon writes. “If we had our druthers, we would never service a defaulted mortgage again. We do not want to be in the business of foreclosure because it is exceedingly painful for our customers, and it is difficult, costly and painful to us and our reputation.”

Dimon said that by making fewer FHA loans, the bank has helped reduce its foreclosure inventory by more than 80%, adding that the bank is negotiating with Fannie Mae and Freddie Mac to have any delinquent mortgages that insured by Fannie and Freddie to be serviced by them as well.

Dimon said that while the bank by scaling back its FHA lending significantly, it opens itself up potential violations of its Community Reinvestment Act and Fair Lending obligations, but states that the bank has a plan.

We believe we have solutions in place to responsibly meet these obligations – both the more subjective requirements and the quantitative components – without unduly jeopardizing our company,” Dimon writes.

Dimon also adds that JPMorgan Chase is planning the rollout of a new originations system, and said that the bank will be going more digital with its mortgage operations.

“We will continue to leverage digital channels to make the application process easier for our customers and more efficient for us,” Dimon said.

You can read Dimon’s entire 50-page letter to shareholders here.

(image above courtesy of GongTo / Shutterstock.com)