San Francisco often ranks among the “hottest” housing markets due to its rapidly rising housing prices. In the last month alone, San Francisco appeared on three separate lists of the “hottest” or “strongest” housing markets for 2016.

But how hot is too hot?

According to a new report from Fitch Ratings, San Francisco is reaching that point, with the dreaded “b” word being thrown around now in regards to San Francisco housing.

Fitch’s report suggests that Bay Area home prices are “overheating” and have reached a “level unsupportable by area income,” and asks if there is a “Bay Area bubble.”

According to Fitch’s report, San Francisco home prices hit an all-time high in third quarter of 2015 and are now 62% above their post-recession low in early 2012.

In the report, Fitch Managing Director Grant Bailey said that San Francisco home prices are up more than 10% in the past year alone, making the San Francisco housing market now approximately 14% overvalued when compared to the area’s underlying supporting economic fundamentals.

“The last time the Bay Area experienced this kind of home price growth was during the dot-com era from 1997-2000,” Bailey said in the report.

According to Fitch’s report, the surge in San Francisco home prices over the last three years has exceeded the growth rate observed during the 2003–2006 housing boom.

“In both the dot-com era and recent years, home price momentum was initiated by undervalued prices and strong income growth,” Fitch’s report stated. “Area home prices fell roughly 5% nominally and 10% in real terms when the dot-com bubble burst.”

The graph below, courtesy of Fitch’s report, shows the rapid rise of home prices in San Francisco compared to the rest of the U.S.

According to Fitch’s report, strong income growth in the San Francisco area has driven the home price increases as the area’s total income is up 44% since the prior peak and 18% since the post-recession low.

But Fitch’s report suggests that home price growth “appears to have exceeded” income growth.

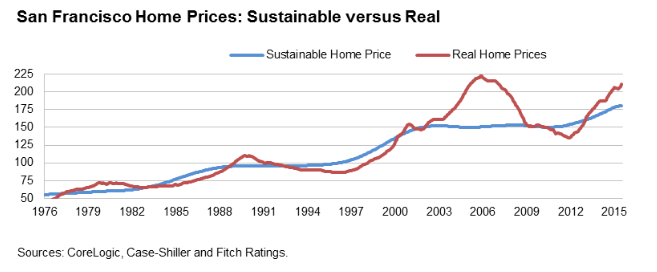

The graph below, also courtesy of Fitch’s report, shows San Francisco’s “sustainable” level of home prices compared to the actual level of home prices over the last 30 years.

While the gap between the “sustainable” home price level and the real home price level was much wider in 2006 than it is now, the current gap is widening.

Fitch isn’t the only one that noticed how much the cost of San Francisco housing has risen lately.

Late last year, one San Francisco credit union announced that it was willing to go to extreme measures to try to help area residents buy a home.

In December, San Francisco Federal Credit Union announced a new loan program that will allow San Francisco-area borrowers to finance up to 100% of their mortgage – with no requirement for mortgage insurance – on loans up to $2 million.

Rebecca Reynolds Lytle, senior vice president and chief lending officer for San Francisco Federal Credit Union, said that the POPPYLOAN program was created to address the stark realties of San Francisco’s housing situation.

“We see POPPYLOAN as a game-changer for the San Francisco real estate market," Reynolds Lytle said.

"Too many of our members have given up hope of buying a home because of escalating home prices and the required down payment,” she continued.

“However, these same families are paying more than a mortgage payment for monthly rent,” Reynolds Lytle said. “Paying $3,600 for a one-bedroom apartment is about the same as making a monthly payment on an $800,000 mortgage. We created POPPYLOAN to help middle class families realize their dream of buying a home without having to move out of the Bay Area."

Overall, Fitch’s report shows that the national home price average rose 1% in the third quarter of 2015, or 5% year-to-date.

“Fitch Ratings views current price levels in most regions as sustainable and supported by improving unemployment and income growth,” the report states. “New home construction spending has picked up as the inventory of for-sale and under construction homes has fallen, reflecting further curing of the post-recession housing overhang.”

But that’s not the case in San Francisco, where prices are rising too quickly and lenders are resorting to extreme measures just to keep up.

Sound familiar?