Fannie Mae officially set the release date for Desktop Underwriter Version 10.0 for the weekend of June 25.

While the updates were announced back in October 2015, the launch date was generally set for mid-2016.

One of the biggest changes in the new update is that Fannie Mae will require lenders to use trended credit data when underwriting single-family borrowers. Fannie is working with Equifax and TransUnion to provide the data.

As it stands, credit reports used in mortgage lending only indicate the outstanding balance and if a borrower has been on time or delinquent on existing credit accounts such as credit cards, mortgages or student loans.

Through trended credit data, lenders can access the monthly payment amounts that a consumer has made on these accounts over time.

The new trended credit data in DU Version 10.0 requires no operational changes by Fannie Mae.

However, Fannie Mae does note that lenders should contact their credit providers for information regarding any steps that need to be taken to obtain credit reports with trended credit data.

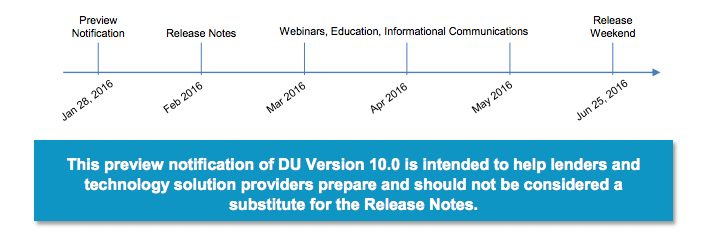

Here is a timeline for the planned implementation of DU Version 10.0:

Click to enlarge

(Source: Fannie Mae)

Check here for the full note from Fannie Mae.