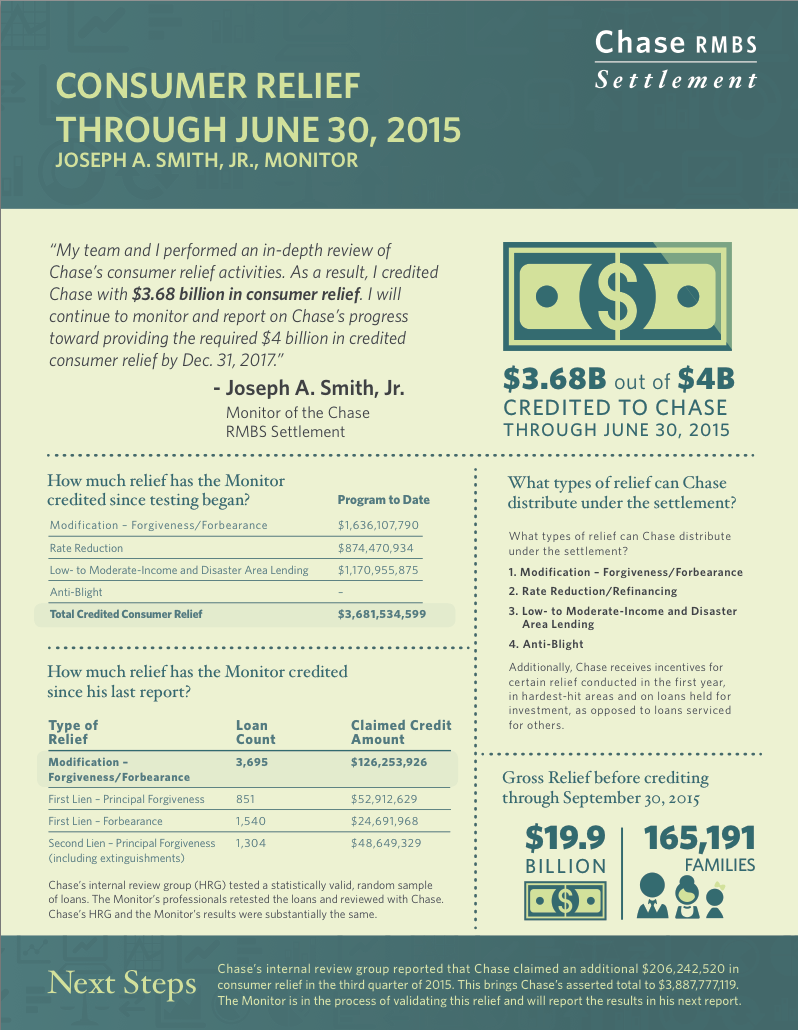

The latest update on JPMorgan Chase's RMBS settlement shows it is nearing its $4 billion requirement in credited consumer relief.

National Mortgage Settlement Monitor Joseph Smith credited JPMorgan Chase with providing $126 million in consumer relief to 3,696 borrowers through the second quarter of 2015.

As a result, this brings the total amount of consumer relief the monitor has credited to $3.68 billion for 161,802 borrowers.

“My team and I performed an in-depth review of Chase’s consumer relief activities. As a result, I have credited Chase with $3.68 billion in consumer relief,” Smith said. “I will continue to monitor and report on Chase’s progress toward providing $4 billion in credited consumer relief by Dec. 31, 2017.”

In addition, the monitor’s report also contains Chase’s self-reported consumer relief credit through the third quarter of 2015. As of Sept. 30, 2015, Chase claimed an additional $206 million in consumer relief.

“I am in the process of confirming Chase’s additional claimed credit,” Smith said. “I plan to report my findings this spring.”

This is Smith’s seventh report on JPMorgan Chase’s progress under its settlement with the federal government and five states concerning claims that Chase, Bear Stearns and Washington Mutual packaged and sold bad residential mortgage-backed securities to investors before the financial crisis.

In Smith’s sixth report, he credited Chase with $3.56 billion in consumer relief to 158,107 borrowers through March 31, 2015.

“We continue to help thousands of families become homeowners and assist those who may be struggling. We have helped over 165,000 families through nearly $20 billion in total mortgage relief,” JPMorgan said in a statement.

Here is a snapshot of the updated consumer relief report.

Click to enlarge

(Source: Joseph Smith)