The Office of the Comptroller of the Currency slapped Wells Fargo (WFC), JPMorgan Chase (JPM) and four other banks with restrictions on each bank’s mortgage servicing operations due to their failure to comply with requirements of the Independent Foreclosure Review, the OCC announced Wednesday.

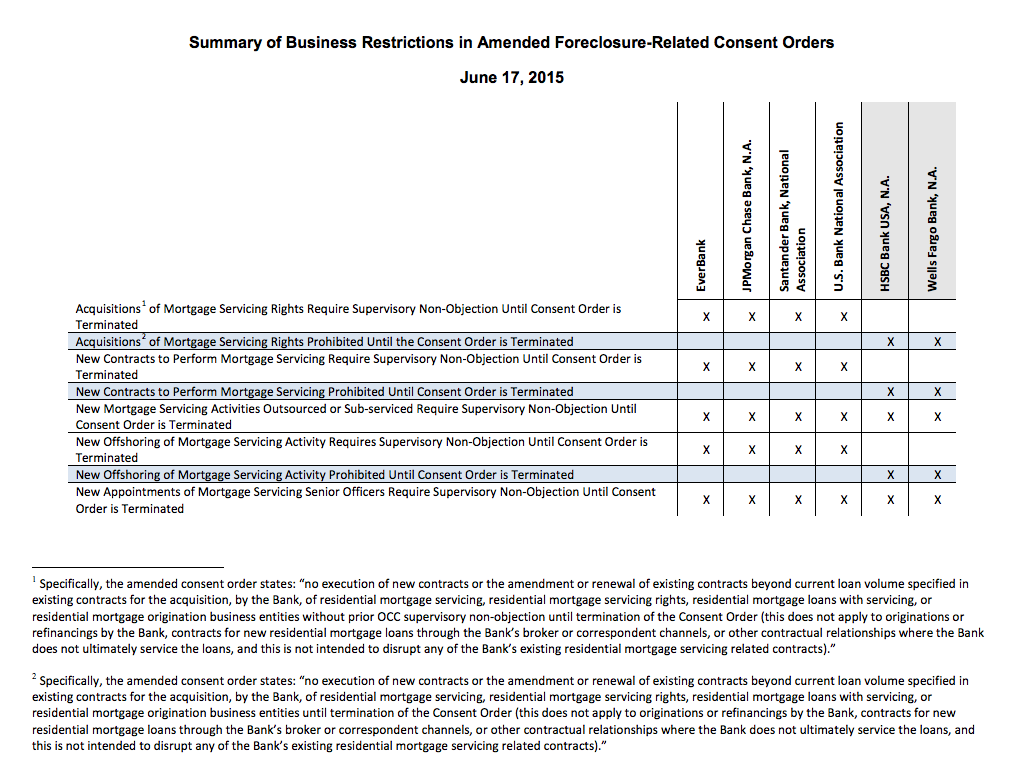

According to the OCC, the six banks, Wells Fargo, HSBC (HSBC), EverBank (EVER), JPMorgan Chase, Santander Bank NA (SAN) and U.S. Bank National Association (USB), are restricted from:

- acquisition of residential mortgage servicing or residential mortgage servicing rights (does not apply to servicing associated with new originations or refinancings by the banks or contracts for new originations by the banks);

- new contracts for the bank to perform residential mortgage servicing for other parties;

- outsourcing or sub-servicing of new residential mortgage servicing activities to other parties;

- off-shoring new residential mortgage servicing activities; and

- new appointments of senior officers responsible for residential mortgage servicing or residential mortgage servicing risk management and compliance.

Wells Fargo and HSBC were dealt the hardest blow and are prohibited from the following:

- Acquiring of mortgage servicing rights until the consent order is terminated

- New contracts to perform mortgage servicing prohibited until the consent order is terminated

- New offshoring of mortgage servicing activity until the consent order is terminated

EverBank, JPMorgan Chase, Santander Bank NA, U.S. Bank National Association are will only need prior approval from the OCC on mortgage servicing activity.

Click this chart for a more in-depth outline of the restrictions placed on each bank.

(Source: OCC)

Each of the affected banks said that they are working with the OCC on the related matters.

“We’ve made significant progress, which has earned us the highest ratings among large banks by the U.S. Department of the Treasury’s MHA Program and J.D. Power, and we believe we’re in a position to complete our remaining items by the end of the summer,” a spokesperson from JPMorgan said in a statement.

“Wells Fargo has implemented significant changes to our mortgage servicing operations and achieved compliance with major elements of the original Consent Order,” said Mike Heid, president of Wells Fargo Home Mortgage.

“We will continue to work with the OCC to address the remaining items, and we have an action plan in place to complete that work in the coming months,” Heid said. “The amended consent order will not impact our retail or correspondent origination activities or our ability to service mortgage loans originated through those channels.”

“The amended consent order relates to a previous mortgage foreclosure order under which Santander has completed almost all of the actions that were required,” a Santander spokesperson said. “Santander has implemented a significant number of practices to improve how mortgages are serviced, and has a plan in place with the OCC to complete the remaining work.The work the bank is undertaking with regards to mortgage servicing is part of an overall effort to enhance all aspects of supporting each and every customer.”

“We take our regulatory obligations very seriously and we are working to resolve the OCC's concerns,” Ripley said in a statement.

“We’re pleased with the substantial progress EverBank has made remediating 91 of the 95 actionable items identified under the 2011 consent order, and we look forward to remediating the final four items still open under the consent order,” said Robert Clements, EverBank’s chairman and chief executive officer. “Based on EverBank’s current business plans and operations, we do not believe that the restrictions included in the revised consent order will have a material impact on our business.”

Robert Sherman, a spokesperson for HSBC said that the bank is working through the issues identified by the OCC.

“The OCC recognized areas of progress in our mortgage servicing, and identified other areas that need improvement,” Sherman said. “We are actively addressing the remaining issues, and we will continue to work closely with the OCC to ensure we fully comply with all requirements of the order.”

The OCC announced that Bank of America (BAC) Citigroup (C) and PNC Financial Services Group (PNC) are in compliance with the IFR and will no longer have restrictions on their mortgage-servicing activity.

“We have and continue to improve our operations with the goal of enhancing the service we provide our clients,” a Citigroup spokesperson said in a statement.

“Regulators recognized Bank of America’s improvement in the way we operate our mortgage business to better assist customers, particularly in times of financial difficulty," said Dan Frahm, a spokesperson with Bank of America. "We have helped more than 2 million customers avoid foreclosure and put legacy mortgage issues behind us, including products and programs inherited from Countrywide. We are compliant with the National Mortgage Servicing standards, and we continue to simplify our business, resulting in improved and more consistent customer service."

In a statement, PNC said it is pleased with the OCC’s decision.

“We are gratified by today’s announcement from the OCC,” PNC said in a statement. “It reflects PNC’s improved home loan servicing process as well as our commitment to meet the expectations of our regulators, support home ownership and build stronger communities.”

So far, the IFR Payment Agreement resulted in the distribution of more than $2.7 billion to more than 3.2 million eligible borrowers, representing more than 90% of the total amount available for distribution.

But despite that high cash rate compared to many other payment distributions, the OCC anticipates that approximately $280 million from OCC-supervised institutions will remain unclaimed at the end of the year after considerable efforts to locate eligible borrowers have been exhausted.

The OCC decided to escheat all funds available from uncashed checks and provide the remaining eligible borrowers a chance to claim the funds through their states’ escheatment claims processes.