Fannie Mae released its Collateral Underwriter program to lenders in January, and the industry reaction has been varied and intense. HousingWire reported how CU was affecting the lending process in a feature story, “Appraisal Disruption,” in our February issue. We also published a series of articles on HousingWire.com that looked at the program from different industry perspectives.

We started off publishing a blog from Jennifer Miller, president of the mortgage solutions division at a la mode, a technology provider. Her company had already been using CU to manage thousands of appraisals, and she wanted to share their findings.

Her take on the changes was summed up in the blog’s title — “There’s no need to freak out about Collateral Underwriter”:

Appraisers have voiced concern about the CU messages related to consistency with their peers on data points since the appraiser doesn’t have access to the peer data Fannie Mae is using.

However, it looks like Uniform Appraisal Dataset guidelines on condition and quality ratings can largely prevent triggering the peer consistency messages. Even in situations where your appraiser’s data is different enough to trigger these messages, your appraiser may be right and can explain the variance up front. Again, appraisers are already handling similar questions routinely.

But the next two articles we published on CU, and the responses, illustrate why some sectors of the industry see the program as cause for alarm.

The appraiser’s perspective

We asked Gary Crabtree, a senior residential appraiser with Affiliated Appraisers, to write a HousingWire.com article from his point of view, and published “Does the mortgage industry still need Appraisal Management Companies?” at the end of January. Here’s part of that story:

Every appraisal will be filed to the appraiser’s license number and if there is a pattern of “high risk” appraisals attributable to an appraiser, he/she will receive a “warning letter” and if, in the opinion of Fannie Mae, appraisal quality does not improve, the appraiser will be placed on the 100% review and/or do not use list, which will result in loss of profession, and all of this without explanation from Fannie Mae if or what recourse the appraiser has to defend his/her appraisal(s).

The “senior” and experienced appraiser that properly uses the scope of work and has knowledge of “paired data” and “regression and market trend analysis” will have no issues with CU. It’s the lesser experienced appraiser that “cuts corners” that will run into major issues with CU. It is the latter that are doing the vast majority of the lender work through appraisal management companies that pay “cram down” fees, forcing the appraiser to “cut corners” and produce an inferior product. If the truth be known, the AMCs are to blame for the inferior quality work, in spite of their insistence that they thoroughly review the appraisal and guarantee it to the client in exchange for 35% to 50% of the appraiser’s “customary and reasonable” fee that was to be codified by Dodd-Frank. I have too many examples of “cram down” fee offers, but let me share just one. One of the “big five” banks has their own AMC. Their fee schedule to the appraiser is $305, yet they charge the customer $550 and the difference becomes a “profit center” for the bank.

Now that the GSEs have the ability to instantly review every appraisal submitted to them and will advise the lender of its accuracy, it occurs to me that appraisal management companies are no longer needed. The individual lender need only to maintain their own independent fee appraiser panel and ensure the orders are randomly assigned. Fannie will take care of the “bad appraisals/appraisers” and appraisers can once again earn a wage commensurate with their education, background and experience.

Here are excerpts of some of the best responses on HousingWire.com:

Andy Widener:

It is my understanding the risk score stays with the property and NOT the appraiser. Are you sure that the risk score is tied to my appraisal license? FNMA admits that even very good appraisers will have #5 risk scores on difficult assignments.

I like the premise of your article but we are all getting conflicting info. Thanks.

Lori Noble:

With all of the GSE wisdom and mega data, did they also track AMC fees? Especially the UNREGULATED era of so called appraisal management. Without this particular unit of comparison, the CU model is flawed by design and not as factual and accurate as reported.

CU is merely another layered symptom, not a solution.

Retired Appraiser:

Within six short years FNMA has managed to take the fee out of “fee” and independent out of “independent appraiser.” How long will it take them to take the appraiser out of “valuation”? Less than 10 years.

Charles Baker, SRA

Good article Gary. This is happening as many smaller AMCs are thinly capitalized and are no longer profitable. Many clients are migrating away from AMCs and toward the web-portal model, ie: DVS, AppraisalTrac, Mercury, RIMS, A-Port, VMSCloud, LenderX, InhouseUSA and others. For non-GSE work most appraisers deal directly with the client.

the AMC perspective:

We also asked Brian Coester, founder and CEO of CoesterVMS, to weigh in. Here are excerpts from his HousingWire.com Rewired blog, “Appraisers are pist with Collateral Underwriter,” and the reaction online.

Only a few days into the release of the Fannie Mae Collateral Underwriter and my prediction of this being the biggest process change in the appraisal industry since the HVCC is becoming a reality for the field appraiser.

Appraisers and lenders are flabbergasted about what to do with the recent findings and feedback that CU has provided regarding appraisers’ work…

The biggest surprises have been the level of detail that CU is going into as well as the specifics of the findings and ultimately the lenders responsibility to certify that the comments and narrative provided by the appraiser is adequate and supportive of the original report.

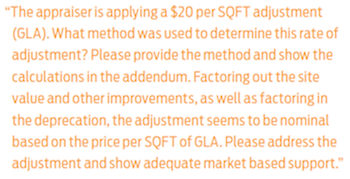

An example from a recent CU flag from some appraisers are below:

** UNDERWRITER REVISIONS **

Message – Comparable 3 (Collateral Underwriter)

The condition rating for comparable #3 is materially different than what has been reported by other appraisers. Please provide supporting commentary for your data on this condition.

Message – Comparable 2 (Collateral Underwriter)

The quality rating for comparable #2 is materially different than what has been reported by other appraisers. Please provide supporting commentary for your data on this condition.

When you look at these messages, the appraiser can make comments regarding this, but ultimately Fannie Mae has different data that it is not sharing that contradicts the appraisers report…

This puts the appraiser in a very tough situation because without access to the full database, appraisers and lenders will have no idea of what they are missing and what conflicting data really says….

Fannie Mae has even clearly said there will be frequent situations in which CU warnings are wrong and findings are incorrect.

The examples above show that most of the CU findings will be left up for interpretation and the problem with this is everyone is interpreting the appraiser is wrong, not that Fannie’s information is wrong or that it’s a misfire.

This has caused a title wave of revision requests from lenders for things appraisers don’t have any reason to comment on — other then there appears to be some differences in FNMA database that no one can see…

The next few months are going to be tough as the industry makes the transition to a new way of managing appraisals and appraisal review.

The online community had a lot to say; here are the best responses:

Andy Widener

Why do we even need AMCs anymore? CU does it all!

Brian Coester

Andy, some lenders don’t use AMCs the big ones have to as they just can’t manage thousands of orders on a monthly basis. I think you’ll continue to see a mix of AMCs and non AMCs like it is now. It’s really a business model issue not a CU or legislative issue. If you’re a lender in a call center that’s licensed in 50 states you need an AMC as you’re doing thousands of loans in random locations. If you’re only doing like a state or two then managing in house makes sense.

Gary Crabtree, SRA

Mr. Coester is right but what he didn’t say was that he is the CEO of one of the AMCs that pay “cram down” fees and doesn’t even come close to a customary and reasonable fee for the appraiser as mandated by Dodd-Frank. Can you say HYPOCRITE!

Retired Appraiser

I second that motion but at least HousingWire has an article online that gives a clue about the severity of the impact from CU. FNMA’s Collateral Underwriter will make the HVCC fee grab look like a digital signature requirement (remember that stink?). The impact on appraisers is massive (as illustrated by 112 comments over two days to the National Real Estate Post’s top two articles). I’ve never been a fan of Brian Coester since he runs an AMC but I thank him for providing a clue about the reality of this meteor strike.

Brian Coester

@Retired Appraiser So there’s a short-term issue and a long-term issue, short-term issue when it comes to dealing with CU is it’s going to be a pain for both lenders and appraisers. Long-term this will help transition the industry to a much more high tech and data driven process in which the appraiser is a very important part of it.The fees are an issue but as an AMC we’d love to charge $600 and pay the appraiser $500 but the market simply won’t support that. Until the market starts thinking as such we are where we are and it will take major changes in the settlement process and legislation (ie. removing appraisal fee from APR and disclosures as well as making it a non calculated fee on the GFE) until we start seeing some traction on fees for appraisers beyond nominal increases. As an appraiser I would start looking at alternative valuations other than the typical 1004 in the future as it’s going to be something that becomes apart of the day-to-day process.

JGaffney, Editor

For the record, I admire Brian for going on the record with his opinion. Second, Mr. Crabtree also penned his thoughts on the subject here: http://develop.housingwire.com/blo… Third, I point to Retired Appraiser’s comments. HousingWire is the only publication to push the implementation of CU. We know it’s a thorny issue, but one that merits full discussion. Thank you everyone for contributing to civil discourse.

Jared Mickel

Brian, I was with you right up to the end there. Any time somebody tries to “streamline” appraising it’s bound to end badly. The reason that this profession exists is that real property is, by its very nature, unique; any credible approach to valuation needs to be sufficiently flexible to honor that uniqueness. Appraising also needs to be sensitive in a human way to the buyers and sellers that create the transactions. Trying to standardize the valuation of real property is fundamentally contrary to what you’ve set out to accomplish in the first place.

As an industry we need to recognize that homes are not the same as shares of Microsoft and that no amount of streamlining will allow homes to be traded with the same simple efficiency as shares in Google.

The only way to provide the level of value assurance that the financial industry is demanding is to pay good fees to well trained and vetted appraisers and reviewers. Of course the AMC model, which was supposed to streamline and reduce influence, has screwed that up as well.

Anybody who thinks the appraisal industry needs more streamlining, has lost sight of the objective.

Brian Coester

Jared Mickel this is a valid point and I understand where you’re coming from here.

William Maloni

About a hundred years ago (actually more like 20), when I was A Fannie SVP—and the company was touting our operational and systemic efficiency at reducing mortgagor costs and “making it easier to finance a home”—I suggested that we get together with Freddie, offer lenders/mortgagors appraisals for @$50, since between us we had the best macro as well as neighborhood information on housing sales prices (the “comparables” which all appraisals relied on),

I argued that our data would be more honest since most appraisers uncannily brought back appraisals just at the seller’s asking price or the lender’s mortage offer.

I also suggested we could save consumers @$500, probably make $40 per appraisal for the company, and self insure against any error in our numbers.

The idea was met warmly but shelved because of concerns that while we likely were saving consumers money, it would look like we were venturing outside our charter. I see it only took two decades for my idea to catch hold.

Jared Mickel

The problem with the “insurance instead of appraisals” scheme is the unintended consequences. The first thing that will happen is you’ll see a lot more fraud without having a third-party inspect the collateral. Basically selling ground beef at steak prices.

But after that you’ll find that your “best micro as well as neighborhood information” will still leave a population of properties that are dramatically under-valued or over-valued. The under-valued properties will be high-end and will take a huge hit in value because of the diminished access to financing; this will see the more well-heeled property owners yanking the chains of the elected representative and they will start manipulating your scheme. The over-valued properties will be the low end of the housing stock, so superior access to financing will inflate values driving out low-end buyers. The politicians hate that. Basically, the valuation technique you’re talking about would flatten the highs and lows of the market and alienate a lot of people which will just stimulate more artificial controls on a markets that have proven to thrive when left to the laws of supply and demand and risk and reward.

Of course the next step will involve some sharp person at the bank or the insurance company realizing that if they could identify the properties that stray from the mean and treat them differently in the lending process they could reduce their risk…and now we’re back to doing appraisals.

The lending/appraisal system works really well when the person making the lending decision has to live with both their successes and their failures. Yes, the capital fluidity that the secondary market allows is a good (maybe even necessary) thing, but the ability to shed risk to the secondary market is killing the goose.

I can tell you as an appraiser there is a VAST difference between my clients that sell everything in the secondary market and those that portfolio their loans.

I can tell you as an appraiser there is a VAST difference between my clients that sell everything in the secondary market and those that portfolio their loans.

The portfolio people care deeply about my valuations, the secondary market people only care if the package gets through to FNMA or not. Any system that does not result in lending decision makers having enduring skin in the game is doomed to failure.

If you want to straighten this industry out, write a law that demands a lender portfolio a loan for five years before selling it.

Brian Coester

Will, this is something that really could happen, but at the same time it would take massive repeals in legislation at this point. With CU and all the data that’s available there is a very good point that appraisals won’t be needed at all in 10 years and it would all be automated. The technology is there now; it’s more of a legislative play at this point.

Diane Cipa

You are using the word as an adjective, not an adverb or interjectionally.[From Urban Dictionary: Pist, adv: “Not to be confused with pissed, pist can be used as an adverb, or interjectionally to describe something as extremely good, or bad. Whether it’s meant to be taken as good or bad depends on the tone in which it’s used.”]

William Maloni

Mr. Mickel—You can postulate all the horrors you want from Fannie’s new offering, but what Fannie is doing isn’t totally new and for several years it has offered mortgagors and lenders optional appraisal information from their copious business records.

My only point was F&F have the data and they could offer it at a lower cost to the consumer or lender and they should.

I’m indifferent now whether they should turn it into a company profit center. But I am sure you (and I) can remember when many — not all — appraisals were drive-bys, with an almost indifferent lender just wanting a piece of paper to cover their pre-approved or stipulated loan amount.