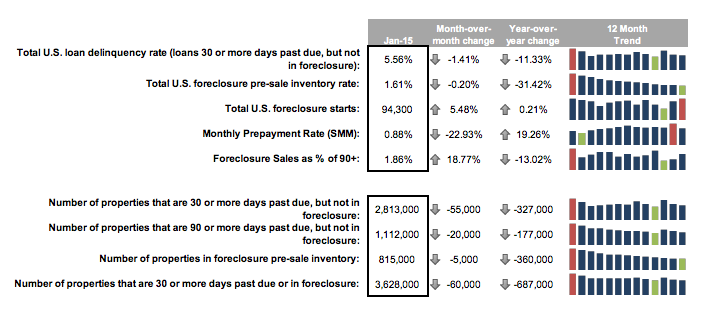

Delinquencies continued to trend down and dropped 11% from January 2014, according to the latest report from Black Knight Financial Services.

January’s 94,300 foreclosure starts marked the highest level of starts since December 2013, up 5.48% month-over-month and 0.21% year-over-year.

Click to enlarge

Source: Black Knight

Meanwhile, prepayment rates — historically a good indicator of refinance activity—dropped 23% from December, though it remains up 19% from this time last year.

Although it was small, there was a decrease in the average days delinquent for a loan in foreclosure, now sitting at 1,009 days – down from 1,010 in December and the all-time high of 1,024 in October. However, it is still up from 943 days this time last year.

The national inventory of loans in foreclosure continues to decline, down 31% year-over-year in January.