After bringing jumbo prime residential mortgage-backed securitizations in two different forms earlier in 2014, JPMorgan Chase & Co. (JPM) is set to break new ground again with a jumbo RMBS backed by hybrid adjustable-rate mortgages.

J.P. Morgan Mortgage Trust 2014-IVR3 is backed by a pool of 551 loans with an aggregate loan balance of $483.56 million, and each of the loans is a 30-year ARM in various forms.

Three individual sub-pools of loans make up the aggregate loan pool. Pool 1, which represents 8.6% of the total pool, is built on 5/1 ARMs. Pool 2, which represents 58.8% of the total pool, consists of 7/1 ARMs. And Pool 3, which represents 32.6% of the total pool, is comprised of 10/1 ARMs.

Also of note is that approximately 23.8% of the loans possess a 10-year interest-only period.

In J.P. Morgan Mortgage Trust’s first jumbo RMBS offerings of 2014, most of the loans in the pool carried 30-year fixed-rate mortgages. J.P. Morgan Mortgage Trust 2014-1, which came to market in February, was comprised of 412 first-lien mortgage loans with an aggregate principal balance of $356 million.

J.P. Morgan Mortgage Trust 2014-2, which was built on a pool of 544 loans with an aggregate loan balance of $303.75 million and came to market in June, was unique because it was built entirely on 15-year fixed-rate notes.

“JPMMT 2014-2 represents the first KBRA-rated transaction consisting entirely of fixed rate mortgages with maturities of 15 years or less, marking a departure from the collateral makeup typically seen in the majority of post-crisis transactions,” Kroll Bond Rating Agency stated in its presale report.

“Fixed rate loans with shorter terms have exhibited strong historical performance when compared to a typical 30-year product, as loans achieve faster amortization and borrowers experience increased equity build-up through higher relative payments.”

But with JPMMT 2014-IVR3, JPMorgan is trying something a bit different, a jumbo RMBS backed by ARMs.

“Mortgage products that include adjustable interest rates or IO features expose borrowers to the risk of fluctuating or increasing monthly payment obligations, which can result in payment shock,” Kroll said in its presale for JPMMT 2014-IVR3.

“The payment shock to the borrower for hybrid ARMs and IO loans can be significant, particularly in a historically low interest rate market. In such an environment, rate increases are likely and refinancing opportunities may be limited. To address this risk, KBRA applied an increase of approximately 18% to the ‘AAA’ expected default probability.”

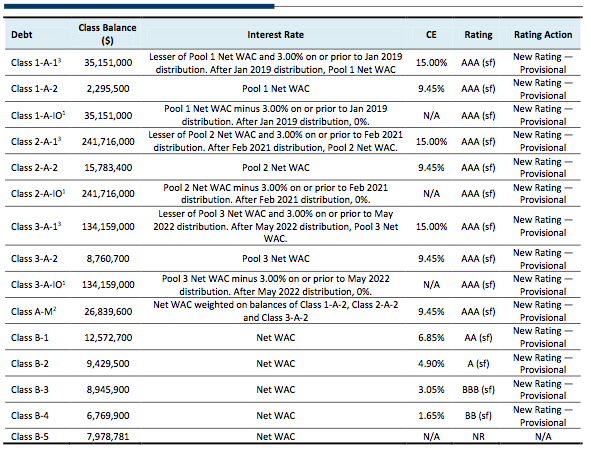

Click the image below to see a breakdown of the offering’s features.

DBRS also issued its presale report on JPMMT 2014-IVR3 and said that hybrid ARMs with shorter teaser periods present “substantially higher risk” when compared to longer-term ARMs.

“Relative to a ten-year ARM, a five-year hybrid and seven-year hybrid generally warrant a 2.0x and 1.7x penalty factor, respectively,” DBRS said in its presale report.

“The affordability nature of crisis era IO products has resulted in truly adverse performance of such loans. Consequently, DBRS has increased the penalty factors for IOs from what was directly derived from our regression analysis. Exact penalties for IOs differ by product, generally IOs warrant a 1.5x to 1.6x penalty factor relative to a fully-amortizing ARM of the same teaser period.”

But the deal carries structural enhancements that DBRS considers a strength of the offering. “Compared with a pre-crisis shifting-interest structure, the transaction employs a subordination floor to address tail risk and retain credit support,” DBRS said.

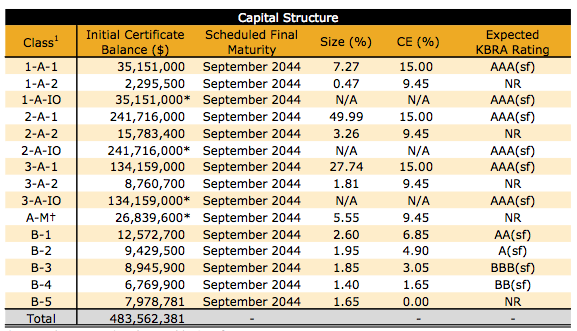

Click the image below to see DBRS presale ratings.

The deal carries other positives as well.

“JPMMT 2014-IVR3 consists of high quality, prime mortgage loans made to borrowers with significant equity in their property, as demonstrated by the pool’s weighted average loan-to-value of 67.7% and WA combined LTV of 68.7%,” Kroll said in its report.

“While 45.7% of the mortgages have CLTVs of 75% or greater, there are only two loans with a CLTV greater than 80%. The amount of equity represented by the WA LTV and CLTV for this pool provides a substantial margin of safety against potential home price declines.”

The borrowers in the pool also carry high credit scores and carry a lower debt-to-income ratio than in several of the previous jumbo RMBS offerings.

“The credit quality of the borrowers in JPMMT 2014-IVR3 is strong, as evidenced by WA original and current credit scores of 766 and 765, respectively,” Kroll said. “A significant portion of the borrowers exhibit high levels of verified assets, and most loans bear prudent DTI ratios (30.9% on average), especially given relatively high borrower incomes.”

Click the image below to see Kroll’s presale ratings.

As with most jumbo securitizations, a high percentage of the loans are located in California.

“Compared to other recent prime jumbo securitizations, the JPMMT 2014-IVR3 pool has a high concentration of loans in California, particularly the San Francisco area with the San Francisco-San Mateo-Redwood City and Oakland-Fremont-Hayward MSAs representing about 22.6% of the pool,” DBRS said. “Additionally, California represents 64.3% of the loans in the transaction.”

DBRS also cautioned on the deal’s “relatively weak representations and warranties framework” as a concern.

“Compared with other post-crisis representations and warranties frameworks, this transaction employs a relatively weak standard, which includes materiality factors, the use of knowledge qualifiers, as well as sunset provisions that allow for certain representations to expire within three to six years after the closing date,” DBRS said.

“The framework is perceived by DBRS to be weak and limiting as compared with the traditional lifetime representations and warranties standard in previous DBRS-rated securitizations.”