Melvin Luther Watt quietly slid into his office as the first appointed director of the Federal Housing Finance Agency. It was the end of last year, in mid-December. Christmas was coming and the markets were in the middle of the harshest winter in years. As he took over the office of Acting Director Ed DeMarco — himself the unassuming lightning rod for the nation’s housing policy — Watt gave no indication of what he intended to do with his new position; arguably the most powerful job in mortgage finance.

And in the months to come he spoke very little and listened very hard. He gave one television interview, in a May taping of C-SPAN’s Newsmakers. He responded to questions slowly and deliberately and generally gave little away. It is this measured approach to the role, I came to find, which will define his next moves for the FHFA.

In the first print interview for the mortgage finance trade, Watt revealed more about himself than I expected. Far from being the corporate type I found Ed DeMarco to be, Watt is a man driven by a deep connection to his roots, his family. (He famously held his 1-year-old grandson Nico on his lap during Eric Holder’s confirmation hearing, to the delight of the House.)

These tells about Watt aren’t immediately discoverable. Indeed, two weeks after speaking, his personality is still somewhat enigmatic. But there is one point that keeps popping up.

While speaking, Watt mentioned his grandfather was also named “Jacob.” His grandfather was a man of great confidence and trustworthiness and the indication for this journalist is that penning this profile came with the feeling of big shoes to fill. Watt’s trust isn’t a given, it’s earned. And in the day and age of social media tempests of information, talking to Mel Watt feels more like a front-porch conversation.

When one speaks to family or friends, they speak from the heart. And it’s this heart that drives the decisions of Watt. It is now clear that his heart directs his brain to formulate the deep feeling of doing what’s right for his family. That family, by the way, is every single homeowner and taxpayer in the United States of America.

When one speaks to family or friends, they speak from the heart. And it’s this heart that drives the decisions of Watt. It is now clear that his heart directs his brain to formulate the deep feeling of doing what’s right for his family. That family, by the way, is every single homeowner and taxpayer in the United States of America.

CHANGE OF HEART

Up until now, supporters of Watt have said he is a staunch advocate for homeownership (true), and bond market players have been worried his actions will consider those homeowners’ interests above their own (not true). Watt knows there is a fine line and his careful nature shows an underlying sagacity.

The director is not fond of granting access and interviews, but that will likely change. Judging by his comments and tone, Watt is setting the stage for a more homeowner-friendly FHFA, one well within the limits of the regulatory role.

“There’s a clear understanding what Fannie and Freddie do by the FHFA and the people who are active players in the housing market on a regular basis. There is virtually no understanding what Fannie and Freddie do by the public,” he said. “So that’s why we will focus primary efforts in encouraging the availability of credit to those who understand what Fannie and Freddie do.”

Watt wants to provide more certainty in that space, like trying to increase transparence in the representations and warranties, to get back to a more normalized situation. And he feels that would address the supply of sufficient housing credit.

“There are things we need to still do on the demand side, as demand is way down. We now have a challenge to get credit-worthy borrowers to come back in and view homeownership as something that is good again. They should not be so worried that they’ll be embarrassed because of a minor credit glitch, as most people do on their credit report.”

The framework of his above comment is telling of his background. Watt sees both sides of the coin.

The framework of his above comment is telling of his background. Watt sees both sides of the coin.

His predecessor DeMarco fought to continue the role of the FHFA as conservator and sought to shrink the GSEs’ footprints. Watt will not do that for the sake of getting smaller. Not unless the mortgage markets are ready.

In one such decision, Watt shows his independent streak — he will not reduce the maximum size of mortgages that Fannie and Freddie can finance. Jumbo mortgages can go as high as $629,500 in hot markets.

Reducing that limit means costs go up for those homeowners, as few issuers of jumbo mortgage securities exist, and lenders keep the loans on portfolio. For now, Watt is in a holding pattern on reducing the limit.

In January, Watt reversed a proposed increase on the guarantee fees, originally announced in December by DeMarco. This was another initiative meant to help reduce the footprint of the GSEs. Watt is now considering increasing the fee, but in his own way.

Perhaps reflective of his time regulating the second-largest financial market after Wall Street — Watt’s former representative district in North Carolina is full of financial institutions — the director decided to open up a request for commentary period. This gave the mortgage industry a say in FHFA decisions and maybe converted some enemies to allies.

The same morning, before the announcement, Markit analysts wrote, “FHFA is considering raising guarantee fees across the board, opening up the credit box to underserved borrowers, and subsidizing their guarantee fee with the increase of higher credit borrower’s fee.” The notice of commentary period likely calmed the nerves of the analysts.

As of press time, there are likely only a few days remaining before the FHFA closes down the submission of comments. That was two month’s worth of open season on g-fees at the FHFA. Of course, comment periods are not unprecedented by any means, but they can be viewed as unnecessary. A request for input was not common for DeMarco — he averaged less than one a year during his tenure. Only six months in and Watt’s already on his first.

CUT FROM THE SAME CLOTH

The DeMarco and Watt comparison needs to end now. The director himself wouldn’t agree on such an aggressive bifurcation of the director versus the acting director. Indeed, in arranging interviews, I offered to completely skip the legacy of DeMarco, if Watt wished to focus on the here and now.

In fact, Watt considers himself cut from the same regulatory cloth and he reveals the intimacy in those crossover days. There was an incident in May where one of DeMarco’s co-workers was arrested for threatening to kidnap or injure him. That would not have happened with Watt around; he has DeMarco’s back, big time.

In fact, Watt considers himself cut from the same regulatory cloth and he reveals the intimacy in those crossover days. There was an incident in May where one of DeMarco’s co-workers was arrested for threatening to kidnap or injure him. That would not have happened with Watt around; he has DeMarco’s back, big time.

“It was a very smooth transition. A lot of the credit goes to Ed DeMarco and the people who were here in the agency,” he said. “They did a substantial amount of preparation for me before the Senate Banking Committee hearing.”

That preparation allowed Watt the understanding of the issues and organizational structure of the FHFA so that he could hit the ground running.

“The fact is Ed stayed through a transition period and was extremely gracious in offering input and advice, not obtrusive and always available to me. So much easier than me just coming in cold.”

If DeMarco had not led the agency the way that he did, Watt said the GSEs could possibly still be “in the middle of a heckuva mess.”

Because of this transition effort, Watt said he is now able to turn attention to how to get everyone to start thinking about a “more normalized” Fannie and Freddie, as opposed to only thinking about stabilization and keeping disasters from happening, as was DeMarco’s charge.

Because of this transition effort, Watt said he is now able to turn attention to how to get everyone to start thinking about a “more normalized” Fannie and Freddie, as opposed to only thinking about stabilization and keeping disasters from happening, as was DeMarco’s charge.

“It created a foundation for me to continue a regularized effort to get the public to feel confident in home buying and to get access to credit. Over time, this will prove to be very important. Ed and I became close friends. It was always about the success of the agency. He’ll be remembered as a key figure in housing financing.”

THE NEXT STEP FOR THE FHFA

First of all, Watt thinks a broader definition of the role of FHFA and Fannie and Freddie, and what role they play, is important. According to Watt, this means it’s time to start telling the public that the number-one priority for the GSEs is maintaining the credit availability to buy a home.

“And also to return to a responsible extension of credit,” he said. “If we don’t do that, the housing market will not be well-served.”

In the second strategic objective, Watt said that instead of reducing the footprint of Fannie and Freddie, it would be wiser to work to reduce the risk exposed to the taxpayer.

“That would be our job as regulator if Fannie and Freddie were not in conservatorship, moving from contracting the footprint to reducing risk,” he said.

The third position is building the common securitization platform for the future. Watt articulated it to be about building the infrastructure of Fannie and Freddie in their current use, without doing anything that would be adverse to what they are doing now and what the Common Securitization Platform will mean in the future.

“We turned a corner, not because we didn’t think the old strategic plan was an important plan for when it was implemented,” Watt said. “It is to recognize that that primary role of Fannie and Freddie is no longer to stop the bleeding in mortgages, but rather in now providing a liquid position to the housing finance market.”

THE MARKETS TODAY

The research Watt is voraciously taking in these days is giving him food for thought. The way he speaks today is that he is now more understanding of the inner traps of the credit crisis. It’s a pro-cyclic vortex and now Watt sees there are a number of factors contributing to a mortgage slowdown.

“This got masked for a while as so many people were going in for a refinancing. People weren’t paying too much attention to the fall-off in new loans being originated,” Watt said.

But, deep inside the heart of Watt, he can’t bring himself to commoditize his fellow Americans to the extent the above quote hints.

“First of all, the first-time homebuyer is typically just out of college and newly married. Now they are coming out with substantially more student loan debt and getting married much later,” he said. “When people buy their first home, in love, married, it’s part of the American dream.”

Also, Watt said that no one stays in one place anymore. No one keeps a job in one locale for a lifetime. When homeowners lost confidence that their houses would go up in value, that’s when many people ended up underwater.

It’s a new America, and housing needs to adjust accordingly.

In three to five years, those same college-graduate lovebirds may need to move for a job. According to Watt, the first-time homebuyer is getting smarter and should be rewarded. They’ll ask tough questions and lenders need honest answers. They’ll ask before buying if their house will even return on the investment.

In three to five years, those same college-graduate lovebirds may need to move for a job. According to Watt, the first-time homebuyer is getting smarter and should be rewarded. They’ll ask tough questions and lenders need honest answers. They’ll ask before buying if their house will even return on the investment.

“As it stands now, people don’t trust their lenders and it’s creating uncertainty. All of this research and anthropological evidence contributes to the downturn. Still there are casualities to this war and the industry would do right to honor that,” he said.

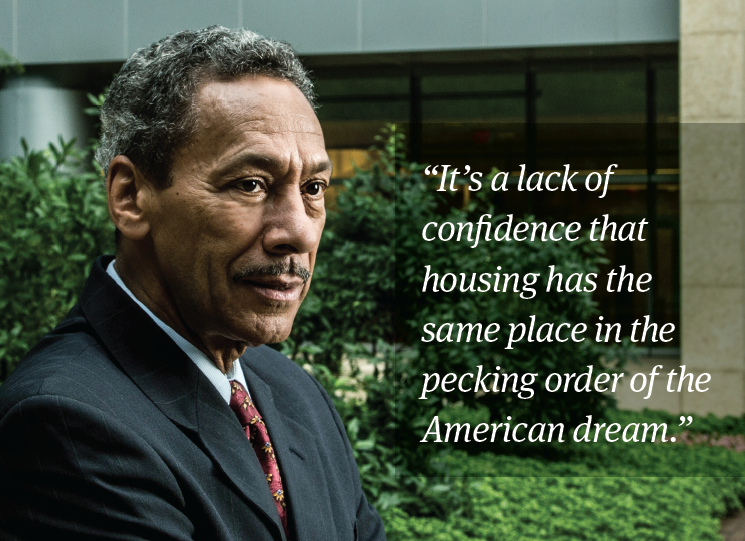

“Today, there’s just a lot of people — and no one pays enough attention to it — who got burned,” Watt said.

“They feel: ‘I got talked into this loan, and now I’m behind on payments. When I get caught up, I probably should not trade up for a new house because I’m not going to get approved for a new home,’” Watt said.

“A ding on the credit score, a lost down payment, there are multiple reasons we think demand is down,” he added. “It’s a lack of confidence that housing has the same place in the pecking order of the American dream.”

“Now that we are getting lenders to remove some of the credit overlays, and we’ve been satisfied on some of our rep and warrants concerns, it is now our job to go out there and grow homeownership in the country,” he adds.

This is not just a challenge for the FHFA as a regulator, but also Fannie and Freddie and the entire industry need to start delivering that message — Watt’s message.

“We can help, but we won’t be the lead horse on that front,” he said.