Fannie Mae and Freddie Mac will not require another bailout or any taxpayer money under any of the Federal Housing Finance Agency’s three scenarios.

Looking at the results, cumulative, combined Treasury draws at the end of 2015 remain unchanged at $187.5 billion as neither enterprise requires additional Treasury draws in any of the scenarios.

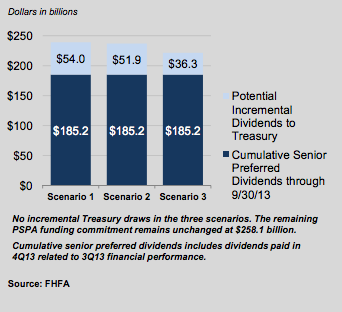

Additionally, in each scenario, the enterprises pay additional senior preferred dividends to the U.S. Treasury ranging between $54 billion to $36.3 billion.

The combined remaining commitment under the Senior Preferred Stock Purchase Agreements is unchanged at $258.1 billion.

“This year as in previous years, Fannie Mae in conjunction with FHFA developed forward looking financial projections across three possible house price paths. In those FHFA scenarios, Fannie Mae would not require a draw from Treasury,” Kelli Parsons, senior vice president and chief communications officer for Fannie Mae, said.

Since the creation of Dodd-Frank, the GSEs are now required to conduct annual stress tests to determine whether the companies have the capital necessary to absorb losses as a result of adverse economic condition.

While this year, as in previous years, the enterprises conducted the FHFA’s three scenarios, in conjunction with the Dodd-Frank stress test, next year the enterprises will only be required to conduct only the Dodd-Frank Act Stress Test.

However, take a look at HousingWire coverage of the Dodd-Frank results; the results, while not all bad, warn of pending Treasury draws in some cases.

(chart from the FHFA)