Today, I am in Miami amongst a gathering of over 3,000 attendees at ABS East, a mortgage investors conference. There is, of course, the required discussion of transparency, regulation and GSE reform and housing bubbles (again).

One discussion that was particularly interesting was by Jim Parrott of the Urban Institute and Mark Zandi of Moody’s Analytics moderated by Nick Timiraos of the Wall Street Journal. The focus was on the availability of mortgage credit.

The idea that mortgage credit is not available to the consumer is widely accepted. It’s true that minimum credit scores are elevated well above what most would consider normal requirements, but that is only one dimension of the “credit box”. In other dimensions, I believe requirements are much more normal.

Debt-to-Income ratios are back to historic norms, documentation requirements have returned, and downpayment requirements have also returned but that is not to say that everyone must put 20% down.

There are low downpayment loan products available to first-time homebuyers as well as existing homeowners with insufficient levels of equity.

The GSEs and FHA, essentially setting the size and shape of the credit box, have defined a box that is larger than what we operationally see today.

This is because mortgage originators overlay even tighter restrictions than what the government agencies will accept for fear of repurchase risk. As the old adage says, better to be safe than sorry.

The problem is that requiring higher credit scores, bigger down payments, or higher income relative to the mortgage payment isn’t reducing the risk of documentation being incorrect or the DTI being calculated incorrectly.

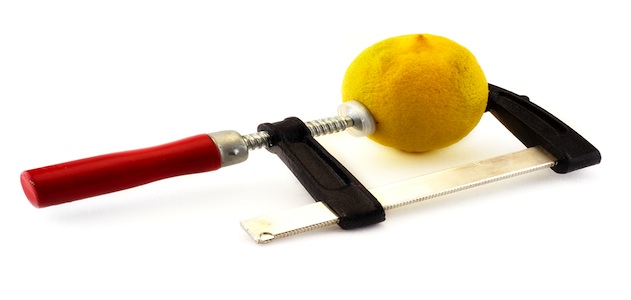

These are the reasons that loans are ultimately repurchased—a failure to manufacture the loan properly. Requiring very high credit scores may reduce the risk of default but it doesn’t prevent us from making a mortgage lemon and only serves to dramatically reduce the pool of eligible borrowers. The same borrowers we will need to keep the housing recovery going.