The Greater Phoenix single-family residential market is in recovery and is no longer in recession. At least that’s what Grand Canyon Title Agency real estate analyst Fletcher Wilcox claimed in his latest report on the Greater Phoenix market.

“If plummeting property values caused by foreclosures, cheap lender owned sales, job losses, and tight lending standards defined the real estate recession, then the recession is over for the single-family property segment in Greater Phoenix,” wrote Wilcox.

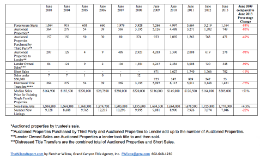

Foreclosure starts, auctioned properties, lender owned sales and short sales have dropped dramatically in Phoenix. In fact, when comparing these categories in June 2009 to June 2013, foreclosure starts are down 84%, auctioned properties dropped 85%, lender owned sales fell 92% and short sales were down 19%. Year-over-year, short sales were down 60% in June.

Compared to 2006, Greater Phoenix is still 133,000 jobs short, although the number of jobs year to date are on the rise, not descending.

Lending standards remain tight, although they have loosened somewhat. Some lenders are now offering conventional loans with a 3% downpayment and mortgage.

According to Wilcox, no longer are cheap homes — specifically lender owned homes — being dumped on to the market, pulling down all property values. Yes, many are still hurting from the recession, but a recovery is happening. No longer are property values descending, but ascending.

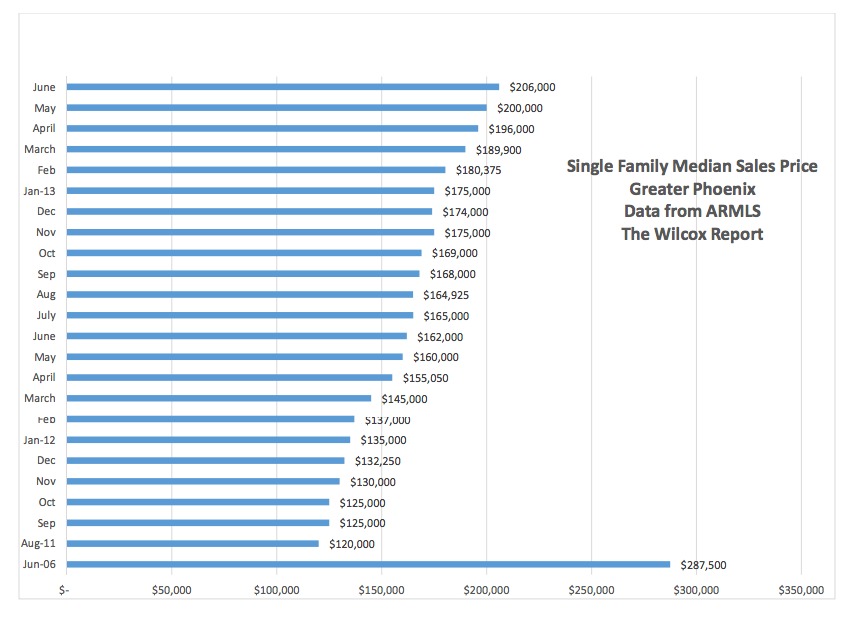

In June, the median sales price for an existing single-family property was $206,000, up 72% from the rock bottom total of $120,000 in August 2011. The June number is still down 28% from the peak of $287,000 in June 2006, a reminder that a recovery is almost always a slow process.

According to the latest CoreLogic (CLGX) Case-Shiller report out Thursday, home prices in Phoenix surged 22.8% year-over-year through the first quarter of 2013. From the first quarter of 2013 to the first quarter of 2014, the report claims Phoenix will see a 5.1% increase in home prices.

Fletcher predicts that foreclosure starts in 2013 will end up around 15,500, which is 2,229 more than the 13,271 in 2003 and 70,815 less than the 86,315 in 2009.