The housing market functions differently than other markets because it can be characterized as a heterogeneous, thinly traded, illiquid market. In other words, it’s a diverse market with a wide variety of different homes of varying ages and levels of repair, and sales happen very rarely.

And there’s another thing that separates the housing market from other markets — the buyer is often also the seller. In most markets, the seller, or supplier, makes their decision about adding supply to the market independent of the buyer, or source of demand, and their decision to buy. In the housing market, the seller and the buyer are, in many cases, the same economic actor.

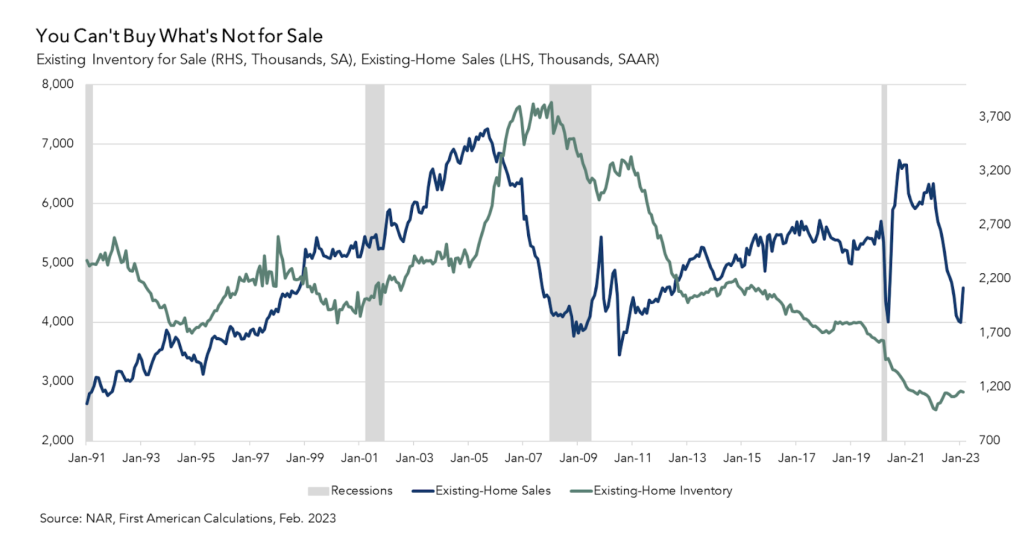

To buy a new home, you must sell the home you already own. From the year 2000 until the start of the pandemic in 2020, existing-home inventory made up nearly 90% of total home inventory. And, unfortunately, sellers are not selling in today’s higher mortgage rate environment. The primary factor holding back today’s housing market is not lack of demand, but a dearth of supply.

The golden handcuffs of low mortgage rates keep sellers rate-locked in

Before the housing market crash in 2007, the average length of time someone lived in their home, or tenure, was approximately five years. Average tenure length grew to approximately eight years during the aftermath of the housing market crisis between 2008 and 2016. Since then, tenure has further increased to a historic high of 10.7 years in March 2023, according to recent data.

The golden handcuffs of low mortgage rates are locking many homeowners in place, especially those who refinanced into rock-bottom mortgage rates over the course of the pandemic. According to the latest second quarter 2022 National Mortgage Database data, 92% of outstanding mortgages have rates below 6% and nearly 83% have a rate below 5%. As long as the average 30-year, fixed mortgage rate remains higher, there is a financial disincentive for homeowners to sell their existing homes only to buy their next residence at a higher rate.

Of course, the fewer homes there are for sale, the harder it becomes to find a home that is better than the home you already own. The rate “lock-in” effect prevents more housing supply from reaching the market and reduces the ability to find a home you might want to buy. The result is fewer sales.

This article is part of our ongoing 2023 Housing Market Forecast series. After this series wraps, join us on May 30 for the next Housing Market Update Event. Bringing together some of the top economists and researchers in housing, the event will provide an in-depth look at the top predictions for this year, along with a roundtable discussion on how these insights apply to your business. To register, go here.

…But some may have the equity to break free

It’s unlikely that mortgage rates will fall below 5% soon, meaning many existing homeowners will continue to be financially disincentivized from selling their home. However, there is one factor that could partially offset the impact of higher rates — equity. Nationally, house prices increased more than 40% from February 2020 (pre-pandemic) to the peak in June 2022.

While prices have since declined nearly 3% from that peak, much of the homeowner equity gained during the pandemic remains. High levels of home equity could mitigate the impact of the rate lock-in effect by allowing sellers to put a larger down payment on their new home, helping offset the effect of higher rates.

In other words, for some equity-rich homeowners, moving and taking on a higher interest rate isn’t a huge deal, especially if they are moving to a more affordable place. Perhaps more importantly, 42% of homeowners have no mortgage at all, so they are completely free from the lock-in effect.

Homer Simpson or Spock?

The shortage of homes on the market continues to stifle home sales. The game of musical chairs that is the housing market needs more chairs. Unfortunately, with sellers being financially disincentivized to sell, it will likely put a ceiling on any increase in housing supply this year.

But there are mitigating factors, such as equity-rich and mortgage-free homeowners, that could offset some of the impact from higher rates. And, of course, there are lifestyle considerations that drive the decision to sell that can sometimes outweigh the financial realities. As Nobel Prize winner Richard H. Thaler once famously said, we are more like Homer Simpson than we are like Spock.

This column does not necessarily reflect the opinion of HousingWire’s editorial department and its owners.

To contact the editor responsible for this story:

Mark Fleming at @mflemingecon (Twitter)

To contact the editor responsible for this story:

Brena Nath at brena@hwmedia.com

Is there a way lenders or services could make current mortgage loans portable? In other words if you sell your home to buy another home could we derive a mechanism to bring the current loan to the next property?