The VA loan is an important financing tool for VA-eligible borrowers to achieve their homeownership dream. In 2021 one in two VA borrowers was a first-time homebuyer (FTHB).

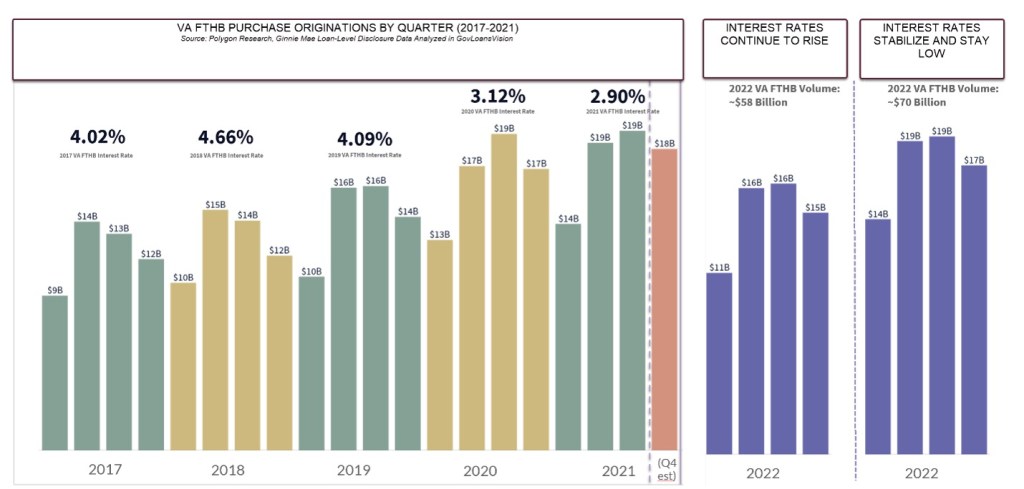

Last year, mortgage interest rates reached record lows. The average VA FTHB’s interest rate was 2.90% and the quarterly FTHB VA purchase loan volume stayed elevated. In Q3 2021, it reached a record level of over $19 billion for that quarter, $174 million higher than Q3 2020. And since 2017, VA purchase loans helped roughly 200,000-230,000 VA-eligible first-time home buyers per year become homeowners.

This translates into an average of $56 billion in mortgage originations per year. In 2021, the VA FTHB segment reached an estimated $69 billion, according to Ginnie Mae loan-level disclosure data updated through January 2022, analyzed in GovLoansVision.

So, what will 2022 look like for the VA FTHB borrowers?

Our scratch pad calculations tell us that if interest rates continue to climb, we might see a lower VA FTHB volume of around $58 billion in 2022. On the other hand, if rates stabilize and stay in low to mid 3’s, we might see the VA FTHB purchase volume at $70 billion in 2022.

Figure 1: VA FTHB Purchase Originations Forecast

Source: Polygon Research. Forecasts are updated monthly.

What is the Size of the VA Borrower Addressable Market?

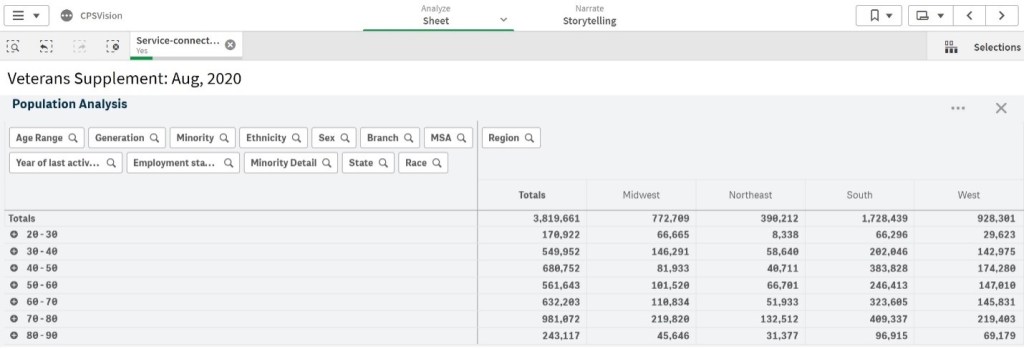

VA FTHB borrowers will mostly come from the U.S. Veteran population (with the rest from current service members and eligible veteran family members). The U.S. Veteran population stood at 18.44 million in 2020 with median age of 68 years old, according to CPS Veteran Supplement (2020), analyzed by Polygon Research in CPSVision. To narrow the sizing of the VA Borrower Addressable Market, we investigate two subsegments: Veterans with service-related disability and Veterans 50 years-old or younger.

In 2020, 3.82 million Veterans had service-connected disability, making them eligible for a wide range of benefits, including waiver of VA funding fee on a mortgage loan. Figure 2 provides a breakdown of these Veterans by age range and location.

Figure 2: Veterans with Service-Connected Disability by Age Range and Geography (Region)

Source: Polygon Research, CPSVision, Veterans Supplement August 2020

Loan originators can educate themselves about the Veterans with service-related disability in their communities and markets and look for opportunities to provide high quality education and financing in an efficient and transparent manner.

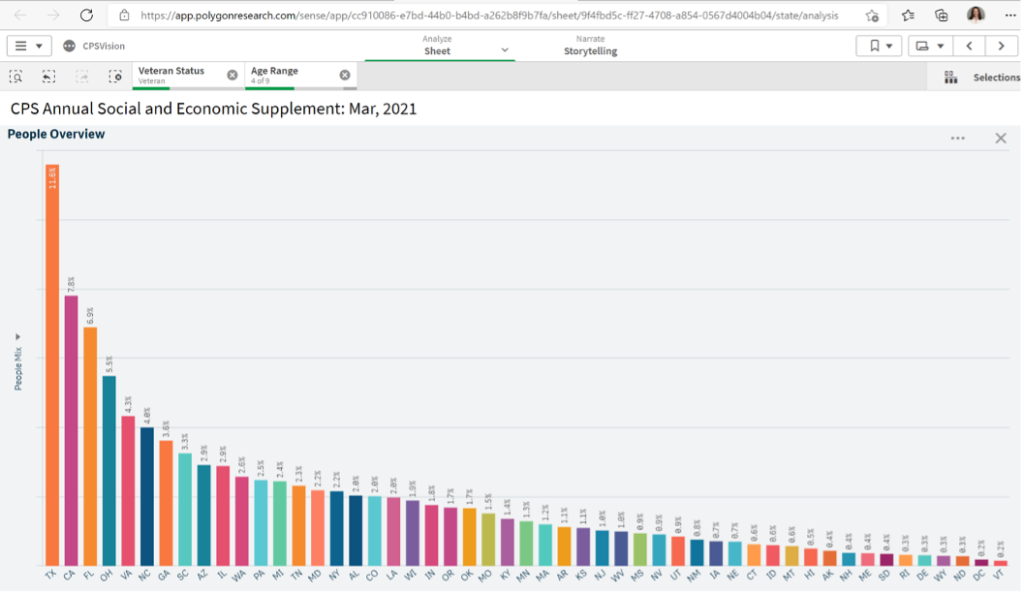

Broadening the scope to include all Veterans within a certain age range regardless of disability status, we estimate that about 4 million Veterans are under the age of 50, with a median household income of $91,400 according to March 2021 ASEC. (source: Polygon Research, CPSVision).

Figure 3: Distribution of Veterans 50 Years–Old or Younger by State

Source: Polygon Research, CPSVision, ASEC March 2021

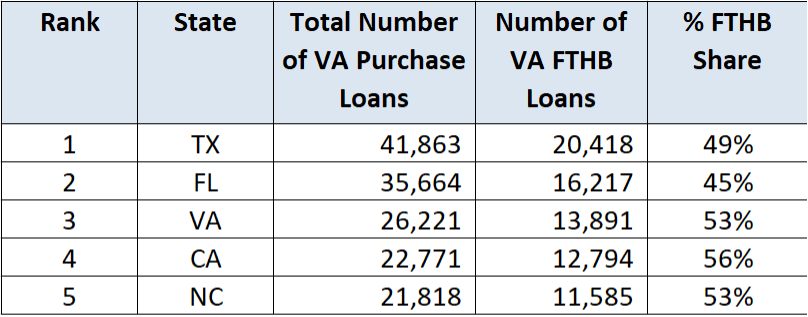

This statistical distribution of Veterans (50-years or younger) by state in Figure 3 closely follows the VA FTHB purchase mortgage originations data found in the Ginnie Mae loan-level disclosure data. The top five states for Veterans who were first-time home buyers and used VA purchase loans to buy homes were TX, FL, VA, CA, and NC – Figure 4.

Figure 4: Top 5 States by Number of VA FTHB Borrowers

Source: Polygon Research, GovLoansVision updated through January 2022

What was the credit profile of VA First-Time Home Buyers?

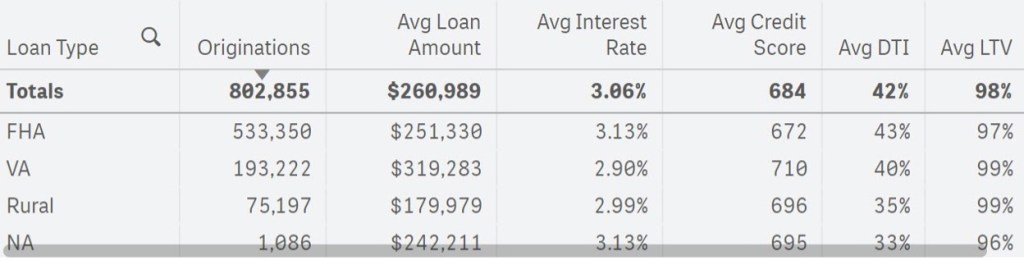

In 2021, the average VA first-time home buyer had a credit score of 710, DTI of 40%, borrowed 99% LTV loans of $319,000 at 2.90% (see Figure 5). VA FTHB borrowers had higher credit score and lower DTI than FHA FTHB borrowers. In the Vetted VA community, as a controlled sample, the average VA purchase borrower (both FTHB and repeat) had a credit score of 717 and a DTI of 40.7% and borrowed 98% LTV loans of $394,000 at 2.69%.

Figure 5: 2021 First-Time Home Buyer Purchase Originations

Source: Polygon Research, GovLoansVision, updated through January 2022

Given the good creditworthiness of VA borrowers, and especially first-time homebuyers, and given the size of the VA FTHB lending market – an estimated $58B to $70B – loan originators and companies may find VA lending as an excellent business opportunity in 2022.

But with this opportunity comes a great responsibility – providing the highest service to our Active Duty, Veterans, and their spouses, and protecting them from abusive lending practices. Understanding the VA-eligible borrower and understanding the financing tools to serve their credit needs is not only an ethical thing to do, but also a necessary professional skill in order to achieve scale and profitability.

Data: VA First-Time Home Buyer (FTHB) Borrower is the actual reported data found in Ginnie Mae loan-level disclosure data sets containing 800 million+ rows and modeled in GovLoansVision by Polygon Research.

Veteran analysis is extracted from CPSVision, which includes monthly CPS data through December 2021, the ASEC of March 2021, and the Veteran Supplement of August 2020.

Statistical records of 325+ million people and 127+ million households.• Forecast are updated monthly.

Nathan Knottingham is the COO of Vetted VA and L. Buresch of Polygon Research.

This column does not necessarily reflect the opinion of HousingWire’s editorial department and its owners.

To contact the author of this story:

Nathan Knottingham at nathan@vettedva.com

L. Buresch at lburesch@polygonresearch.com

To contact the editor responsible for this story:

Sarah Wheeler at swheeler@housingwire.com