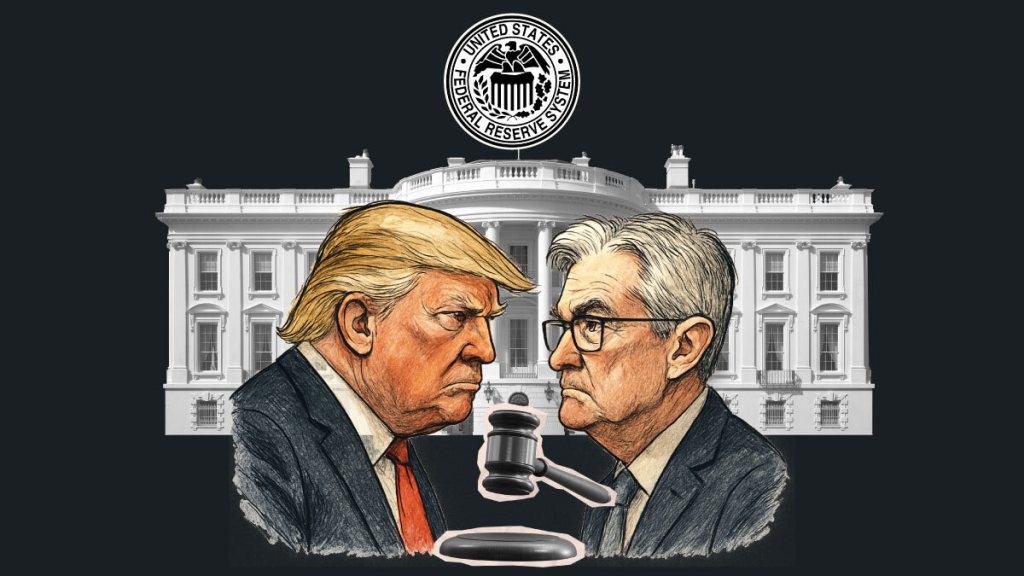

This morning, several news outlets reported that President Trump had officially prepared the paperwork to fire Federal Reserve Chair Jerome Powell. The bond market, which was lower today after the softer inflation report, quickly reversed and headed higher.

Then, after talking to Republicans in Congress, Trump told reporters that he wasn’t going to fire Powell. We all know the stories of a call to investigate Powell for the cost of remodeling the Federal Reserve, but this type of action goes beyond that talking point.

At this point, it’s unclear what might happen next but I want to talk about why this strategy of firing Powell won’t get President Trump what he ultimately wants: lower mortgage rates.

Firing Powell would be just the start

Most people believe that dismissing Powell is off the table this year and even the President himself recently asked why he would fire Powell when he’s going to replace him as soon as his term ends.

Since November 2024, I’ve repeatedly highlighted the White House’s intention to push for lower interest rates. However, Trump is pursuing rates that no sitting Federal Reserve Chairman or regional president would ever endorse. We should acknowledge that if the President continues down this path, he will not stop at Chairman Powell; he will aggressively target every regional Fed president who dares to vote against rate cuts.

Since the Federal Reserve is a board committee, and not everyone will be in favor of the rate cuts the President wants — which, to be clear, are recessionary rates — Trump would look to replace any voting member if they don’t advocate for those types of rate cuts. And Federal Reserve members would be mindful that their actions might mean the end of their job: this is not how the Federal Reserve has operated in modern history. If Trump can fire Powell, then every voting member of the Federal Reserve is at risk, and that has sweeping consequences.

An unwelcome market reaction

The marketplace had its own reaction after the news broke this morning that Trump had prepared paperwork to fire Powell: stocks fell and bond yields rose. That’s not the response President Trump wants. After the Godzilla tariffs were implemented and the stock market dropped by over 20%, it forced the White House to change tactics and call for a 90-day delay on tariffs.

Instead of firing Powell, I’ve discussed the strategy of installing a shadow Fed president as a workable but unusual option in this chaotic time. Using this strategy, Trump would let everyone know who he’s going to appoint as the next Fed Chairman in hopes of undermining Powell’s stance of keeping rates elevated.

However Trump chooses to pressure Powell, I do not advocate going the route of firing Powell because once he opens Pandora’s box, he may not like the market outcome.