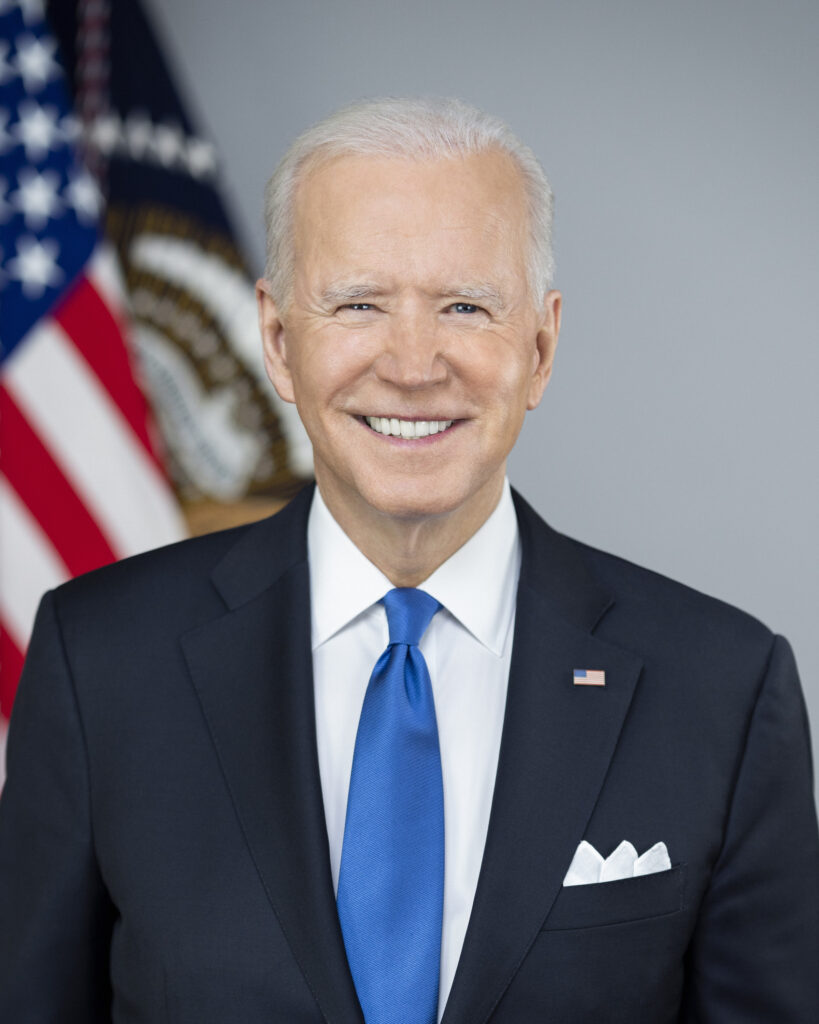

The White House on Friday publicly unveiled President Joe Biden’s discretionary funding request to Congress, otherwise known as its “skinny budget” ahead of its full budget proposal that is expected later this spring. The request includes several provisions related to housing. While the Home Equity Conversion Mortgage (HECM) program is not mentioned in the document, there are provisions as it relates to housing for seniors and which could be relevant to the reverse mortgage industry in its mission to help older Americans.

In terms of its requested allocation to the U.S. Department of Housing and Urban Development (HUD) for fiscal year (FY) 2022, the Biden administration is requesting $68.7 billion for HUD, which is $9 billion more than it received in the 2021 enacted funding level under the administration of Former President Donald Trump and Former HUD Secretary Dr. Ben Carson.

Senior priorities in housing

While much of the president’s priorities in housing understandably revolve around reducing levels of homelessness and increasing the construction of affordable housing for low-income individuals, there are certain priorities in the HUD proposal that are aimed specifically to assist the senior demographic.

“To address the critical shortage of affordable housing in communities throughout the Nation, the discretionary request provides a $500 million increase to the HOME Investment Partnerships Program, for a total of $1.9 billion, to construct and rehabilitate affordable rental housing, and to support other housing-related needs,” the White House document reads. “This is the highest funding level for HOME since 2009. In addition, the request provides $180 million to support 2,000 units of new permanently affordable housing for the elderly and persons with disabilities, supporting independent living for seniors and people with disabilities.”

The White House also aims to increase the funding allocation for the Social Security Administration (SSA) by $1.3 billion, which accounts for a 9.7% increase from the prior year’s allocation under the previous administration. This accounts for a major focus of the new proposal’s initiatives to assist seniors, according to the document.

“The Social Security Administration (SSA) is responsible for providing essential benefits to retirees, survivors, individuals with disabilities, and elderly Americans with limited income and resources,” the proposal reads. “The 2022 discretionary request would improve the timely processing of disability claims, expand outreach to vulnerable populations, ensure that SSA makes the correct payments to those who qualify, and modernize information technology to increase the accessibility of benefits for seniors and people with disabilities.”

HUD response, HECM details to follow

HUD Secretary Marcia Fudge released a statement responding to the administration’s desire to increase the government’s investment in HUD and its programs, saying that President Biden’s desire to funnel additional money into the Department represents a break from previous years of cuts that have been harmful to both the Department’s mission and the programs it oversees.

“Addressing our nation’s urgent housing challenges and building a more affordable, equitable, and resilient housing system demands strong federal leadership backed by robust federal funding,” said Secretary Fudge in a statement. “President Biden’s FY22 discretionary funding request turns the page on years of inadequate and harmful spending requests and instead empowers HUD to meet the housing needs of families and communities across the country. I am particularly pleased that the request proposes more than $30 billion to expand housing vouchers to an additional 200,000 low-income families. I look forward to working with the President to advance HUD’s critical priorities.”

In terms of specific details regarding the White House’s budget requests for more directly relevant reverse mortgage-related programs – including for the HECM program itself – a spokesperson for the Department told RMD that those details will be available in the full budget proposal that the White House will submit later in the spring. Details related to the HECM program are not yet ready to be made public, the spokesperson said.

Last year’s HECM proposals

When the new budget proposal arrives later this year, it is likely to look markedly different from the final budget proposal introduced by the Trump administration in 2020.

Last February, the legislative and provisional proposals outlined in HUD’s congressional justifications for the Trump White House’s budget proposal specific to the FHA Fund aimed to eliminate the cap on HECM loans that can be insured by the Federal Housing Administration (FHA), while also building in support for other legislative initiatives that would have an effect on the HECM program.

These included a waiver of the HECM counseling requirement to provide HUD with the authority to mandate counseling for all HECM transactions, as well as an update of the actuarial analysis that FHA uses to determine the adequacy of its HECM insurance premiums, which was originally conducted in 2001. The FHA under the Trump administration did not believe that the study which led to that actuarial basis was “adequate” any longer, given modern concerns.

The Trump proposal also repeated a previously-introduced proposal to institute regional HECM lending limits as opposed to operating off of a single national limit, a move which in the past has been deemed “ill-advised” by National Reverse Mortgage Lenders Association CEO and Former President Peter Bell.

“Applying the forward mortgage concept of ‘area limits’ to a financial resource (HECMs) created for a completely different population at a completely different time of their life would be ill-advised,” Bell said in a statement submitted to the House of Representatives ahead of a HECM-focused hearing in September 2019. “This discussion took place in the [Financial Services] Committee when the single national limit was enacted in 2007-2008 and that provision should remain in place.”

The pandemic, and what went into prior HUD choices

Also likely to change the equation for the Biden administration’s HECM program proposals is the COVID-19 coronavirus pandemic, which was declared a national emergency by President Trump the month after his administration submitted its final budget proposal to Congress.

The Trump administration implemented several relief measures for housing more broadly and the HECM program specifically, a difficult crisis to respond to according to Former HUD Deputy Secretary Brian Montgomery, who hopes that his team’s successors take the time to understand why certain decisions were made.

“So here you are, offering what you think is a good policy idea. But then someone says, ‘somebody did that in a previous administration.’ And you respond, ‘okay, did it work?’ This knee-jerk reaction that ‘if someone from the other party tried it, it must be bad,’ I just want people to avoid that temptation,” Montgomery told RMD in an exclusive interview earlier this year. “And it’s a hard temptation to avoid, oh, boy. Trust me. The new administration has been there just a few weeks. So hopefully, when they start getting their team in place […] I hope they understand why we came to whatever decision it was, and the process behind it.”

Some original relief measures introduced by the Trump administration have been carried over into the Biden administration, including a re-extension of foreclosure and eviction moratoriums as well as the ability to complete exterior-only appraisals.

Read the White House discretionary request, and a HUD-specific fact sheet relating to it.