“People used to talk about Compass all the time,” said Jonathan Miller, a real estate appraiser at Miller Samuel, who compiles housing market reports for Douglas Elliman, a Compass rival. “Now, you don’t really hear about them.”

If Miller is right and Compass, after raising $1.5 billion and flying to a $6.4 billion valuation in 2019, is a stale subject, that’s a shame because now anyone can become a Compass expert. The real estate brokerage unveiled its first annual report Monday, a federally required document for any public company. The dossier unveils everything from CEO Robert Reffkin’s ability to soon control 67% of the company to an all-you-can-eat buffet of details on an up to $600 million revolving line of credit provided by Barclay’s Bank.

Here are the five biggest takeaways from the 2021 10K report. Compass did not respond to messages for this story:

1. Shooting the non-GAAP

Under Securities and Exchange Commission law, companies must apply generally accepted accounting principles, or GAAP, in reporting their finances. In other words, companies cannot make stuff up. However, while companies cannot lie, they can have fun and devise non-GAAP measurements.

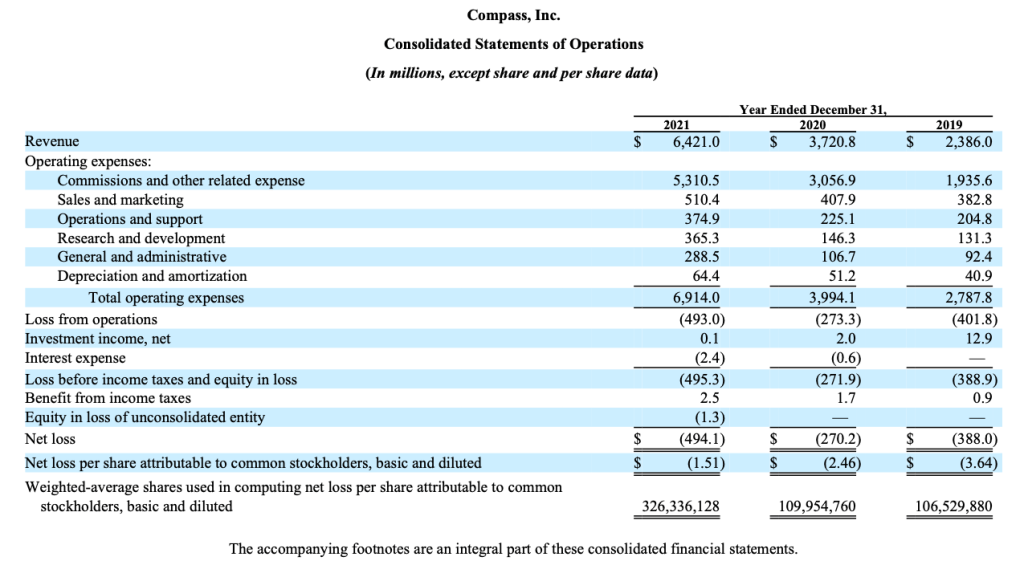

No less than 16 times during its February earnings call, Reffkin and CFO Kristen Ankerbrandt mentioned “adjusted EBITDA” or adjusted earnings before interest, taxes, depreciation, and amortization. Though Compass had lost $494 million in net income, they made a $2 million profit through adjusted EBITDA.

Compass arrives at its adjusted EBITDA figure by subtracting $386 million in stock-based compensation, though the majority of this expense is recurring annually. It also takes out $24 million in “acquisition-related expenses” despite the report stating Compass intends more acquisitions. And there’s a $21.3 million “litigation charge” (more on that in a sec).

Instead of justifying dropping these expenses, the report warns about adjusted EBITDA’s limitations. “In evaluating adjusted EBITDA, you should be aware that in the future we may incur expenses that are the same as or similar to some of the adjustments reflected in this presentation,” the report reads, later adding that Compass’s Adjusted EBITDA “varies from others in the industry.”

Indeed, most other brokerages either do not provide an adjusted EBITDA figure or give one at less variance to net income. eXp World Holding’s yearly report, for instance, gives an adjusted EBITDA measurement of $4 million less than its $82 million in annual income.

“All expenses should be included in their EBITDA,” said Michael Nourmand, president of Nourmand & Associates Realtors, a brokerage headquartered in Beverly Hills. “I run a privately owned company and we include all expenses in our profit and loss. In particular, I don’t see any reason to exclude litigation costs other than to make their numbers appear better.”

Compass, though, is hardly reinventing the non-GAAP wheel. Office subleasing company WeWork became a punchline in 2018 partly because its “community adjusted EBITDA” took out marketing and even administrative costs as expenses. And Opendoor turned a $662 million loss in 2021 to a $58 million gain under Adjusted EBITDA. Perhaps coincidentally, all three companies grew after venture capital funding from the SoftBank Vision Fund.

2. Litigation

As The Real Deal first reported in November, Compass settled its lawsuit with Avi Dorfman who claimed that, along with Reffkin and Ori Allon, he co-founded the company. The yearly report reveals that the settlement was for $21.3 million, the aforementioned litigation charge.

But while Compass is done duking it out with Dorfman, the company is locked in a three-year-old lawsuit with brokerage conglomerate Realogy. Compass has repeatedly lost motions to compel arbitration and take the case out of the public eye, according to the report. They are now in the discovery, or fact-finding stage, which is scheduled to last until October.

Meanwhile, Compass is fending off with a stick trade secret lawsuits from brokerages, and even breach of contract cases from Compass’s own agents. Litigation, as Nourmand argued, may be a recurring expense.

3. Agent productivity

Compass has made agent productivity a calling card – the firm’s principal agents do 2.7 times the deals of the average agent, the report states.

And agents who work at Compass say the brokerage gives them tools to be productive. User friendly templates for social media, email, and digital ads plus the ability to quickly customize videos are part of what “Compass has to offer that those other brokerages may not,” said Beatrice Stambulski, a Compass agent based in Sherman Oaks, California who spent a decade at Realogy-owned Coldwell Banker.

Other agents praise Compass for listening. “The difference with Compass is that they regularly seek input and feedback, and testing from the agents,” said Matt McKee, a Compass broker in Orlando. “They do not deliver their product until it has been thoroughly tested by agents.”

To ineptly paraphrase F. Scott Fitzgerald, one can hold two seemingly opposed thoughts about Compass – a financially troubled company admired by agents.

Still, those agents are not necessarily more productive. Principal agents refer to agents either working as lone wolves or heading a team. At Compass, agent teams can include the Aaron Kirman Group, a Los Angeles outfit that consists of Kirman and 84 additional agents. Whether that 2.7 number refers to deals Kirman did or deals Kirman and the 84 other agents did combined is not explained.

Compass’s agents do not appear more productive than the average agent who does 10 deals a year, Miller said, declaring, “I would think that the leaders of teams would be doing many multiples more than the rest of the pack – 2.7 seems modest.”

4. Mortgage joint venture

Compass has invested just $3.7 million in a company for which it owns 49.9%

Compass announced to some fanfare in July a partnership with Guaranteed Rate, a mortgage lender in Chicago that already partners with Realogy and @properties. For some observers, the joint venture holds promise as a path to the brokerage’s profitability.

But the impact of the mortgage lender, OriginPoint, is so far minimal. Compass has invested just $3.7 million in a company for which it owns 49.9%, though this number could swell in 2022. Compass expects OriginPoint available in the majority of the company’s markets by year’s end.

5. Profitability

There may not be a sharper critic of Compass than the company’s own investor warning.

“We have incurred net losses on an annual basis since we were founded, anticipate increasing our operating expenses in the future, and may not achieve or sustain profitability,” the report explains.

Compass has $618 million in cash, and $1.6 billion in debt. Its future success, the report states, “depends upon the continued service of our senior management team, including, in particular, Robert Reffkin, our founder, chairman and chief executive officer.”

“I’m clearly biased, but I just don’t understand their business plan,” Miller said. “They were in one of the biggest housing booms ever and didn’t make money. It’s hard not to be cynical.”

“I’m clearly biased” – Jonathan Miller, now the ‘independent’ appraiser of competing brokerages?

Thanks for this honest statement in ‘your’ article.

Hey Leonard, thanks for reading. While it’s true that Jonathan’s comments bookend the piece, it’s a story that reflects my reporting on the subject. I have received, as the piece shows, a lot of constructive feedback from Compass agents, but the company has not commented on the financial and public reporting issues I raise. It would be great to connect with you – I have left a couple of messages to you with my phone number, and my email is mblake@housingwire.com. -Matt