Private-sector payrolls increased by 183,000 jobs in February, the second-highest level in almost a year, according to ADP Research Institute and Moody’s Analytics.

While February’s gain was smaller than January’s downwardly revised 209,000, it still beat expectations. Economists in a Reuters poll forecasted private payrolls increasing by 170,000 jobs in February.

The strongest labor market in more than a generation is acting as a buffer against the economic toll of the spread of the coronavirus that causes COVID-19, said Mark Zandi, Moody’s Analytics’ chief economist.

“COVID-19 will need to break through the job market firewall if it is to do significant damage to the economy,” Zandi said. “The firewall has some cracks but judging by the February employment gain it should be strong enough to weather most scenarios.”

Most of February’s payroll gains were in large companies, said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute.

“The labor market remains firm, as private-sector payrolls continued to expand,” Yildirmaz said. “Job creation remained heavily concentrated in large companies, which continue to be the strongest performer.”

According to the report, the goods-producing sector, which includes construction employment, increased by 11,000 jobs, with the building sector gaining 18,000 new employees.

Below is a breakdown of job segments that saw changes in payrolls between January and February:

The goods-producing sector increased by 11,000 jobs, including:

Natural resources and mining: Decrease 3,000

Construction: Increase 18,000

Manufacturing: Decrease 4,000

The service-providing sector increased by 172,000 jobs, including:

Trade, transportation, and utilities: Increase 31,000

Information: Decrease 2,000

Financial activities: Increase 9,000

Professional and business services: Increase 38,000

Education and health services: Increase 46,000

Leisure and hospitality: Increase 44,000

Other services: Increase 7,000

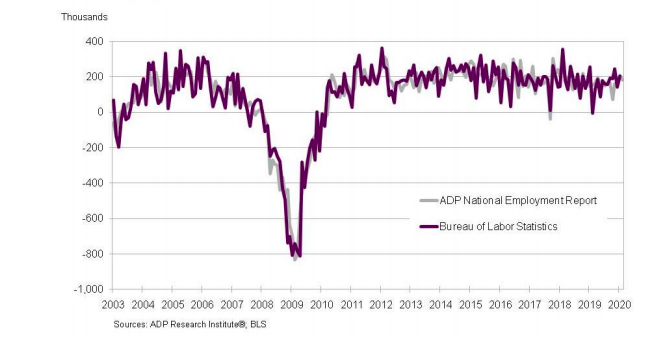

The chart below demonstrates the rate of increase since 2013: