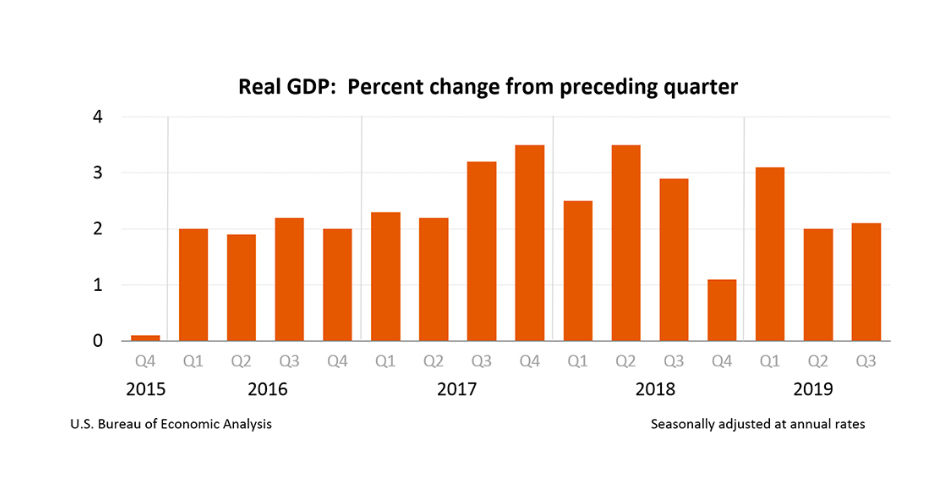

Inflation-adjusted GDP increased at an annual rate of 2.1% in the third quarter, according to the third estimate from the Bureau of Economic Analysis. In the second quarter of the year, GDP grew at a 2% pace.

Friday’s GDP estimate is based on more complete source data than October’s second estimate.

With the third estimate for Q3, upward revisions to personal consumption expenditures and nonresidential fixed investment were offset by a downward revision to private inventory investment.

The GDP increase also reflects positive contributions from federal government spending, residential investment, exports, and state and local government spending. The acceleration in Q3 reflects upturns in both exports and residential fixed investment.

Notably, corporate profits, which account for current production, decreased $4.7 billion in Q3, compared to an increase of $75.8 billion in Q2. Overall, profits decreased by 0.2% at a quarterly rate in Q3 after rising 3.8% in the previous quarter.

Current-dollar GDP increased by 3.8%, or $202.3 billion, in Q3 to a level of $21.54 trillion. This is down from the second quarter’s 4.7%, or $241.4 billion.

The gross domestic price purchase index increased by 1.4% in Q3, down from an increase of 2.2% in Q2. Personal consumption expenditures – meaning household spending – increased by 1.5%, down from 2.4% last quarter.

Here are updates to the previous estimate:

Real GDP: Remained at last estimate’s 2.1%

Current-dollar GDP: Remained at last estimate’s 3.8%

Gross domestic purchases price index: Remained at last estimate’s 1.4%

Personal consumption expenditures: Remained at last estimate’s 1.5%

The chart below shows that GDP remains almost on par from the second quarter and sits nearly one percentage points below Q3 of 2018.