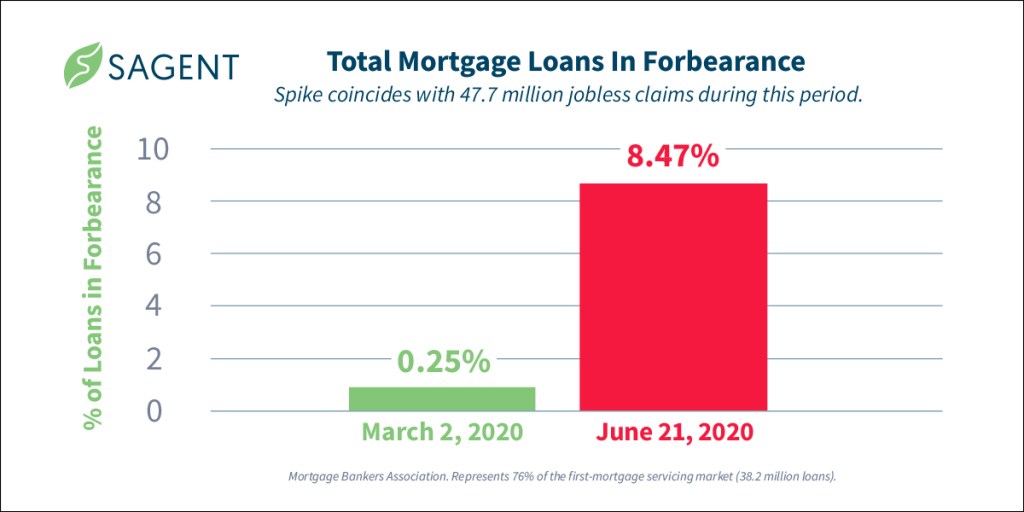

Since March, mortgage forbearances rose to about 8.5% of all outstanding loans, hit a brief reprieve mid-June and now the COVID economy is posing risks again.

Smart policy response (12-month forbearance runway, missed payments added to loan, etc.) has unquestionably eased forbearance and housing strain, but persistent jobless claims and COVID cases will impact homeowners and mortgage servicers well into 2021.

This puts servicers in pole position to care for customers during one of the tougher times in their homeownership journey. It’s also a catalyst for modernizing servicing from the customer care, retention and engagement perspective. What works to help customers during hardship also works for the rest of their home owning life.

Since Sagent powers servicers to get all of this right for homeowners, below I’m sharing answers to questions we get asked most from servicers right now. I hope this helps you raise your customer care game while staying efficient, compliant and increasing your MSR values in this complex business.

Where does Sagent fit into the mortgage servicing ecosystem?

Sagent is the technology provider powering the homeownership and consumer lending experience for 12 million borrowers and growing.

As America’s second largest loan servicing software company, we fully understand the complexity of mortgage servicing at scale. We believe now is the time for servicers to show homeowners what real-time engagement means.

Homeowners, especially when they’re strained, need accurate, quality information and the ability to take action or get help using any device.

How can loan servicers give homeowners real-time engagement and a modern experience?

We all watch TV and shop seamlessly across all of our devices. We stop a show on our TV and start it again on our tablet. We buy new vitamins using recommendations made based on our previous buying.

And when we need help, customer care teams see the same data we see.

This omni-channel, data-driven consumer experience progressed rapidly since 2015 in originations and is now accelerating in servicing.

COVID gave us all a stark reminder of how hardship can hit borrowers hard from nowhere, and we must enable them to understand and act on their options quickly, whether by using their phone app or calling your customer care team for advice.

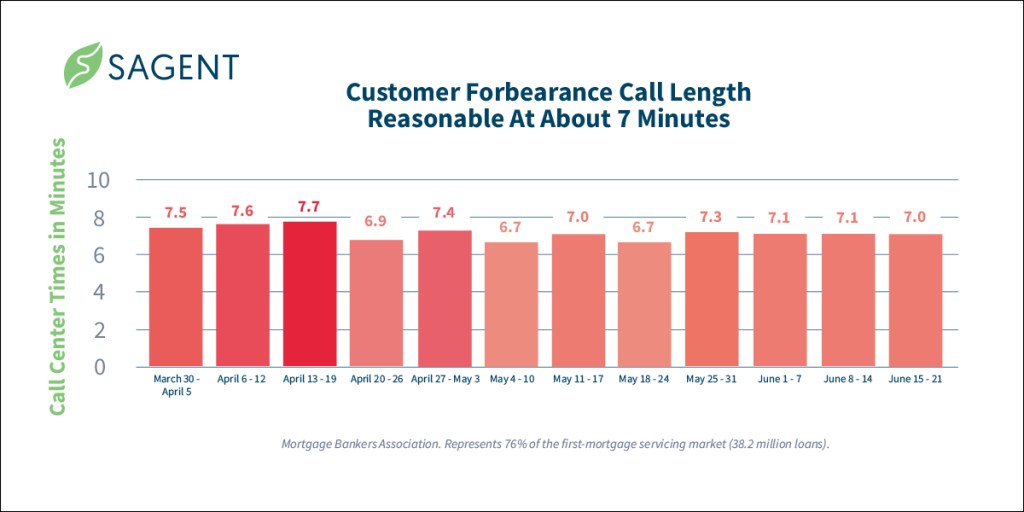

So far, servicers have been able to handle customers’ hardship requests in about 7 minutes per call as forbearances spiked to about 8.5% of all outstanding mortgages from March 2 to present.

Servicers using Sagent led the way on this by giving their borrowers targeted and actionable messaging, education and guidance based on what the borrower is seeing.

How did servicers using Sagent enable homeowner self-service so quickly during COVID?

Our methodology is enabling servicers to configure, rather than code, systems for constant changes they need.

This approach enables servicers to immediately adapt Sagent’s consumer-facing Account Connect suite to constantly changing markets, regulations and GSE/investor loan guidelines.

It also enables servicers to rapidly configure our flagship LoanServ suite for their needs, and all changes are seamlessly carried through to borrowers via Account Connect.

When COVID economic strain hit American homeowners all at once in March and April, our servicers were able to quickly add self-serve (using Account Connect) to their full-serve customer care, and also quickly adjust their systems (using LoanServ) to manage critical compliance and accounting functions as CARES and other forbearance and relief efforts came in real-time.

What else can servicers do for homeowners using Sagent Account Connect?

When a homeowner uses their servicer’s branded version of Account Connect, they don’t see any generic calls to action. Everything is hyper-relevant to their situation and current market conditions.

Right now, a homeowner might “Click for COVID-related mortgage assistance” to explore options based on their needs.

On an ongoing basis, a homeowner might see messages about managing their escrow balance or updating insurance. All of these are custom to their profile so they can actively manage their mortgage.

The visionary part for servicers is to let homeowners actively manage not just their loan today, but for any lending needs they have over their life of borrowing and homeownership.

How can servicers let borrowers actively manage their homeownership experience?

Because our real-time LoanServ data communicates directly with Account Connect, we are building Account Connect as the dashboard for a borrower to manage their whole homeownership lifecycle.

It begins with the basics like showing loan balances, making payments and showing amortization schedules in real time.

It then gets more engaging when servicers can enable borrowers to model interest cost savings and faster payoff times by applying extra principal or refinancing.

Integrating rate data from your product and pricing engine lets servicers show rate-and-term or cash-out refinance scenarios to borrowers based on market, home improvement, debt consolidation or other opportunities – all of which improve retention.

And it’s especially important for retention if servicers can give borrowers a real-time lens on their home(s), valuation and also enable full-MLS search.

This is how all of us in loan servicing must redefine lifetime customer care, retention and engagement.

What does it mean to redefine “customer for life” in loan servicing?

The entire lending and banking industry talks about the concept of “customer for life” but loan servicing must be a bigger part of this conversation.

Think about how it works: origination, sales and marketing teams engage customers fully from top to bottom of the funnel and close the loan, then servicing takes over for the life of the loan.

But it’s not just the life of the loan customers have today. Servicing must engage customers for any lending needs they have over their life of borrowing and homeownership.

Now that software like Sagent’s has made servicers highly efficient at collecting payments, administering impounds and managing accounting and compliance, it’s time to expand into lifetime customer engagement in the ways described above.

Servicers are best-positioned for lifetime customer engagement because they can use Sagent’s Account Connect borrower and property data to keep borrowers informed about their largest asset – their home – and present relevant options to optimize their finances or even buy a new home.

If originators are the finders of new customers, servicers must be the keepers of those customers.

How close are we to this “customer for life” vision for homeowners?

Right now, servicers must win on customer care in this volatile COVID environment. This means rapidly translating real-time regulations, relief efforts and investor guidelines into easily understood education and advice so homeowners can make confident, informed decisions.

This will play out well into 2021. But executing well on COVID response is also a catalyst for accelerating the modernization of servicing to finally build in the customer retention and engagement concepts discussed above.

When we look at these themes again one year from now, I’m confident we’ll see material progress in the customer for life vision we all share as an industry. This is a huge win for homeowners as well as servicers.