More than 1,400 Consumer Financial Protection Bureau (CFPB) workers were terminated from their positions on Thursday, sources told WIRED. There were around 1,700 employees in total at the CFPB.

Fox Business reports that around 1,500 workers will receive RIF notices across core functions, based on an unnamed source.

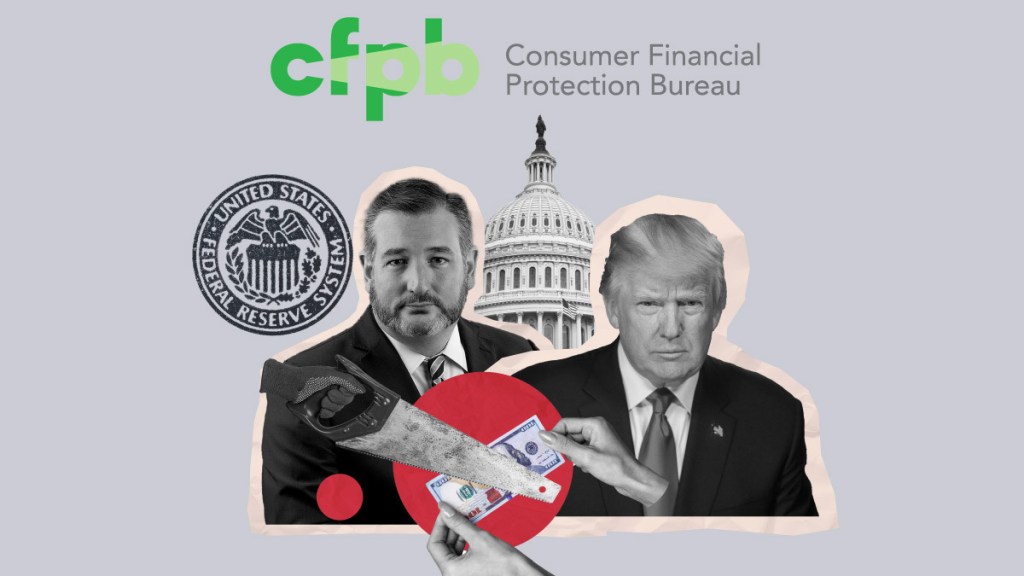

This move is the latest in the Trump administration‘s latest action in cleaning house when it comes to government agencies and their respective employees.

The layoffs come after an email was sent to CFPB staff on Wednesday, which Wall Street Journal’s White House Economic Policy Reporter Brian Schwartz posted on the social media platform X. In the email, CFPB chief legal officer Mark Paoletta outlined the agency’s new focus, noting that it would be shifting its attention away from supervisory roles and toward “tangible harm to consumers.”

The document lists medical debt, student loans, consumer data, and digital payments as topics the CFPB will “deprioritize.” Problems with mortgages will be the agency’s top priority.

Per the Associated Press, employees’ access to agency systems, including email, ends on Friday evening.

“The Consumer Financial Protection Bureau identified your position being eliminated and your employment is subject to termination in accordance with reduction-in-force (RIF) procedures,” the emails said.

The CFPB, established after the 2008 financial crisis and the brainchild of Senator Elizabeth Warren, has faced criticism from the Trump administration, as well as from some in Silicon Valley and on Wall Street, who argue that it exceeds its regulatory authority.

The layoffs follow a contentious period at the agency. In February, acting CFPB Director Russell Vought instructed agency staff to stop all work “unless expressly approved by the Acting Director or required by law.” In early March, CFPB employees were told to continue working on “statutorily required work.”

The CFPB did not respond to HousingWire’s request for comment at the time of publication.

This is outstanding. Elon and DOGE are doing great work and eliminating all the wasteful spending in Washington. Washington, the bureaucracy, is fat with waste and largely is bloat in headcount (which is often the single largest expenditure in any company). Just like Twitter/X 80% of the company was deemwd to be unnecessary or redundant and the company adjusted and came out all the better for it. That’s what running a smart company looks like. I commend DOGE’s work. It’s incredibly courageous to make difficult and bold but right decisions for a better future. Doing what’s right, what’s best, what’s necessary is often not popular. But leadership requires being bold. Our country is going to be even more AMAZING than it ever has been.

Favorite quote of the week from James Clear

Novelist Robert Louis Stevenson on personal responsibility:

“Sooner or later we all sit down to a banquet of consequences.”

Source: Old Mortality (1884)

Next – update the law to allow for full LO Compensation flexibility, flexibility for how the originating entity may collect compensation, and offer consistent updates / clarity in law with to reduce grey areas.

Put the responsibility on professionals to do an honest and good job.

Put the responsibility on the consumer to do minimal due diligence when shopping / choosing their mortgage professional.

Business is for Profit by its very nature – not for Charity. The coddling needs to end.