While mainstream advertising across the world seems to miss the mark when it comes to effectively appealing to the senior demographic, one of the few businesses that seems to understand the potential reward of advertising to the cohort – across both the United States and Canada – is the reverse mortgage industry. This is according to a column published last week by the Canadian news publication The Globe and Mail.

“Boomers’ words and actions are powerful, given they account for a huge chunk of the population and have more financial might than younger generations after decades of accumulating wealth from cooperative stock markets and rising real estate prices,” the column reads. “It’s a generation with a lot of influence – but you wouldn’t know it by watching mainstream advertising, where the focus is overwhelmingly on youth.”

This kind of youth-oriented focus may have made more sense in previous decades when brand loyalty advertising had greater potential to create customers “for life,” the column says, but modern advertising has not been able to tap into – or create – that kind of connection in a long time.

“Once you hit 55, it’s like you don’t see any creative briefs, a media buy or research targeting anyone that old. It is like you fall off a cliff,” said Jeff Weiss, CEO of ad consulting company Age of Majority to the publication.

The result is that companies could be missing out of billions of dollars in sales by neglecting the 55-plus demographic in particular, according to research conducted by Age of Majority and cited in the column. However, Weiss is able to identify an industry operating in both the U.S. and Canada that understands this shortcoming and have generally avoided it.

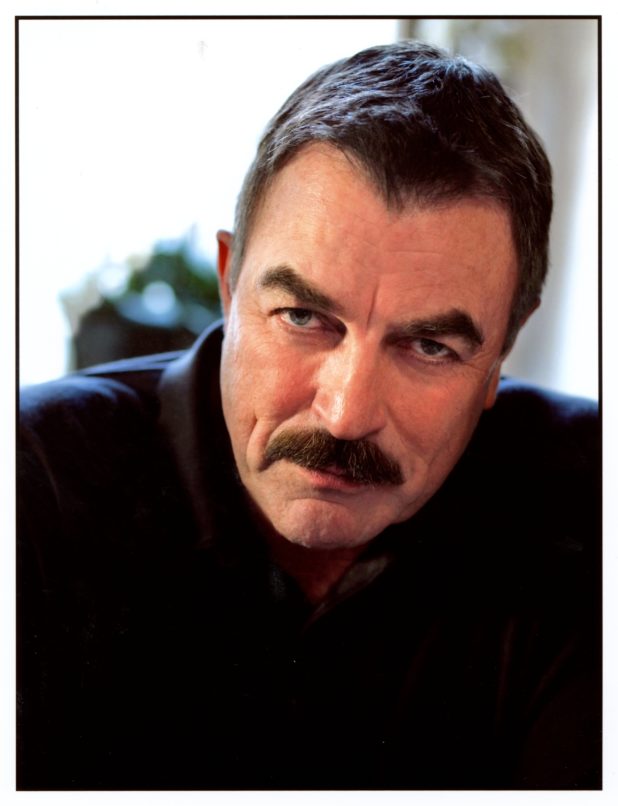

“On both sides of the border, it’s reverse mortgage companies that stand out: American Advisors Group in the U.S. which uses famous actor Tom Selleck and HomeEquity Bank in Canada which uses homegrown Olympian Kurt Browning,” the column reads.

AAG recently rolled out a new advertising campaign featuring Selleck, and HomeEquity Bank has been dabbling in less conventional ads for years which even includes American personalities such as thief-turned-security consultant Frank Abagnale, Jr. in a series of informational ads designed to help seniors avoid being scammed.

Read the column at the Globe and Mail.