When Goldman Sachs recently predicted that 2.25 million people would file for unemployment last week, it made headlines nationwide (including here on HousingWire). That figure would have obliterated the previous weekly record that has stood since 1982.

But the actual figure is far, far worse than Goldman Sachs predicted. According to the Department of Labor, nearly 3.3 million people filed for unemployment in the week ending March 21, 2020, an increase of more than 3 million from the week before (282,000 to 3.28 million).

That figure shatters the previous weekly record of 695,000 initial jobless claims, which was set in 1982, and it’s a clear indication of just how bad things are for millions of people around the country. The Labor Department report puts it succinctly: “This marks the highest level of seasonally adjusted initial claims in the history of the seasonally adjusted series.”

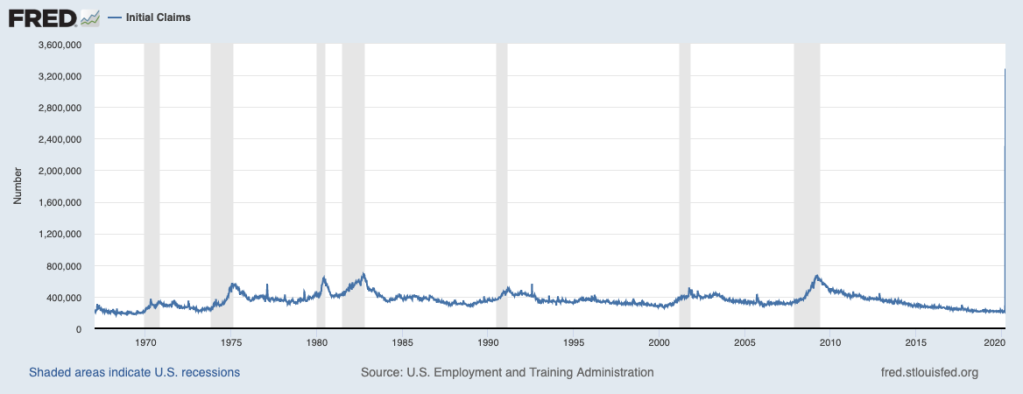

For more evidence of just how outsized the recent data is, click on the image below. The massive spike on the far right of the graph is the number of recent jobless claims.

According to the report, every single state and U.S. territory saw an increase in jobless claims from week-to-week.

The state with the most new unemployment claims was Pennsylvania, which saw its jobless claim total climb from an estimated 15,439 in the week ending March 14 to 378,908 in the week ending March 21. That’s an increase of 2,354% in just one week.

The other states with the largest number of new unemployment claims were Ohio (which saw its figure increase from 7,046 to 187,784 in one week); New Jersey (which saw its figure increase from 9,467 to 155,454 in one week); Massachusetts (which saw its figure increase from 7,449 to 147,995 in one week); Texas (which saw its figure increase from 16,176 to 155,657 in one week); and California (which saw its figure increase from 57,606 to 186,809 in one week).

Figures of that size mean that millions of people are now out of a job due to coronavirus-related shutdowns and layoffs. And that means that there’s about to be a massive flood of delinquent mortgages and overdue rent payments as many people are unable to make their next payment.

The housing industry is already mobilizing to try to limit the impact of these missed payments, with industry leaders offering mortgage forbearance, deferrals, foreclosure and eviction moratoriums, and other options for borrowers and renters.

But the sheer number of people who are suddenly out of a job is something that’s literally never been seen before. “These layoffs will lead to real hardships for millions of households across the country,” Mortgage Bankers Association Senior Vice President and Chief Economist Mike Fratantoni said in a statement.

“Mortgage servicers are already hearing from a substantial number of homeowners who are concerned about their ability to make their mortgage payments on time. The mortgage industry is ready and willing to help through the use of established forbearance programs, allowing borrowers who have lost their jobs or been furloughed as a result of the virus the ability to delay their payments for at least six months,” Fratantoni added.

But widespread mortgage forbearance, which will likely be needed with so many people suddenly out of work, will cause some serious problems in the secondary mortgage market. “However, the unprecedented and unexpected wave of forbearance requests will place a significant strain on mortgage servicers. Even if a quarter of all borrowers request forbearance for six months or longer, cash demands on servicers could exceed $75 billion and could climb well above $100 billion,” Fratantoni said.

That’s why the MBA this week joined several other groups to ask the government for a solution to the payment advance situation.

When a borrower is unable to make their monthly mortgage payment, the mortgage servicer must still pay the principal and interest to investors, as well as the real estate taxes, homeowners’ insurance, and mortgage insurance on the borrower’s behalf. Servicers typically retain some reserves to cover such shortages, but they simply don’t have enough money to cover the mortgage payments if a widespread forbearance program is put in place.

“That is why it is absolutely critical for the Federal Reserve and U.S. Treasury to immediately establish a liquidity facility so that otherwise solvent mortgage servicers can borrow from the Fed to support these forbearance programs,” Fratantoni said. “This needed backstop for servicers will ultimately support homeowners during these challenging times.”