It is now over one month since the CARES Act was passed, creating a blanket forbearance option for all borrowers in a GSE, FHFA, VA, or USDA loan to skip six to 12 months of payments. Legislation established by Congress with the intent of calming concerns of homeowners across the country has thrust an entirely new credit availability contraction over the entire nation.

Because of the rush to pass legislation, the unforeseen adverse impacts could not have been fully vetted in advance. As a result, we found a multitude of challenges, but it really came down to these two:

- How would mortgage servicers come up with the tens of billions in needed advances to bond holders of loans in forbearance?

- What about borrowers who went into forbearance after settlement and before the loans were sold to the GSEs or into GNMA securities?

Unfortunately, the FHFA director made some unwelcome judgmental comments and policy decisions that have resulted in an unprecedented tightening of credit across the entire mortgage industry, threatening to impair a key sector of the economy that some economists were expecting would help lead us back to recovery.

Guest Author

Statements about allowing nonbank servicers to fail, the ease in which servicing could be transitioned, and statements even suggesting consumers might be better off sent shock waves into the credit markets, impacting correspondent loan buyers, warehouse lenders, MSR investors and more.

Overnight we saw a series of overlays come into the market broadly. These included 700 FICO floors in some cases, 80% LTV maximums, the elimination of bond lending, DPA, high balance conforming, jumbo non agency, non-QM and more. This was bad, and lenders were trying to respond to the barrage of new underwriting and pricing policies they were receiving, but unfortunately it only got worse.

Next, the FHFA director implemented policies around first-payment forbearance. This one is really tricky because there is almost no way that an originator can determine whether a borrower intends to forbear after settlement. In many cases, credit-worthy borrowers who still are able to make their payments have chosen forbearance. In some cases, they have been approved for forbearance yet continue to make their payments on time. And yet in most cases they likely lost their job or lost one income in the family sometime after settlement but before sale to the GSEs.

Regardless, FHFA established that if it was an unsold but settled first payment qualifying forbearance that they would allow the originator to sell the loan to the GSEs for either 500bps for a first-time borrower/buyer or 700bps for other purchase loans or a limited cash-out refinance. Other cash-out refinances, NOO, 2-4, and all other previously eligible loans were no longer deliverable.

The market response was swift. Immediately cash-out refinances began to evaporate. Wells Fargo was swift and eliminated them altogether, as did others. In some cases, steep delivery fees, LTV limits, FICO/LTV, caps, risk-based pricing grids or more were added. As of this writing, cash-out refinancing is getting harder to find. And more importantly, the policies being implemented by originators and investors in response to this is wildly varying — only adding to the confusion in the market.

So what needs to happen? It’s simple really.

First: Director Calabria needs to state that the GSEs will establish liquidity facilities for only those that need it. This is simple really, as he has already stated that in his research most servicers state that they can get through this on their own. Given that, his risk is minimal but establishing this with clarity would convey support just in case it would be needed and calm the credit markets.

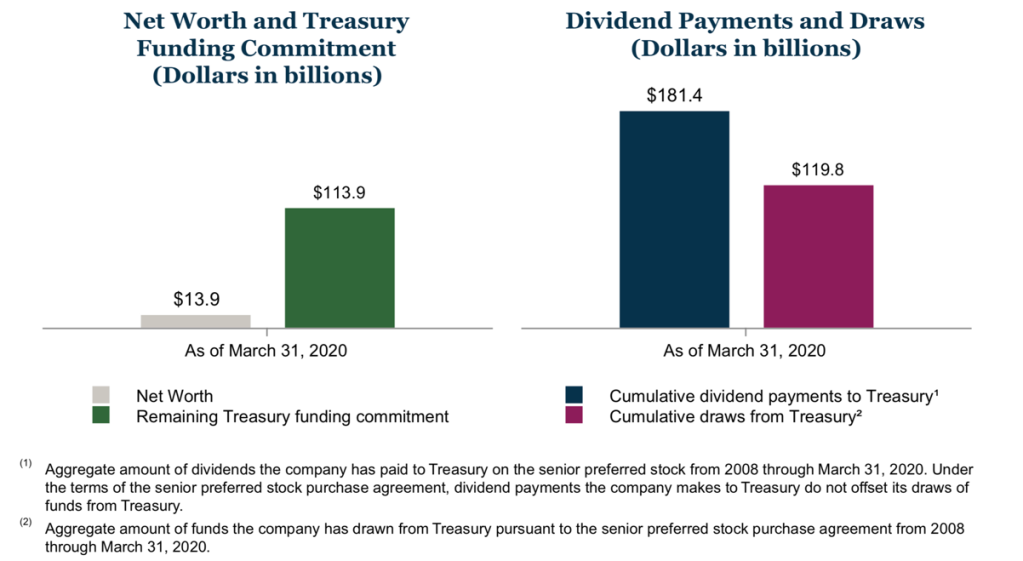

Why do this? This is even more simple. The GSEs own the servicing anyway. It’s their asset and ultimately if the loan re-performs they get replenished for advances and if not, they guaranteed the loan anyway and would have to reimburse the servicer for any losses including advances made. And they have the capital. As Fannie Mae reported in its own earnings release this past week, they have ample resources.

One point to remember is this: The GSEs were primarily created to bring stability to the markets, especially during periods of counter-cyclical credit events. Fannie was created in 1938 as part of the New Deal to help the housing system pull the economy out of the depression.

We are now in a period that’s about as close to that historical period as it gets. And the GSEs together are backed by approximately $240bb in available resources that are fully funded. They have government backing — the mortgage industry, particularly nonbanks, which are the life blood to mortgage lending, do not.

They own these assets, they have the liquidity, this is really that simple.

Second: The director needs to get rid of these outrageous delivery fees that have all but killed refinancing. If the loan is a rate and term, or limited cash-out refinance, they already own this risk if it’s refinancing from the same GSE to GSE. It likely means the payment is being reduced so it is only improving their risk. For other eligible loans closed and meeting their standards, the “gotcha” of this delivery fee is literally crushing credit access. There are options, but the GSEs need to permit first credit forbearances post closing to be sold regardless of loan type. They could apply a small fee across all loans in order to keep credit flowing, but to smooth out the cost while compensating them for the risk. They could put a reasonable cash-out cap of some sort. There are reasonable options.

Why is it necessary to turn back the dial on these recent exclusions? Take cash-out refinancing for example. Small business owners, self-employed borrowers, or a family with the loss of maybe one income earner in a household may use this cash out in order to stay afloat or keep their business alive during this period. Cash-out loans put money back into the economy as spendable dollars and yet the delivery fee has not just stopped first payment forbearance refis, it has stopped almost all of these loans from having an investor.

But that is not all. We need to eliminate any incentive for bad behavior here. Changes to the LO Comp rule to permit lenders to not pay any commission to an LO if the loan goes into first payment forbearance would eliminate the concern of a rogue loan originator ‘helping’ the borrower get a mortgage with the known intent to forbear. Additionally, the borrower could be required to sign a new attestation at closing that “their employment has not changed and that they are not aware of anything that would interrupt future income.” This would then add a misrepresentation attestation if the borrower had disclosed incorrectly or intentionally.

The FHFA has single-handedly forced an extreme and unstable level of credit contraction onto one of the bright spots in the economy: housing. Its has signaled publicly its lack of support to the largest segment of mortgage lending in the middle of national crisis, resulting in an even greater pull back, especially to nonbank lenders.

FHFA is showing an unhealthy level of resistance to the housing sector and is almost solely responsible for the contraction taking place and the loss of some critical products and programs altogether. They can fix this, and it is their job to do so. Establishing the liquidity facility, one that Calabria himself says likely won’t be needed, would eliminate the uncertainty premium being applied here. Eliminating or modifying the post closing delivery fee for first payment forbearances while permitting all loans that were eligible for sale when the loan was closed/settled by the lender is of upmost importance as well.

The FHFA director needs to do the job of regulator based on what these tools of government were created for by congress — to infuse more liquidity into the economy and not constrain credit, as is the case now. He needs to set aside his ideology and his goals for the long-term reform of the GSEs and focus on this pandemic and the economic recovery. And he needs to act now.