High lumber prices are often blamed for high home prices. I recently saw a $60k home price reduction offered by a builder because “lumber prices have fallen…we are passing that savings to you.” That just doesn’t add up.

In a blog post from January 4, the National Association of Home Builders said that the 167% rise from last summer’s low lumber prices to over $1,000 per thousand board feet (mbf) added only about $18,600 to the cost of a home. Nevertheless, can today’s falling lumber prices possibly bring back demand for housing?

Lumber math

If the lumber price was around $400/mbf last summer, then a 167% increase is equivalent to $1,070 in January. That’s a reasonable range for this analysis. That means a $670/mbf move in lumber prices is equivalent to $18,600 in additional cost. Therefore, every $1/mbf of lumber pricing costs the homebuyer about $28 in lumber ($18,600 / $670).

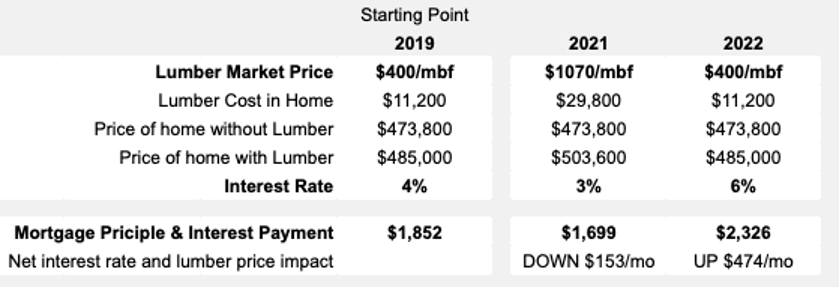

Keeping the figures simple, here is some math tied to the NAHB blog:

- If lumber in 2019 was $400/mbf, lumber cost was $11,200 per home

- If lumber in 2020 was $1070/mbf, lumber cost was $29,800 per home

- If lumber in 2022 is $400/mbf, lumber cost is back to $11,200 per home

Over the same time period, here is what happened to 30-year mortgage interest rates:

- 4% in 2019

- 3% in 2021

- 6% in 2022

What is the impact of lumber relative to interest rates?

In January 2020, Carmel Ford of the NAHB Economics and Housing Policy Group published a special study titled Cost of Constructing a Home. The home was 2,594 square feet for a total sale price of $485,000. This may not be the same home upon which NAHB based its Jan. 4 blog about lumber price increases, but it’s close enough for this purpose.

Using a 30-year mortgage amortization assuming 80% loan to value financing on a $485,000 home and this calculator at Bankrate.com, here is a table showing the impact of lumber pricing and interest rate on a monthly house payment:

From 2019 to 2021, increasing lumber prices added $63 to the 2021 mortgage payment and a 1% drop in interest rates saved $216 for a net savings of $153. From 2019 to 2022, interest rates added $474.

In other words, a 1% move in interest rates has more than three times the impact of a 167% increase in lumber.

Lumber price is always a follower, never a leader

Lumber prices were driven higher by high demand and low availability of lumber. That’s the same factor that drove home prices higher — high demand relative to availability. What drove high demand for homes? Record low interest rates. Homebuilders were able to pass all rising costs on to homebuyers due to record low buyer borrowing costs. As borrowing power of the buyer decreases, home demand decreases, lumber demand decreases relative to supply, and lumber prices drop.

Lumber never leads, it always follows.

The NAHB and media can vilify commodity lumber markets for high prices during the unprecedented supply chain disruptions in 2020 and 2021, but falling lumber prices cannot overcome rising interest rates to bring back demand for housing.

Matt Meyers is the founder and CEO of Yesler Marketplace.

This column does not necessarily reflect the opinion of HousingWire’s editorial department and its owners.

To contact the author of this story:

Matt Meyers at meyers@goyesler.com

To contact the editor responsible for this story:

Sarah Wheeler at sarah@hwmedia.com