One of the most common misconceptions in the broader discussion of America’s housing crisis is that the rapid increase of the single-family rental (SFR) market is preventing prospective homeowners — especially younger homeowners — from attaining the American Dream. That is not the case, in fact, SFR properties serve as a critical housing “safety valve,” providing an intermediate step toward home ownership. SFR is an attractive option for those seeking a better quality of life amid a persistently tight housing market.

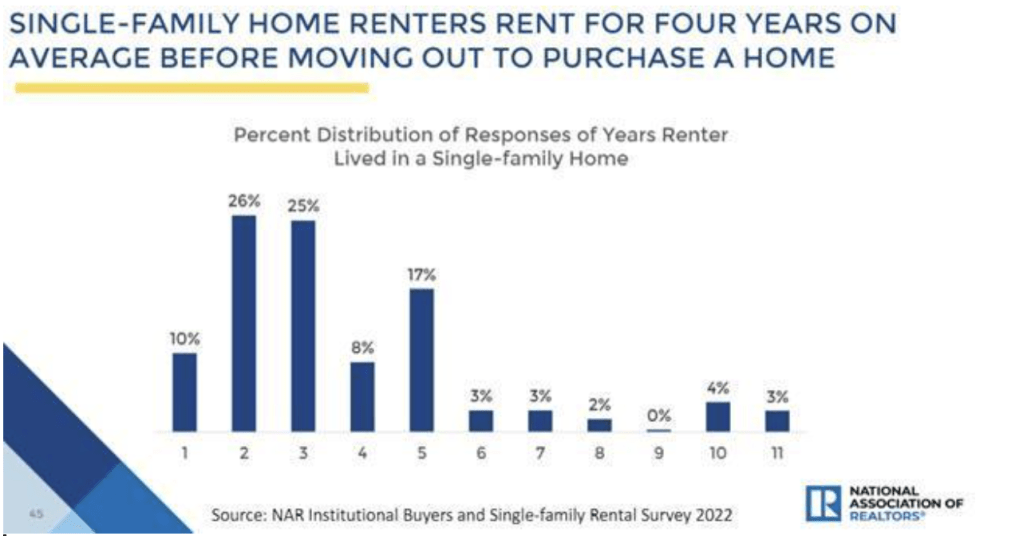

Contrary to popular belief, single-family renters are not typically “renting-in-perpetuity” or locking themselves out of home ownership, but rather are seeking out the best current value amid a challenging and rapidly evolving economic environment over which they have little control. And the numbers back up this counter narrative. According to a recent National Association of Realtors (NAR) survey, 86% of tenants renting single-family homes end up purchasing a home within five years.

How did we get to this point? It’s impossible to pick out just one factor, but longstanding underinvestment in new housing, coupled with a confluence of certain federal and monetary policies, have all played a role in limiting options for first-time home buyers.

Housing Shortages and Mortgage Rate Fluctuations

America had a problem with housing availability even before the pandemic. One recent estimate found that the U.S. requires up to 6.8 million new units to meet current housing demand. So, when interest in buying suburban homes surged during the pandemic, prospects for first-time homeowners suffered. In the last year alone, U.S. home prices have risen 20%. But such volatility in the housing market cannot simply be attributed to a supply shortage. Since 2008, major banks have pumped over $25 trillion into the global economy. Such quantitative easing has pushed prices of the nation’s finite housing supply to record levels.

30-year fixed rate mortgages were at a historic 2.68% low as recently as December 2020 according to Freddie Mac, but skyrocketing property values pushed many frustrated buyers out of the market and into renting. This trend only intensified in 2022 in the wake of several, successive interest rate increases by the Fed. These higher rates sidelined more potential buyers as mortgage rates hit a 10-year high, now hovering above 7%. Such mortgage rate hikes have become the largest driver of the widening year-over-year gap between first-time buying and renting that we see in many markets across the country.

Unfortunately, the outlook for the U.S. economy remains hazy as inflationary concerns continue to fuel rate increases. Not surprisingly, this level of added uncertainty has created a whole new pool of homebuyers who are watching and waiting for a cool-down from the sidelines.

Aging in Place

Along with changes to first-time buyer habits, seniors are keeping their homes for longer. Baby boomers, who as a group are healthier and better educated than their parents, have benefited from vast improvements in healthcare and technology that have made aging in place much easier. This trend shows no signs of slowing and adds pressure in markets where the housing supply is unable to keep pace with new population growth. A 2019 study by Freddie Mac found that baby boomers, compared to generations before them, are holding onto 1.6 million more households — roughly equivalent to the same amount of new construction the United States sees in a year. In the context of a finite housing supply, it means that younger generations either need to wait longer or pay more for their first homes relative to older generations.

Student Loan Debt

There are other factors at play as well. According to a poll commissioned by NAR last year, half of the non-homeowners (51%) said student loan debt is delaying them from purchasing a home. Student loan debt has been growing at an unprecedented rate over the past two decades, far outpacing auto loans, housing debt and credit card debt. Equally concerning, according to the Federal Reserve Bank of New York, is that two-thirds of student-debt holders had growing or flat balances at the end of 2021, compared with just 48% in 2019. For younger renters — millennials or younger — high levels of student debt have put homeownership beyond their reach.

A Bridge to Homeownership

Taking all these factors into account, it’s not surprising that the age gap between renters and homeowners has continued to widen. According to Zillow’s recent Consumer Housing Trends Report, the median age of U.S. renters is 37 years old, while about two-thirds (65%) of renters are under the age of 40. This contrasts sharply with homeowners, where the average age is approximately 56.

But it would be wrong to suggest the rise of SFR is simply a matter of economic strife and policymaking. Many are attracted to renting because it provides a greater level of financial freedom and access to a higher quality of living, along with access to better neighborhoods and newer amenities, than would otherwise be attainable through ownership. In addition to providing a more affordable price point, SFR offers spatial flexibility and greater mobility. In fact, mobility is often cited as a paramount selling point for millennials, who spend, on average, only three years in the same job.

A tight labor market and the shift toward remote working have provided additional incentives for younger workers to seek opportunities in new locations. In this regard, renting is not just a tool of necessity, but one of convenience before purchasing a home. As workers find greater job stability and favorable neighborhoods where they feel their preferences are being met, they are more compelled to set down roots and eventually buy.

Until the United States addresses the underlying shortage and underproduction of housing, SFR will continue to serve as an important bridge from renting to first-time homeownership. Not only is SFR here to stay, but it plays a critical role in helping younger generations address their housing needs while strengthening neighborhoods that have historically been slow to embrace change.

David Piscatelli is a strategy expert at Avenue One, a proptech service platform that streamlines institutional capital’s access to SFR. Piscatelli earned his MBA from the London School of Business and completed his undergraduate degree at the University of Florida.

This column does not necessarily reflect the opinion of HousingWire’s editorial department and its owners.

To contact the author of this story:

David Piscatelli at piscatelli@aveone.com

To contact the editor responsible for this story:

Sarah Wheeler at swheeler@housingwire.com