A few months ago, the United States housing market failed Econ 101. Table 1, below, reports the 10 hottest U.S. metropolitan areas in February 2022, based on year-over-year growth in median listing price according to the residential real estate listing website, Realtor.com. The table also reports the year-over-year percent change in new listings for each market.

Table 1: 10 Hottest Housing Markets out of the Top 250 Metro Areas, February 2022

| Metro Area | Median Listing Price (Y/Y) | New Listing Count (Y/Y) |

| Bridgeport-Stamford-Norwalk, CT | 64.5% | -8.9% |

| Naples-Immokalee-Marco Island, FL | 53.0% | -16.7% |

| Bellingham, WA | 51.7% | -8.3% |

| Myrtle Beach-Conway-North Myrtle Beach, SC-NC | 50.8% | -18.2% |

| Santa Fe, NM | 48.9% | -4.7% |

| Cape Coral-Fort Myers, FL | 45.0% | -0.8% |

| Punta Gorda, FL | 43.6% | -7.7% |

| Torrington, CT | 43.0% | -4.6% |

| Panama City, FL | 39.7% | 17.9% |

| Las Vegas-Henderson-Paradise, NV | 39.6% | -6.2% |

| Source: Realtor.com |

Even though sellers’ median valuations in each of these housing markets grew by an astounding 40% or more over the previous year, only one market, Panama City, Florida, saw a year-over-year increase in the number of homes newly listed for sale.

The finding was equally confounding on the other side of the distribution where house price growth was weakest; though home values dropped by at least 10% in each of the 10 coldest markets, the number of homes added to the for-sale inventory increased in eight of them.

These results defy economic logic; a big price increase is supposed to attract more sellers into a market, not fewer. When economists observe this pattern, they usually attribute it to a downward shift in supply that is unrelated to price. For example, if a natural disaster destroyed thousands of homes in a housing market, prices would rise due to the loss of inventory. But this explanation cannot support the data in Table 1; no calamity decimated housing markets across the United States in February.

A different explanation makes more sense: Growth in the for-sale inventory slowed in nearly all the hottest markets a few months ago because of speculation. Despite unprecedented house price appreciation, homeowners in the hottest metro areas gambled that their property values would continue to grow at red-hot rates, and these gamblers did not want to risk missing out on an even bigger payday in the near future.

That “near future” may now be in the past; the latest data indicate that homeowner speculation in the housing market has come to an end.

This change is evident in Table 2, which lists the 10 hottest housing markets in June, the most recent month of available data from Realtor.com. Contrary to the findings from five months ago, eight of these housing markets reported a year-over-year increase in the number of new listings, which is the supply response normally follows a hefty price increase. Gamblers in the housing market appear to be content with their gains, and now they are cashing in their chips.

Table 2: 10 Hottest Housing Markets out of the Top 250 Metro Areas, June 2022

| Metro Area | Median Listing Price (Y/Y) | New Listing Count (Y/Y) |

| Panama City, FL | 42.9% | 65.6% |

| Cedar Rapids, IA | 40.9% | 6.8% |

| Waterloo-Cedar Falls, IA | 40.7% | -2.9% |

| Topeka, KS | 40.7% | -12.0% |

| Miami-Fort Lauderdale-West Palm Beach, FL | 40.1% | 4.1% |

| Fayetteville, NC | 37.7% | 9.0% |

| Killeen-Temple, TX | 36.1% | 31.2% |

| North Port-Sarasota-Bradenton, FL | 36.0% | 21.2% |

| Huntington-Ashland, WV-KY-OH | 36.0% | 18.3% |

| Punta Gorda, FL | 35.3% | 7.5% |

| Source: Realtor.com |

The end of seller speculation in the housing market is long overdue and welcome news for buyers. If this trend persists, it will mean that more existing homes will soon be added to housing markets that have been starved for inventory for the last two years. This rise in inventory will tilt the bargaining power in these market toward buyers, and house price growth will ease.

Early signs of blossoming competition for buyers are already evident in the data from Reator.com. Nationwide, the number of listings with a price cut surged 74% month-over-month in May and 51% month-over-month in June, easily the biggest increases on record.

But some analysts may be missing these signals. For example, in the face of rising mortgage rates and reduced affordability, forecasters at Realtor.com recently revised their prediction for the annual change in existing home sales in 2022 from 6.6% increase to 6.7% decrease. But contrary to this new projection, home sales will not falter if sellers are speculating no longer, adding more inventory to the market, and settling for lower prices.

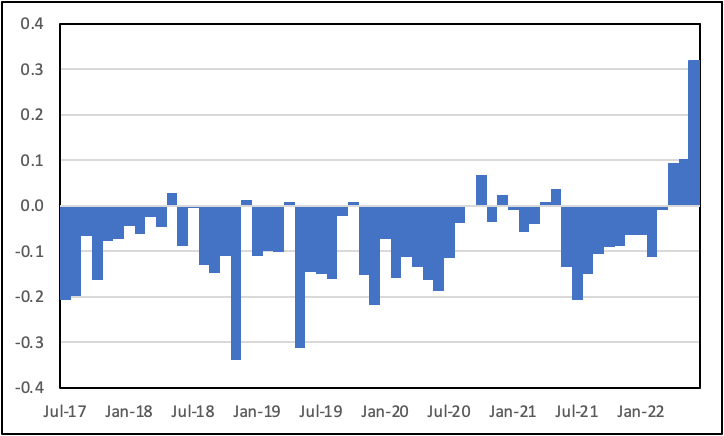

The forecast is uncertain because economic fundamentals have been absent from the housing market for a while. Figure 1 below plots the correlation between the year-over-year change in the median listing price and the year-over-year change in new listing count for the top 250 housing markets in the nation.

This analysis is restricted to the top 250 markets because smaller markets typically have fewer than 200 active listings per month, which makes average values more susceptible to a handful of random, unusual events. (Graphs for cut-offs ranging between the top 100 and top 400 housing markets have the same pattern.)

Figure 1: Correlation between Median Listing Price (Y/Y) and New Listing Count (Y/Y), Top 250 Metro Areas

As previously mentioned, conventional economic reasoning predicts that housing markets with faster house-price growth will attract more listings; in other words, the correlation between changes in these two series should be positive. But Figure 1 illustrates that the data over the last five years generally contradicts this expectation. Since 2017, the start of the series from Realtor.com, this correlation has been negative 80% of the time. Steady house price growth has not encouraged more listings in the hottest markets.

When put in context, this history makes sense. During the earliest years of the series, many residences were still worth less than they were at the peak of the housing bubble in 2006. This was especially true in low- and moderate-income ZIP codes. Even though homeowners had enjoyed several years of rapid house-price appreciation during the recovery, many resisted selling their properties at a loss.

The end of the series was punctuated by unparalleled house price growth following the COVID-19 recession. Homeowners in the hottest markets did not sell because they anticipated or hoped for even greater returns.

Neither of these conditions remain true today. For the first time in a generation, almost all long-term homeowners have substantial equity and no expectation of outsized house-price gains. Put differently, the housing market is returning to normal, and the latest findings reflect this new reality.

For the first time on record, the correlation between house price growth and the change in new listings has been positive, as expected, for three consecutive months. And last month, this positive correlation was three times stronger than any previous month in the series. Conventional economic wisdom predicts this outcome, but home sales models that have been tuned to the market’s abnormal behavior over the last decade might not be accounting for a return to normalcy.

Kwame Donaldson is an economist whose research focuses on residential and commercial real estate markets, demographic trends, and GIS analysis. Over the last decade, he has held senior roles in the U.S. Census Bureau, Moody’s Analytics, and Zillow.

This column does not necessarily reflect the opinion of HousingWire’s editorial department and its owners.

To contact the author of this story:

Kwame Donaldson at knd@alumni.rice.edu

To contact the editor responsible for this story:

Sarah Wheeler at sarah@hwmedia.com