Prime apartment leasing season in 2019 proved to be strong across the country, RealPage reports.

When is prime leasing season? For most renters, especially those in warmer climates, they tend to prefer to move when it is warmer during the second quarter and third quarter. In areas where it’s colder, peaking moving season takes place between April and September.

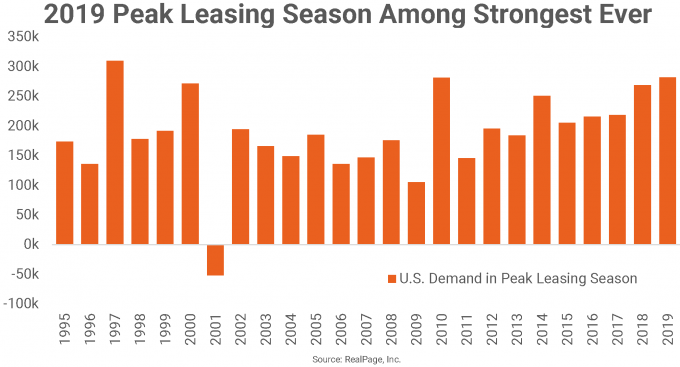

According to new analysis from RealPage, this year was the second highest apartment leasing season ever, with 281,800 units absorbed (or rented).

The highest leasing season was in 1997 during the tech boom.

Although high rental rates were seen across the nation, it was the Southern markets that saw record-setting seasons.

Dallas saw the most demand in Q2 and Q3, absorbing more than 16,500 units.

Occupancy in Dallas reached 95.6% in Q3.

Dallas’ Western neighbor, Fort Worth, also saw peak demand in Q2 and Q3.

Fort Worth nearly doubled its average performance since 2000, absorbing over 3,600 units in the last six months.

Houston also saw strong demand, absorbing nearly 14,800 units in 2019’s prime leasing season, basically doubling its typical volume.

Previously, Houston has ranked near the bottom on a national level in terms of occupancy and rent growth, but this uptick could lead to some vital stabilization after Hurricane Harvey damaged the market in fall 2017.

The only market outside of Houston to see record-setting demand is Seattle, with a demand of nearly 6,700 units in 2019’s prime leasing season. Seattle’s typical performance is about 2,900. Seattle’s occupancy reached 96.2% in Q3.

Across the nation, multifamily occupancy rates continue to climb as younger generations are opting to rent instead of own.

Apartment occupancies have also reached record setting numbers, and haven’t dropped since 2000. In fact, multifamily vacancies also haven’t been as low as they are now, since 2000.

In the third quarter of this year, multifamily vacancy fell to 3.6%, down 40 basis points from 2018, to the lowest level since 2000, according to a report from CBRE.