The NMLS Policy Committee announced it will be extending certain deadlines in light of the COVID-19 pandemic that continues to spread across the U.S.

Following the Federal Financial Institutions Examination Council’s release announcing there would be a 30-day extension for certain reports, the NMLS Policy Committee has amended the previously announced 60-day temporary deadline extension for the following types of reporting submitted in NMLS:

- Money Services Businesses Call Report

- Mortgage Call Report

- Mortgage Call Report Financial Condition

- Financial Statements

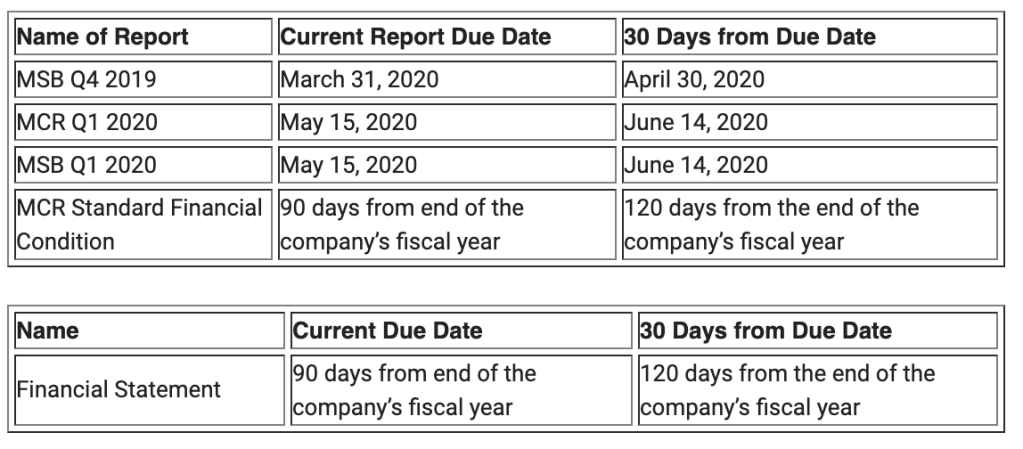

The chart below shows the new NMLS extension dates:

With the amended policy, instead of an extension, the NMLS Policy Committee encourages regulators to be lenient and not take administrative action if reports are filed within 30 days of the placement of the license item.

With this temporary change in reporting deadlines, new language will appear in the external notes field for the following set license items:

- Financial Statement Not Submitted

- Financial Statement Insufficient

- Standard- Financial Condition – 2019

- Standard-RMLA – 2020(Q1)

- MSBCR – 2020 (Q1)

Currently there are 875,000 people reported to have contracted coronavirus worldwide and more than 43,000 deaths, according to the New York Times. And this is quickly approaching 200,000 cases in the U.S. alone and nearly 4,000 deaths.

In light of this crisis, the need for more flexibility and remote work capabilities has risen.

And it’s not just NMLS that is extending deadlines; regulators have also announced they will be easing up on reporting deadlines.