The New York Department of Financial Services (NYDFS) issued a letter to any entity within the state that intends to originate reverse mortgage loans on co-operative apartments, something that has only recently become viable due to the recent passage and codification of a bill specifically allowing for such loans in New York.

Since the Home Equity Conversion Mortgage (HECM) program rules require “real property,” only proprietary products may be used for co-ops.

The letter is intended to establish the expectations from NYDFS for all companies which plan on engaging in such business, since the new legal provision which allows reverse mortgages on co-op living spaces is slated to go into effect on May 30.

The notice

The letter describes a pre-existing “comprehensive regulatory framework that addresses the marketing, origination, and servicing of reverse mortgages in New York,” and that existing law establishes requirements for marketing, origination, servicing and termination of reverse mortgages within the state. Separate regulations focus more specifically on the marketing requirements of a reverse mortgage, which apply to co-op loans except in certain areas.

“The Department is of the view that most of the existing requirements of [current regulations] apply to Coop-Reverse Mortgages with equal force,” the letter reads. “However, there are certain provisions of these regulations that, due to the different nature of the collateral securing the loan, are not applicable to Coop-Reverse Mortgages, or conflict with the provisions of [the new law].”

NYDFS, meanwhile, will be considering any new additions to the current law to account for the new ability to originate reverse mortgages on co-op units, the letter reads. While that is taking place, those preparing to offer such loans on co-ops are directed to follow all the current regulations in place which govern practices of marketing, originating, servicing and terminating reverse mortgages in New York.

If there is any inconsistency between the way the new and previous laws operate with respect to co-op loans, provisions of the new law will take precedent in some of those circumstances, the letter reads.

“Title 3 of the New York Code of Rules and Regulations Part 79 (“3 NYCRR 79”), establishes various requirements relating to the marketing, origination, servicing and termination of reverse mortgage loans in New York,” the letter describes of current laws. “In addition, Title 3 of the New York Code of Rules and Regulations Part 38 (“3 NYCRR 38”), addresses issues involving, among other things, commitments and advertising for mortgage loans generally.”

How current laws apply to co-op reverse mortgages

For the purposes of 3 NYCRR 79 relating to the origination, servicing and termination, the word “reverse cooperative apartment unit loan” will be added to the existing framework in order to accommodate the co-op property type in the existing reverse mortgage state law. A couple of other specific terms are also now being retroactively applied to co-op loans.

“To comply with the requirements of [the new law], a ‘housing counselor,’ as defined in 3 NYCRR 79.2(k), may only be referred to a borrower if such person has received ‘cooperative housing training,’” the letter reads. “The term ‘property charges,’ as defined in 3 NYCRR 79.2(p), shall include cooperative maintenance fees.”

Understandably, definitions regarding what constitutes “property” or “real property” need to be modified to more correctly reflect the nature of a negatively-amortizing loan on a cooperative apartment.

“For Coop-Reverse Mortgages, ‘real property’ or ‘property’ shall be read as either the ‘cooperative apartment unit’ or the ‘shares or membership representing an ownership interest in the apartment unit securing the Coop-Reverse Mortgage’ as appropriate for the specific requirement to which the language relates,” the letter explains.

The term “HECM Loan” as used in the origination, servicing and termination provisions shall not apply to co-op loans, the letter says, due to the proprietary product restriction.

Authority to make reverse mortgages on co-ops, recent history

The criteria that dictate what qualifies as an “authorized lender” for such loans on co-ops will be similar to existing regulations, meaning they have to apply for and be granted the right to do so by the superintendent of NYDFS, the letter says. Additionally, product providers are reminded that only proprietary products — not Federal Housing Administration (FHA)-sponsored HECMs — are allowed on co-ops.

“As such, entities currently holding a ‘Reverse Mortgage Lending Dual Authority’ from the [NYDFS] are not required to submit a new application for authority to engage in Coop-Reverse Mortgage lending activities, as the existing ‘dual authority’ authorizes the lender to originate proprietary reverse mortgages,” the letter reads.

As of May 2022, three lenders are currently qualified to offer proprietary reverse mortgages in New York State: Finance of America Reverse (FAR), Nationwide Equities and Plaza Home Mortgage.

The law allowing reverse mortgages on co-ops in the state — which serves as the culmination of a years-long effort by members of the reverse mortgage industry and New York state lawmakers — was authored after a similar bill that would allow reverse mortgages on co-ops failed to overcome a veto by then-Gov. Andrew Cuomo.

The revised version of the bill was passed less than 60 days before Cuomo resigned from office following allegations of sexual misconduct, and appeared to be in legislative limbo precisely because of the turnover in the governor’s office.

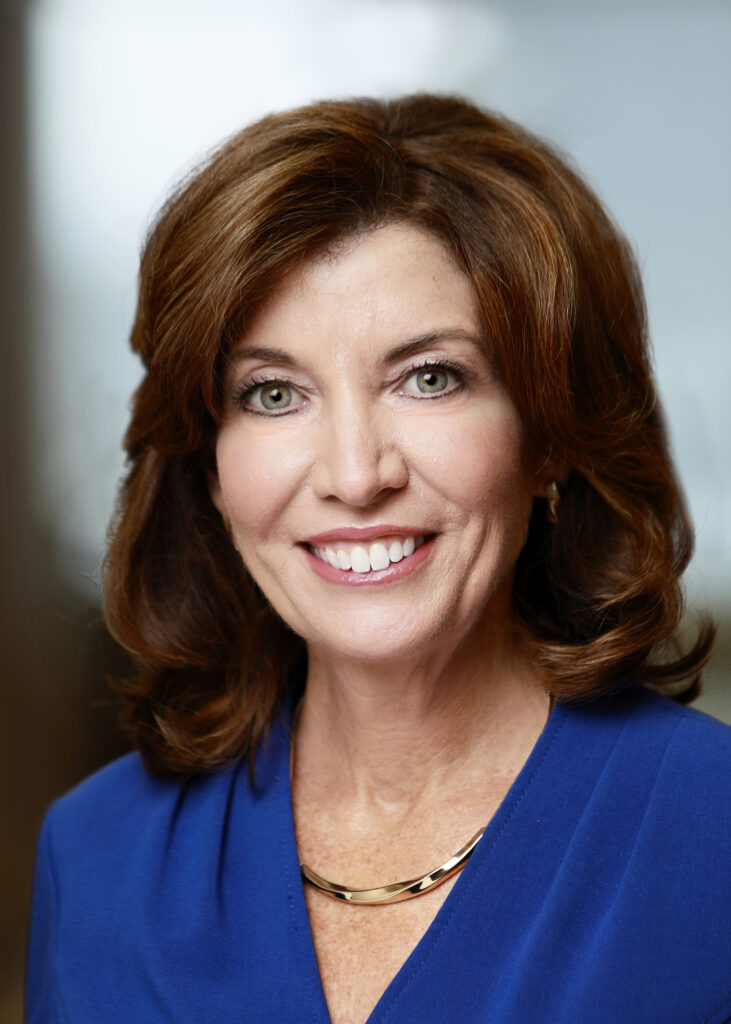

However, nearly six months after it cleared the State Assembly and the State Senate, the bill was delivered to Gov. Hochul who signed it in relatively short order. The governor acted well within a deadline of 30 days, avoiding a “pocket veto” and allowing the bill to become law.

Read the letter by the NYDFS.