The traditional spring selling boost that home builders were counting on to prop up sagging demand never materialized, likely signaling further pain ahead in the U.S housing market in the months to come. The Commerce Dept. reported Wednesday that new home purchase activity fell to a 512,000 annualized pace during May, off 2.5 percent from a revised 525,000 rate in April; the monthly sales number was the worst May sales total since 1991, when the U.S. was in the throes of a major recession, and largely reversed a earlier one-month jump. The new home sales number was right on with expectations of economists, according to Bloomberg News, which noted that the new home sales volume recorded in May was the worst in almost 17 years. “I don’t know that we’ve found a bottom yet,” said a banking executive that spoke with Housing Wire. “If anything the spring boost managed to keep sales flat, which could put us into pretty ugly territory by the end of this year.” “Home builders have been doing everything they can to limit the production of new units and move existing inventory, but it hasn’t been enough to make a significant dent in the backlog yet,” said National Association of Home Builders chief economist David Seiders, in a press statement Wednesday. Home builders have been pushing for a housing aid package currently under consideration in the Senate, characterizing it as critical stimulus for a flagging housing market; the rhetoric echoes similar language used by the organization when Congress passed the Economic Stimulus Act of 2008, which has since done little to help matters. “The fact that new-home sales are occurring at such a slow pace in the middle of the home buying season, with inventories only barely inching downward, is a strong indication of just how critical it is for Congress to move forward immediately with housing stimulus legislation,” said NAHB president Sandy Dunn. The seasonally-adjusted estimate of new houses for sale at the end of May was 453,000, according to Commerce Dept. data, a drop of 8,000 from April’s estimated total. Weak sales activity, however, managed to push the months of supply metric up to 10.9 months compared to 10.7 months in April; Last year, months supply stood at 7.8 months, underscoring what critics say was a pull-back by builders that came far too late in the current cycle.

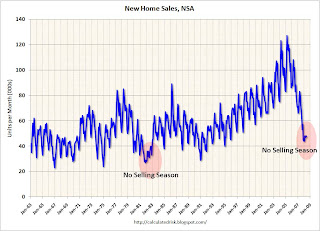

The graph on the right, used with permission from the Calculated Risk blog, shows new home sales (not seasonally-adjusted) for the last 45 years –it’s worth noting that the early 1980s housing bust came with sky-high interest rates, and cutting rates helped housing rebound. “The previous worst spring on record was 1982 – in the midst of a severe recession, with 30 year fixed mortgage rates at 17 percent, and close to double digit unemployment,” wrote the blog’s eponymous author. “In 1982, sales picked up late in the year as interest rates declined sharply.” That sort of saving grace isn’t around for the current crisis in housing and mortgages. Given current market dynamics, mortgage rates would seem to only have one way to go as inflation bares its teeth more frequently in the months ahead — and that direction is anything but downward.